MoneyMinder, tailored for volunteer treasurers of nonprofits, simplifies finance tracking with budget management and reporting tools. Supporting multiple languages, it integrates with PayPal, Venmo, and Stripe, emphasizing user-friendly accessibility.

Alternatives like QuickBooks Online Advanced and Blackbaud Tuition Management exist, highlighting the need for nonprofits to evaluate systems catering to specific requirements. This introduction provides a glimpse into MoneyMinder’s capabilities.

Key Takeaways

- MoneyMinder simplifies nonprofit financial tasks with key features like fund accounting, donation management, and multiple language support for $179 per year.

- Enhance MoneyMinder’s functionality with add-ons such as account integration and e-filing tax forms.

- Alternatives to consider include Blackbaud Tuition Management and QuickBooks, each offering unique tools suitable for different organization sizes and needs.

MoneyMinder Overview

MoneyMinder is financial software designed specifically for volunteer treasurers of nonprofit organizations, offering a blend of budget management and reporting tools. Its purpose is straightforward: to streamline the often complex finance tracking tasks that nonprofits face, optimizing their operations with a focus on simplicity and security.

With an ability to handle multiple languages including English, Spanish, and Chinese among others, it stands out as accessible and user-friendly.

The importance of such a platform cannot be overstated in today’s non-profit sector which demands accountability and efficiency. MoneyMinder addresses these needs by integrating with popular payment processors like PayPal, Venmo, and Stripe – making transactions smoother for its users who rate it highly for customer support and ease of navigation.

In identifying key attributes of MoneyMinder’s services, one should note its 59 diverse features across categories such as analytics and contact management. However, its current framework does not extend to custom API integrations.

To ensure affordability, it promotes a discounted annual subscription option if purchased or renewed before December 31st this year.

While evaluating the broader landscape in which MoneyMinder operates reveals alternatives like QuickBooks Online Advanced and Blackbaud Tuition Management; it remains imperative for those managing nonprofit finances to understand how different systems can cater to their specific requirements.

Purpose and target users

MoneyMinder caters specifically to the needs of volunteer treasurers who manage nonprofit finances. It’s an essential tool for those in charge of fund accounting and donation management within various organizations, including churches and membership-based groups.

This software aims to simplify the complex tasks that come with nonprofit financial management, making it a perfect fit for users looking for streamlined operations without sacrificing accuracy or control.

Its tailor-made features assist in volunteer management, ensuring that all facets of an organization’s financial well-being are taken care of—from tracking memberships to managing donations.

Recognized by multiple awards in its field, MoneyMinder serves as a trustworthy companion for anyone tasked with safeguarding the fiscal responsibilities of a nonprofit entity. The platform is built not just to record transactions but also to empower users through robust reporting tools and budgeting software capabilities that maintain healthy financial practices.

MoneyMinder Features

Now that we’ve identified MoneyMinder’s core audience, let’s dive into the software’s key features and benefits which define its value for volunteer treasurers and nonprofit organizations. These elements work together to streamline financial management and bookkeeping.

| Feature | Description |

|---|---|

| Simplified Fund Accounting | The platform specializes in fund accounting, an essential aspect of managing nonprofit finances. It allows users to track and report on specific funds, ensuring accuracy and accountability. |

| Donation Management | MoneyMinder provides robust tools for donation tracking and reporting. Organizations can easily manage donor information and their contributions, making financial oversight a breeze. |

| Integrated Payment Solutions | With compatibility with PayPal, Cheddar Up, Stripe, Venmo, and other applications, MoneyMinder simplifies transaction processes by enabling smooth payment integration. |

| User-Friendly Volunteer Treasurer Software | Designed specifically for volunteers rather than professional accountants, the software emphasizes ease of use without compromising comprehensive features. |

| Multilingual Support | Flexibility is key; therefore MoneyMinder supports multiple languages including Chinese, Dutch, English, and French, among others – making it accessible worldwide. |

| Award-Winning Functionality | The accolades received by MoneyMinder speak volumes about its effectiveness in areas like church accounting and financial management within the non-profit sector. |

