Tax season can feel overwhelming, but the right software makes it easier to file accurately, maximize deductions, and stay compliant with tax laws. Among the many options available, TurboTax and H&R Block stand out as two of the most trusted names in tax preparation.

Whether you’re a freelancer, self-employed professional, or someone filing a straightforward W-2 return, choosing the right platform can save both time and money.

Why Choosing the Right Tax Software Matters

Not all tax software is created equal. Some offer step-by-step guidance for beginners, while others provide advanced deduction tracking for business owners and freelancers. The ideal choice depends on individual needs—whether it’s affordability, ease of use, or access to expert support.

This guide will compare TurboTax and H&R Block across key factors:

✅ Ease of use & user experience – How intuitive is the platform for first-time filers and experienced users?

✅ Feature set – Does it cover all tax situations, including self-employed and investment income?

✅ Pricing – Which offers the best value for different budgets?

✅ Customer support & audit protection – Can users get professional tax assistance when needed?

By the end, you’ll have a clear understanding of which tax software is the best fit for your needs in 2025. Let’s get started!

Overview of TurboTax

A Brief History of TurboTax

TurboTax, developed by Intuit, has been a leader in the tax preparation industry for decades. Launched in the 1980s, it has grown into one of the most trusted tax filing solutions, offering digital tools and expert guidance to make filing easier for individuals and businesses. With continuous updates to comply with tax laws and user-friendly interfaces, TurboTax remains a go-to choice for millions of taxpayers.

Unique Benefits of TurboTax

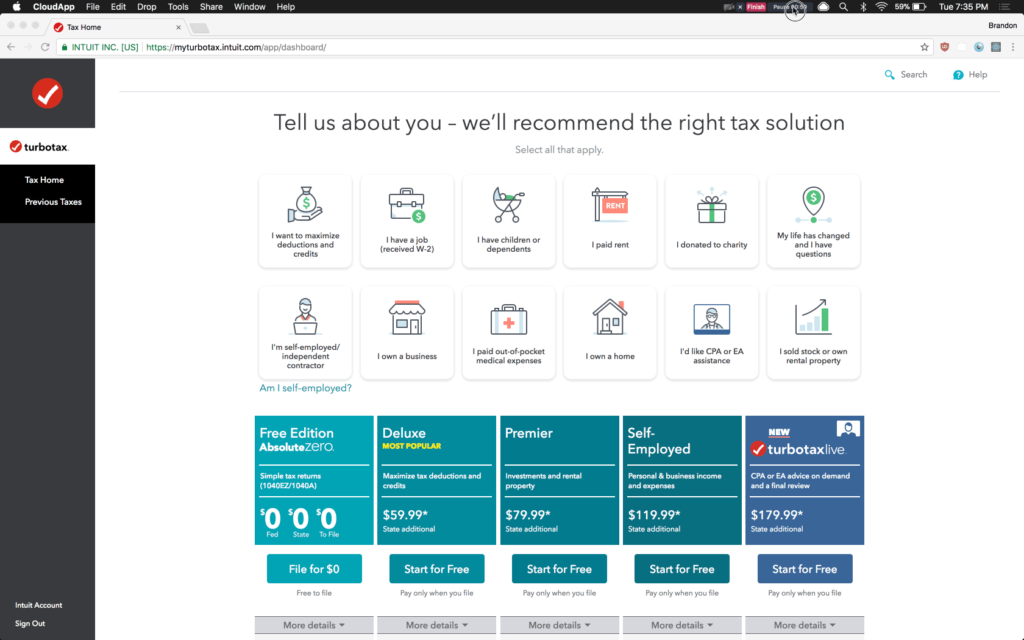

TurboTax is known for its intuitive design and AI-powered tax assistance, making it a top choice for filers looking for a seamless experience.

- AI-Powered Tax Guidance – The software provides smart recommendations by analyzing tax situations in real time, ensuring users maximize deductions and credits.

