Stay updated on the latest SaaS funding news, including investments in Prismatic and AiDash. Explore the launch of Equirus InnovateX Fund, dedicated to supporting seed-stage tech startups, with a focus on SaaS. Discover insights from the Indian Startups Deal Report 2023, highlighting Fintech and SaaS dominance in secondary deals. Despite a 72% decline in startup deals in 2023, the article emphasizes the resilience of the SaaS sector and anticipates increased venture capital activity later in the year.

Key Takeaways

- Latest SaaS funding news: Vertice, Prismatic, Kiefa and AiDash

- Equirus launches the $25 million Equirus InnovateX Fund to support seed-stage tech startups, including SaaS

- Private Circle’s Report: Fintech and SaaS dominated secondary deals in 2023

Latest SaaS Funding: Vertice, Prismatic, Kiefa and AiDash

Dive into the latest Saas funding news with remarkable investments in Vertice, Prismatic, Kiefa, and AiDash:

| Company Name | Category | Funding Type | SaaS Funding | Lead Investor |

|---|---|---|---|---|

| Vertice | Spend Management | Series B | $25 million | 83North and Bessemer Venture Partners |

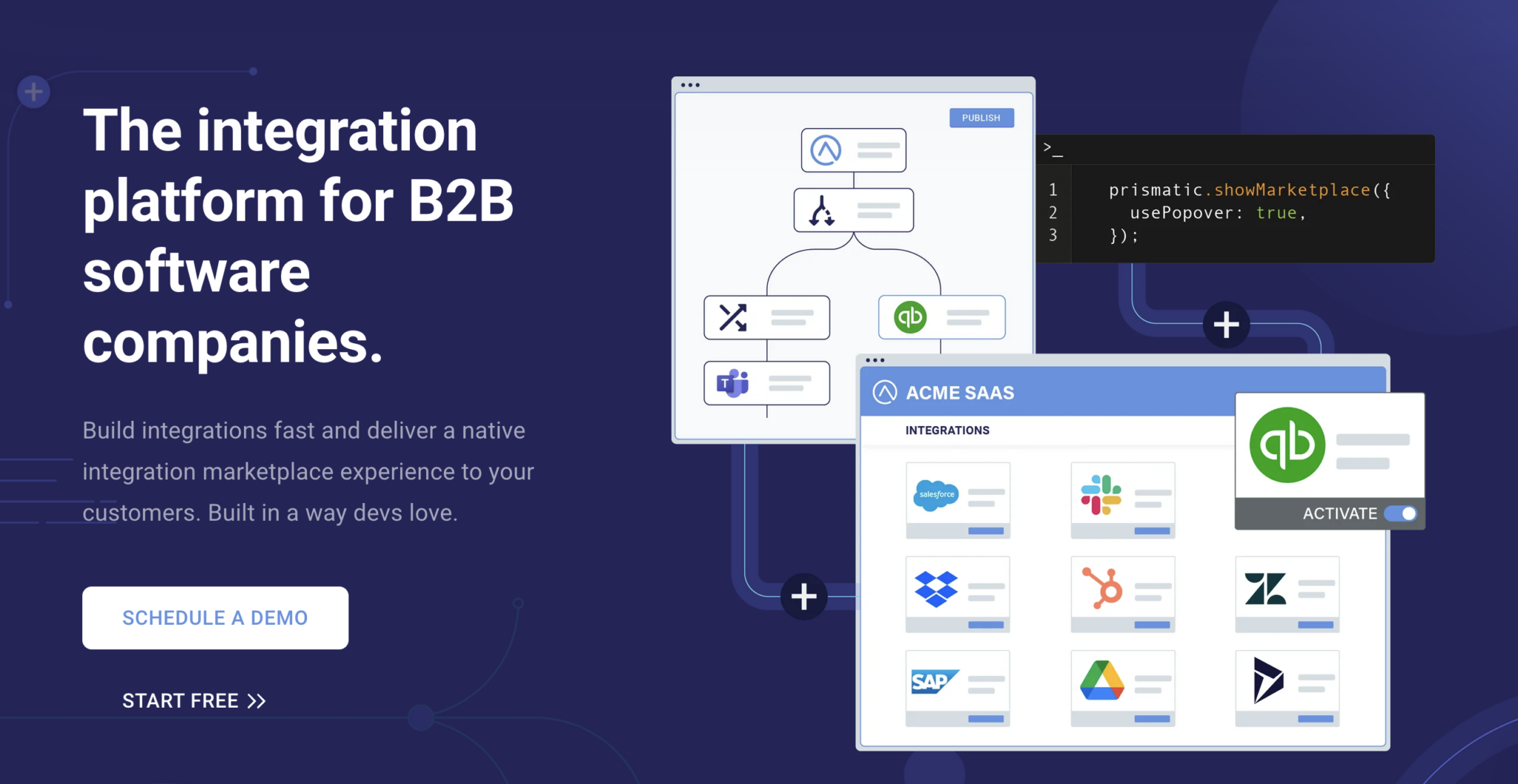

| Prismatic | Embedded Integration Platform | Series B | $22 million | Five Elms Capital |

| Kiefa | Cannabis Cultivation | Seed Funding | $2 million | Bienville |

| AiDash | Climate Tech | Series C | $50 million | Lightrock |

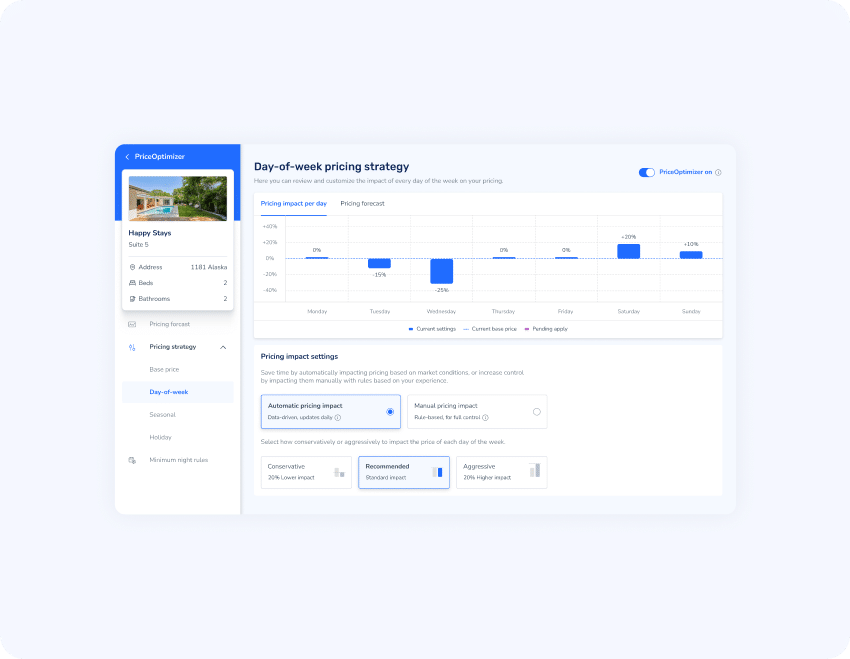

(Image Source: Prismatic Website)

Equirus Launched the $25 Million Equirus InnovateX Fund to Support Seed-stage Tech Startups, including SaaS