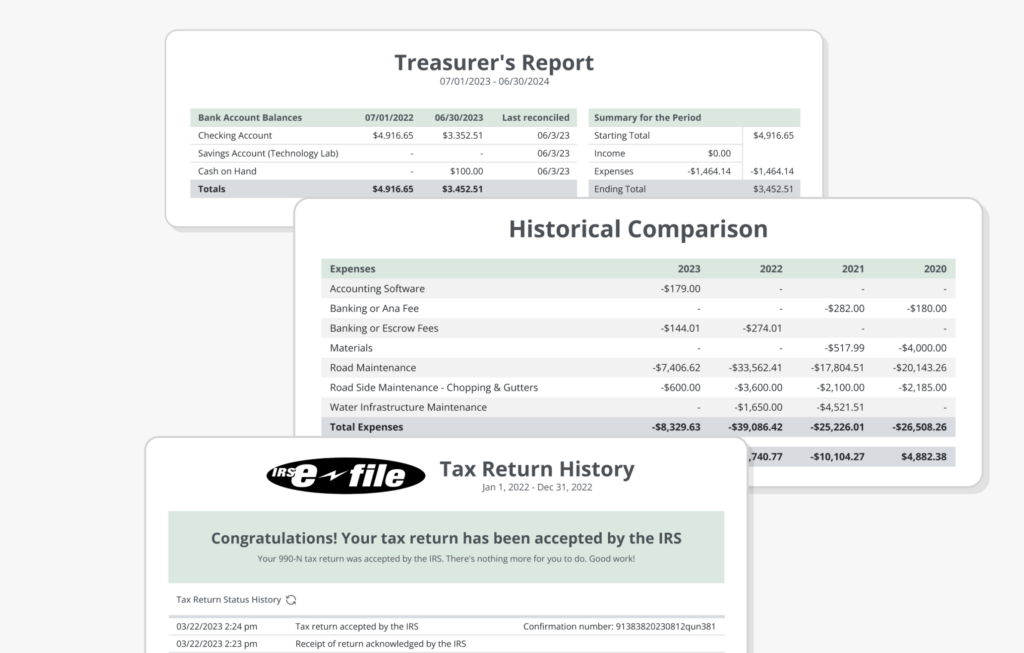

| Financial Reporting Ease | Generate detailed reports effortlessly. Financial reporting tools are crafted to meet strict standards required in nonprofit accounting scenarios. |

| Excellent Customer Support | Having an overall rating of 4.9/5 based on customer reviews highlights the exceptional support provided to users—any issues or questions are addressed promptly and effectively. |

MoneyMinder Pricing

MoneyMinder offers a simple annual pricing model with optional add-ons for enhanced functionality. This ensures that users have access to all the features they need without any hidden costs or complicated pricing tiers.

One simple annual price

MoneyMinder simplifies your budgeting with its straightforward annual fee. Instead of dealing with complex pricing tiers or hidden costs, you get full access to the software’s features for a flat rate of $179.00 per year.

This single yearly cost eliminates any guesswork from your financial planning and ensures that there are no surprise charges down the line.

Lock in this discounted rate by renewing or making your purchase before December 31st, 2023. This one-time payment guarantees another year of streamlined money management without any hassle.

With MoneyMinder, investing in financial clarity is not only smart but also economical—a win for tech-savvy budgeters everywhere.