- Step-by-Step Navigation – TurboTax simplifies the tax filing process with a guided interface that asks clear, easy-to-answer questions.

- QuickBooks Integration – Small business owners and self-employed users benefit from direct integration with QuickBooks for easier income and expense tracking.

- Live Tax Expert Support – With TurboTax Live, filers can connect with tax professionals for real-time assistance or full-service tax preparation.

- Maximum Refund Guarantee – TurboTax ensures users claim every deduction they qualify for, with a promise to get the biggest refund possible.

Who Should Use TurboTax?

TurboTax is ideal for individuals and business owners who prefer a highly automated, AI-driven tax filing experience. It is best suited for:

- Freelancers and Gig Workers – TurboTax Self-Employed offers extensive deductions tracking for 1099 income.

- Small Business Owners – The integration with QuickBooks makes it easier to manage income and expenses.

- Individuals with Complex Tax Situations – Those with multiple income sources, investments, or rental properties can benefit from TurboTax’s advanced features and expert tax support.

- Users Seeking a Hands-Off Approach – With TurboTax Live, filers can have tax professionals review or even complete their returns, reducing stress and ensuring accuracy.

TurboTax stands out for its high level of automation, real-time expert assistance, and ease of use, making it a solid choice for those willing to pay a little extra for premium tax filing features.

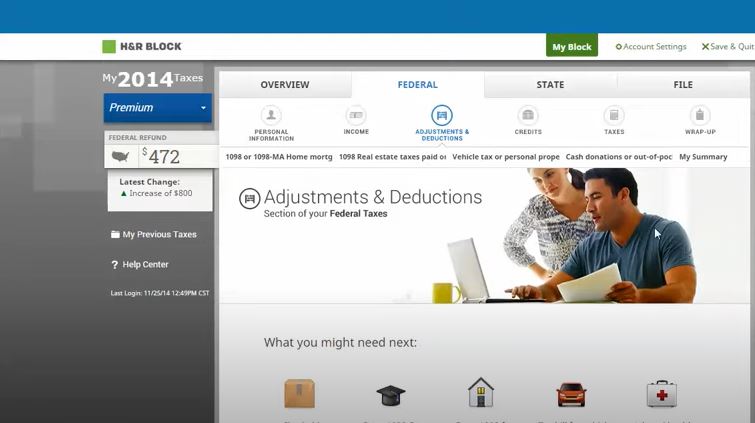

Overview of H&R Block

A Brief Introduction to H&R Block

H&R Block has been a trusted name in tax preparation for over six decades, providing both online and in-person filing solutions. Founded in 1955, the company offers a range of tax services, from DIY software to professional tax assistance at its nationwide retail locations. Known for its affordability and accessibility, H&R Block is a great option for those looking for expert-backed support without breaking the bank.

Unique Benefits of H&R Block

H&R Block stands out for its blend of digital convenience and personalized tax assistance, making it a strong competitor in the tax software market.

- In-Person Tax Assistance – Unlike many other tax software providers, H&R Block operates thousands of physical offices, allowing users to get face-to-face help from tax professionals.

- Affordable Pricing – H&R Block offers competitive pricing compared to TurboTax, making it a cost-effective solution for both basic and complex tax needs.

- Step-by-Step Guidance – The software provides clear, easy-to-follow prompts that simplify tax filing for users at any experience level.

- Free Online Filing for Simple Returns – Those with straightforward tax situations can file their federal and state returns at no cost.

- Tax Pro Review and Full-Service Filing – Users can opt for professional review or hand off their taxes entirely to an H&R Block expert.

Who Should Use H&R Block?

H&R Block caters to a wide range of taxpayers, particularly those looking for a balance between affordability and expert support.

- DIY Filers – The software’s intuitive design makes it easy for individuals who want to file their own taxes.

- Those Who Prefer Expert Assistance – With in-person offices and online tax pro support, filers can get help when needed.

- Budget-Conscious Users – Compared to TurboTax, H&R Block offers similar features at a lower cost.