Equirus, a financial services company, introduced the Equirus InnovateX Fund (EIF), a $25 million fund aimed at supporting early-stage technology startups, including Saas startups. The Equirus InnovateX Fund plans to invest an average cheque size of $500,000 and $1 million across 15 to 20 seed-stage startups, primarily in sectors like SaaS, deep tech, fintech, and others. The Equirus InnovateX Fund is dedicated to empowering entrepreneurs to successfully navigate the challenges of the startup journey.

Private Circle’s Report: Fintech and SaaS Dominated Secondary Deals in 2023

The Indian Startups Deal Report 2023 (Private Circle) reveals that the Fintech and SaaS sectors maintained their dominance in funding transactions for the second consecutive year. In the evaluation of 117 startups valued at $500 million or more in the last three years, Private Circle identified a total of 252 secondary deals for these startups since 2021. Secondary rounds occur when existing shareholders sell their shares to third parties. Murali Loganathan, Director of Research, PrivateCircle, stated SaaS was common in both 2022 and 2023, showing the sector’s resilience in providing exits to investors.

However, in 2023, there was a 72% decline in the number of startup deals compared to previous years. The report indicates a 62% year-over-year drop in startup funding. Despite the slowdown in funding rounds, venture capital funds have substantial reserves, and while investor caution has persisted for nearly two years, there’s an expectation of increased venture capital activity later in the year, according to Loganathan.