Optional add-ons for enhanced functionality

MoneyMinder offers users the option to enhance their functionality with a variety of additional features and supplementary functionalities for an extra annual fee. These include:

| Add-on | Description |

|---|---|

| Account Integration | Users can seamlessly integrate their accounts with MoneyMinder, allowing for streamlined financial management and reporting. |

| Bank Integration | The software offers bank integration capabilities, enabling users to efficiently manage transactions and account balances directly within the platform. |

| Tax Form E-filing | With annual fees ranging from $14 to $99, users can opt for tax form e-filing for 990-N, 990-EZ, and 8868 forms, simplifying the process of tax compliance. |

| Multiunit Reporting | MoneyMinder provides multi-chapter reporting for groups with multiple units, chapters, or associations. This feature offers bookkeeping oversight and facilitates the sharing of best practices among different entities. |

MoneyMinder’s Standout Features

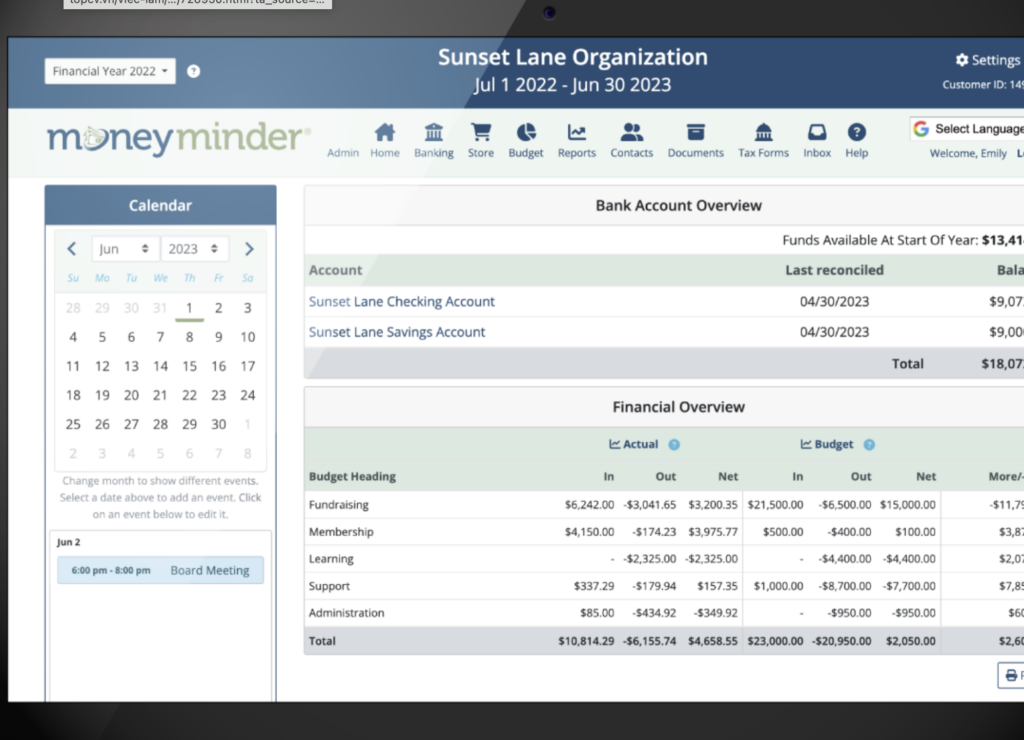

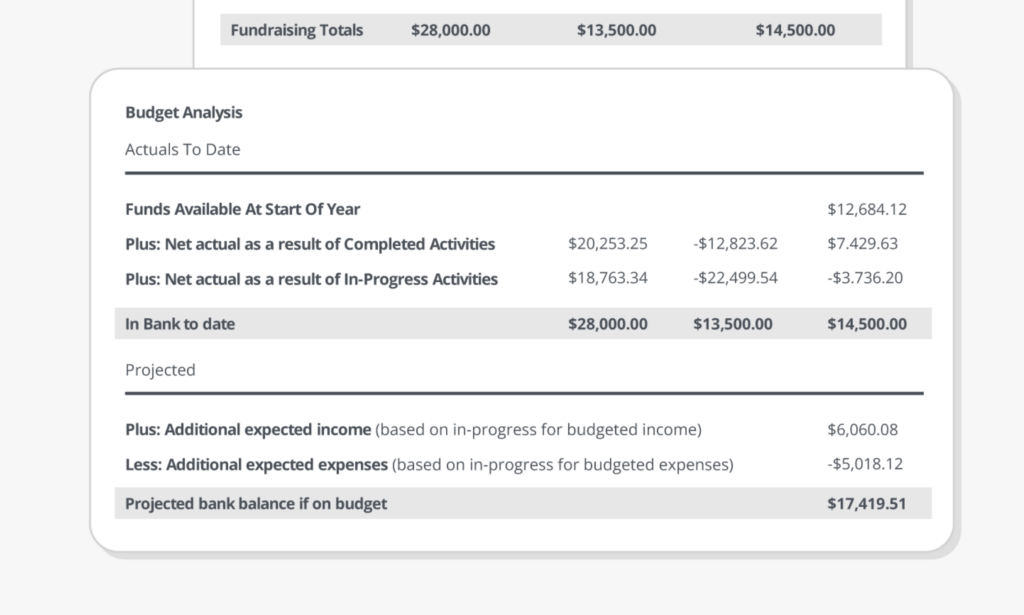