- First-Time Tax Filers – The guided experience simplifies the process, making it easy for those new to tax filing.

H&R Block combines digital convenience with real-world expertise, making it an excellent choice for individuals who want professional support while maintaining control over their tax filing process.

Feature Comparison: TurboTax vs H&R Block

| Feature | TurboTax | H&R Block |

|---|---|---|

| Ease of Use | Simple, interview-style filing process | User-friendly with guided steps |

| Tax Forms Supported | All major tax forms (W-2, 1099, self-employed, business, etc.) | Covers all standard tax forms |

| Audit Support | Limited, requires additional purchase for full audit defense | Offers audit assistance with some plans |

| Live Expert Help | TurboTax Live connects users to CPAs & tax experts | Online & in-person assistance available |

| State Filing Fees | Additional cost per state | Additional cost per state |

Pricing Comparison: TurboTax vs H&R Block

| Plan | TurboTax | H&R Block | State Filing Fee |

|---|---|---|---|

| Free Edition | $0 Federal | $0 Federal | $0 per state |

| Deluxe | $59 | $55 | $39 per state |

| Premium (Premier) | $89 | $85 | $39 per state |

| Self-Employed | $119 | $115 | $39 per state |

| Live Expert Assistance | Starts at $89 (TurboTax Live) | Starts at $85 (Online Assist) | $39 per state |

Ease of Use & User Experience: TurboTax vs H&R Block

When choosing tax software, ease of use plays a crucial role, especially for beginners or those unfamiliar with tax filing processes. TurboTax and H&R Block both provide intuitive platforms, but they differ in approach, navigation, and user experience.

| Feature | TurboTax | H&R Block |

|---|---|---|

| Beginner-Friendly | ✔ Easy interview-style process | ✔ Step-by-step guided filing |

| Mobile App | ✔ Full-featured & smooth | ✘ Limited functionality |

| Deductions & Tax Savings | ✔ AI-powered recommendations | ✔ Strong deduction tools |

| In-Person Assistance | ✘ Online-only support | ✔ Available at physical locations |

Beginner-Friendly Navigation

- TurboTax: Designed with an interview-style approach, TurboTax asks users simple questions and automatically fills in tax forms. It feels more like a conversation, making it ideal for first-time filers. The software highlights potential deductions and provides real-time refund updates as you progress.

- H&R Block: Uses a step-by-step guided process with clear instructions, helping users understand why each form is needed. It’s slightly more structured than TurboTax, making it a good choice for those who want a traditional walkthrough.

Mobile-Friendliness & App Availability

- TurboTax: Offers a feature-rich mobile app that allows users to file their taxes entirely from their phone. The app supports document scanning (e.g., W-2 and 1099s), saving time on manual entry. Users can switch between mobile and desktop without losing progress.

- H&R Block: Also has a mobile app, but its functionality is slightly more limited than TurboTax. While it allows tax filing, some advanced features (like business expense tracking) may require switching to the desktop version.

Navigating Deductions & Tax-Saving Opportunities

- TurboTax: Uses AI-powered recommendations to identify overlooked deductions. Freelancers and business owners benefit from QuickBooks integration, which automatically imports business expenses and helps maximize deductions.

- H&R Block: Offers robust deduction-finding tools, but they are slightly less automated than TurboTax. However, it excels in providing human assistance—users can visit local H&R Block offices for expert reviews if needed.

Verdict: Which Is More User-Friendly?

- If you prioritize automation, an intuitive experience, and mobile convenience, TurboTax is the better choice.

- If you prefer a structured approach with easy access to in-person assistance, H&R Block is ideal.

Both platforms simplify tax filing, but TurboTax stands out for mobile users and AI-powered guidance, while H&R Block is better for those who want guided steps with the option for expert assistance.

Customer Support & Audit Assistance: TurboTax vs H&R Block

When it comes to customer support and audit assistance, both TurboTax and H&R Block offer different levels of service. The right choice depends on whether you prefer self-help options, live expert guidance, or in-person support.

Customer Support Options

| Support Type | TurboTax | H&R Block |

|---|---|---|

| Live Chat Support | ✅ Available with paid plans | ✅ Available |

| Phone Support | ✅ 24/7 with premium plans | ✅ Available during business hours |

| In-Person Support | ❌ Not available | ✅ Offered at physical locations |

| Tax Expert Access | ✅ TurboTax Live connects to CPAs & Enrolled Agents | ✅ Online and in-office tax experts available |

| Community Forum | ✅ Extensive user forum for common questions | ✅ Community help and online FAQs |

TurboTax provides convenient online support with live chat and expert help via TurboTax Live. However, H&R Block outshines TurboTax by offering in-person support at thousands of physical locations, making it the better choice for those who prefer face-to-face assistance.

Audit Protection & Assistance

| Feature | TurboTax | H&R Block |

|---|---|---|

| Basic Audit Guidance | ✅ Free with all plans | ✅ Free with all plans |

| Full Audit Defense | ❌ Requires additional purchase of MAX Defend & Restore | ✅ Included with some paid plans |

| Assistance from Tax Pros | ✅ Available with TurboTax Live | ✅ Available with in-person & online filing |

| In-Person IRS Audit Help | ❌ Not available | ✅ Yes, in select locations |

TurboTax offers basic audit support for free, but full audit defense requires an additional purchase of the MAX package. On the other hand, H&R Block includes some level of audit assistance in its plans and allows customers to visit an office for help in case of an IRS audit.

Which One is Better?

- Choose TurboTax if you prefer online support, live chat, and virtual tax expert assistance.

- Choose H&R Block if you value in-person support, better audit protection, and physical office visits.

If audit protection is a top priority, H&R Block is the better choice as it includes more comprehensive IRS audit assistance without requiring an extra fee.

Who Should Choose TurboTax?

TurboTax is a great option for taxpayers who prefer a fully online, user-friendly experience with advanced automation and AI-driven guidance. It simplifies tax filing with an intuitive, step-by-step interface, making it easy for users to navigate even complex tax situations.

Best for:

- Self-Employed & Business Owners – TurboTax Self-Employed helps freelancers, contractors, and small business owners track expenses, deductions, and maximize tax savings with AI-powered recommendations.

- Users Who Prefer Virtual Tax Assistance – TurboTax Live offers on-demand access to CPAs and tax experts, ensuring that users can get personalized help without visiting an office.

- Tech-Savvy Filers Who Want Automation – With features like QuickBooks integration and automatic income import, TurboTax reduces manual data entry, making the filing process seamless.

- Those Comfortable with DIY Tax Filing – If you prefer self-filing with AI-driven guidance, TurboTax provides real-time recommendations to help maximize deductions and credits.

Why Choose TurboTax?

- Advanced AI-powered recommendations to ensure accurate filing.

- Live CPA & tax expert help is available via TurboTax Live (for an additional fee).

- Seamless integration with QuickBooks for self-employed individuals.

- User-friendly, step-by-step interview process for an intuitive experience.

TurboTax is best for those who want a premium, AI-driven, and fully online tax filing experience with expert guidance available on demand.

Who Should Choose H&R Block?

H&R Block is a strong choice for taxpayers who prefer a balance between DIY filing and in-person support. It provides affordable pricing, an easy-to-use interface, and the option to visit a physical office for expert tax assistance if needed.

Best for:

- DIY Filers Who Want the Option of In-Person Help – H&R Block allows users to start their return online and visit a local tax office if they need assistance, making it a flexible choice for those who prefer human guidance.

- Budget-Conscious Filers – Compared to TurboTax, H&R Block offers competitive pricing for similar features, making it a better option for those looking to save money on tax preparation.

- Individuals with Standard Tax Situations – The software provides step-by-step guidance, ensuring an easy filing process for W-2 employees, homeowners, and those with basic deductions.