MoneyMinder offers robust budget tracking and expense management tools, making it ideal for volunteer-based groups. Its account integration capabilities streamline financial tasks, while its reporting options provide transparency and accountability.

Budget tracking and expense management

Track your budget and manage expenses seamlessly with MoneyMinder’s standout features. Stay on top of your financial tracking, expense management, and budgeting software needs effortlessly.

This robust tool offers account and bank integration capabilities to streamline cost tracking and financial management tasks efficiently.

MoneyMinder stands out in its ability to simplify spending tracking and expenditure management for non-profit organizations. Its user-friendly interface makes it an ideal choice for volunteers, ensuring an easy learning curve when it comes to budget management.

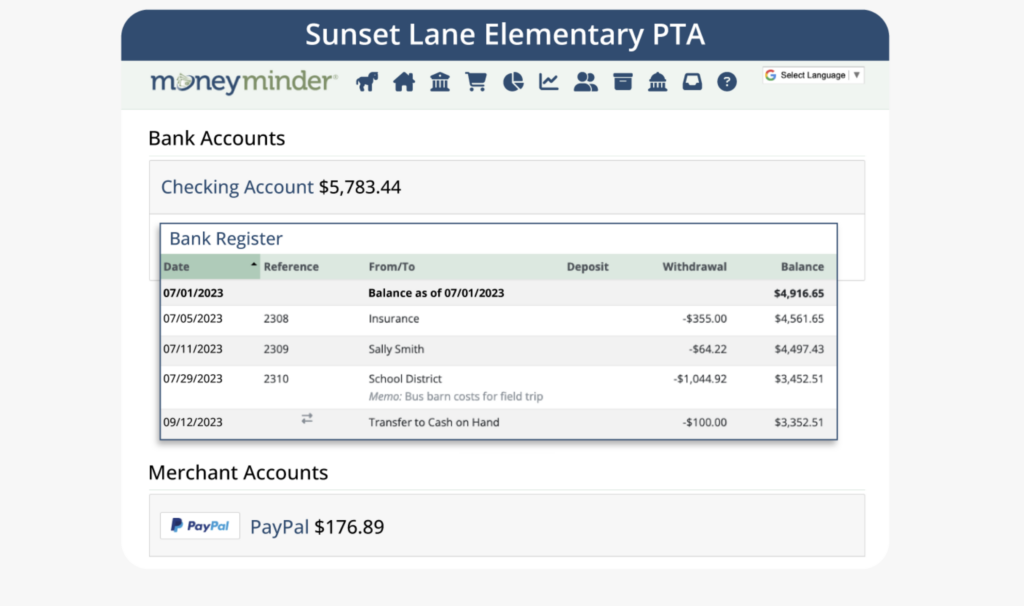

Account and bank integration capabilities

MoneyMinder stands out for its seamless account and bank integration capabilities, allowing users to connect with various banking institutions for transaction import. This feature enables faster and more accurate recording of transactions, providing a convenient way to link multiple supported accounts with the paid add-on feature.

With stringent security measures in place, MoneyMinder offers read-only bank feeds, ensuring privacy and compliance regulations are met.

The platform also boasts an online store function that allows groups to securely accept payments via credit card or eCheck while seamlessly importing transactions directly into MoneyMinder.

MoneyMinder Alternatives

Consider exploring other options such as Blackbaud Tuition Management for a comprehensive comparison of features and pricing. These alternatives provide similar solutions for nonprofit accounting and financial management needs.

Popular comparisons with other Nonprofit Accounting products, including Blackbaud Tuition Management

MoneyMinder is frequently compared to a variety of other Nonprofit Accounting products to help users identify the best fit for their organization’s needs. Below, we compare MoneyMinder and some popular alternatives, including Blackbaud Tuition Management.

| Software | Core Features | Intended Users | Pricing |

|---|---|---|---|

| MoneyMinder | Budget tracking, expense management, account/bank integration | Nonprofits, Clubs, Associations | Annual subscription with optional add-ons |

| Blackbaud Tuition Management | Tuition billing, payment processing, financial reporting | Educational Institutions | Custom pricing based on institution size and needs |

| QuickBooks Desktop Enterprise | Advanced reporting, inventory management, user permissions | Mid to large-sized organizations | Annual subscription with tiered pricing |

| Aplos | Fund accounting, online donation tracking, financial reporting | Nonprofits, Churches | Monthly subscription with tiered pricing |

| ZipBooks | Simplified bookkeeping, invoicing, expense management | Small businesses, Nonprofits | Free starter option, Premium plans available |

| Sage Intacct | Cloud accounting, multi-entity management, financial insights | Mid to large-sized organizations | Custom pricing based on features and user count |

| AccuFund Accounting Suite | Nonprofit-specific modules, reporting, fund accounting | Nonprofits, Government entities | Pricing upon request |

| MonkeyPod | Integrated CRM, accounting, donor management | Nonprofits | Monthly subscription with tiered pricing |

| QuickBooks Online Advanced | Customizable reporting, batch invoicing, dedicated support | Midsize businesses | Monthly subscription with tiered pricing |

Each of these Nonprofit Accounting products offers unique features and benefits tailored to specific types of users. Organizations should assess their specific requirements and compare them to the functionalities and pricing offered by these solutions.

MoneyMinder, with its focus on budget tracking, expense management, and account integration, presents a compelling option for nonprofits seeking a straightforward and effective financial management tool.

Conclusion

MoneyMinder is a comprehensive financial management software tailored for volunteer treasurers in nonprofit organizations. With affordable annual pricing starting from $179 and optional add-ons, MoneyMinder allows budget tracking, expense management, and seamless bank integration.

In comparison to other alternatives like Blackbaud Tuition Management, MoneyMinder stands out with its user-friendly interface and valuable features. By offering support in multiple languages and receiving high ratings from users for customer support and ease of use, MoneyMinder proves to be a reliable solution for small groups and nonprofits looking for efficient financial management.

For a closer look at how MoneyMinder compares with other solutions, explore our detailed review of Blackbaud Tuition Management pricing, features, and alternatives.

Frequently Asked Questions

What is MoneyMinder?

MoneyMinder is a financial management software designed to help individuals and businesses track their income, expenses, and budgeting.

How much does MoneyMinder cost?

The pricing for MoneyMinder varies based on the plan chosen, with options for individual users as well as small businesses. It’s best to visit their website for the latest pricing information.

What features does MoneyMinder offer?

MoneyMinder offers features such as expense tracking, budget creation, bill payment reminders, financial goal setting, and customizable reporting tools.

Are there any alternatives to MoneyMinder?

Yes, there are alternative financial management software available in the market that offer similar capabilities to MoneyMinder. Some popular alternatives include Mint, Quicken, and YNAB (You Need A Budget).

Is it easy to integrate MoneyMinder with other financial platforms or apps?

Yes, MoneyMinder allows integration with various financial platforms and apps for seamless data import/export and synchronization of accounts.