- Users Who Want a Mix of Online & Expert Support – H&R Block offers both virtual and in-person tax assistance, making it a great option for those who prefer personalized help when needed.

Why Choose H&R Block?

- In-person tax filing option at local offices for face-to-face assistance.

- More affordable pricing compared to TurboTax, especially for state returns.

- Easy-to-use interface with step-by-step guidance.

- Strong audit assistance included in some plans for added peace of mind.

H&R Block is ideal for budget-conscious filers who want an easy-to-use tax software with the flexibility of online and in-person support.

TurboTax vs H&R Block: Which is Better?

Both TurboTax and H&R Block offer excellent tax software solutions, but the best choice depends on individual needs, budget, and preferred level of support.

Key Differences:

- TurboTax excels in AI-driven guidance, advanced automation, and expert tax support through TurboTax Live. It’s best suited for self-employed professionals, business owners, and those with complex tax situations.

- H&R Block provides a cost-effective alternative with affordable pricing, in-person support, and strong audit protection. It’s a great option for budget-conscious filers, individuals with standard tax returns, and those who prefer expert assistance in person.

Best Choice Based on Taxpayer Needs:

| Taxpayer Type | Best Choice | Reason |

|---|---|---|

| Freelancers & Gig Workers | TurboTax | Advanced self-employment tools, integration with QuickBooks, and expert CPA assistance |

| Small Business Owners | TurboTax | Best for handling business deductions, expenses, and complex tax scenarios |

| Basic Tax Filers (W-2 Employees) | H&R Block | More affordable for simple tax returns with easy-to-use online filing |

| Investors & Stock Traders | TurboTax | Strong investment income reporting tools and automated stock trade tracking |

| Budget-Conscious Filers | H&R Block | Lower cost, offers free in-person support, and includes audit assistance in some plans |

| Filers Who Want In-Person Help | H&R Block | The only software that provides local office tax preparation services |

Final Thought

Both platforms offer great features and accurate tax filing. The decision comes down to how much support you need, your budget, and whether you prefer in-person assistance or an entirely online experience.

Conclusion

Both TurboTax and H&R Block offer powerful tax filing solutions, but the best choice depends on individual needs. If you prefer a guided, user-friendly experience with advanced deduction tools, TurboTax is a solid pick.

On the other hand, if you’re looking for a cost-effective solution with in-person support options, H&R Block is a great alternative.

Key Takeaways from the Comparison:

✅ Ease of Use: TurboTax provides a smoother, more intuitive experience, while H&R Block offers a straightforward interface with additional support options.

✅ Best for Self-Employed Filers: TurboTax excels in handling freelance and self-employment taxes with robust deduction tracking.

✅ Pricing & Value: H&R Block is often more budget-friendly while still offering great features.

✅ Expert Assistance & Audit Support: Both offer live expert help, but H&R Block includes in-person tax professional access at physical locations.

Try Before You Buy

Both TurboTax and H&R Block offer free versions or trial options, making it easy to test the software before committing. Exploring these options ensures you get a tool that aligns with your tax situation and filing preferences.

Make the Right Choice for 2025

The right tax software can simplify tax season, help maximize deductions, and provide peace of mind. Whether you prioritize affordability, ease of use, or expert support, there’s an option that fits your needs.

Frequently Asked Questions

Which is better, TurboTax or H&R Block?

TurboTax is best for online filers needing AI-driven guidance, while H&R Block offers affordable plans with in-person assistance.

Does TurboTax or H&R Block offer free tax filing?

Both offer free filing for simple tax returns, but state filing fees may apply.

Which tax software is better for self-employed individuals?

TurboTax Self-Employed is ideal for freelancers and business owners due to AI-driven deduction tracking.

Does H&R Block offer better audit protection than TurboTax?

H&R Block includes basic audit assistance, while TurboTax requires an additional purchase for full audit defense.

Can I file state taxes with TurboTax and H&R Block?

Yes, both support state filing, but additional fees apply for each state return.