Managing bills can often feel like a juggling act, especially when you’re short on cash but have plenty of credit. Plastiq stands out as a platform that bridges this gap by allowing credit card payments in places they weren’t possible before.

This article will guide you through utilizing Plastiq effectively, ensuring your bill payments are timely and reward-earning without unnecessary hassle.

Key Takeaways

- Plastiq lets you use credit cards for payments like rent and utilities, letting you earn rewards points on bills that usually don’t accept cards.

- There’s a 2.9% fee for transactions on Plastiq, but promotions and referrals can give Fee-Free Dollars to waive this cost for a limited time.

- Small businesses can benefit from Plastiq by making it easier to manage cash flow without setting up traditional merchant accounts.

- Users need to weigh the convenience of using Plastiq against the service fees and consider if their card rewards offset these costs.

- It’s important to use Fee-Free Dollars within 90 days before they expire, so keeping track of them ensures they won’t go to waste.

Plastiq Overview

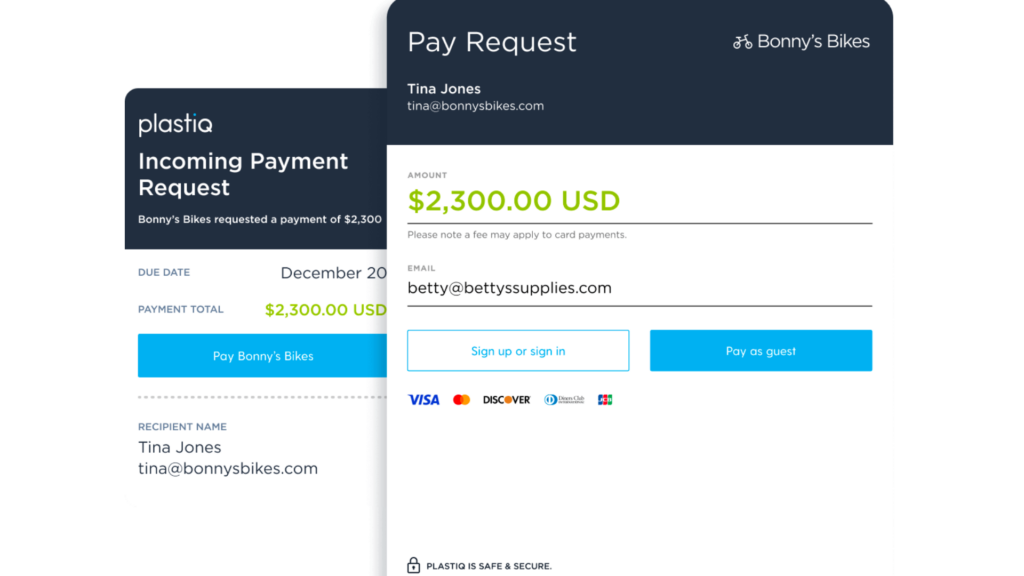

Plastiq revolutionizes the way individuals and businesses manage bill payments by allowing them to use various credit cards. It simplifies financial transactions, offering users the freedom to pay for expenses like rent, utilities, or even taxes with their preferred Visa card, Mastercard, Discover, Diners Club or JCB card.

The system caters to those who aim to maximize credit card rewards or need short-term cash flow assistance by leveraging existing credit lines.

This platform fills a unique space in payment processing by bringing convenience and flexibility. Users can earn Fee-Free Dollars (FFDs) through various promotions or referrals which waive the standard 2.9% fee on payments made within 90 days of acquisition.

More than just a tool for individual use; Plastiq extends its services to small- and medium-sized businesses seeking reliable business payment solutions with competitive fees. Transitioning now from what Plastiq is to how it operates: let’s delve into the workings of this innovative platform in the next section.

How Plastiq Works

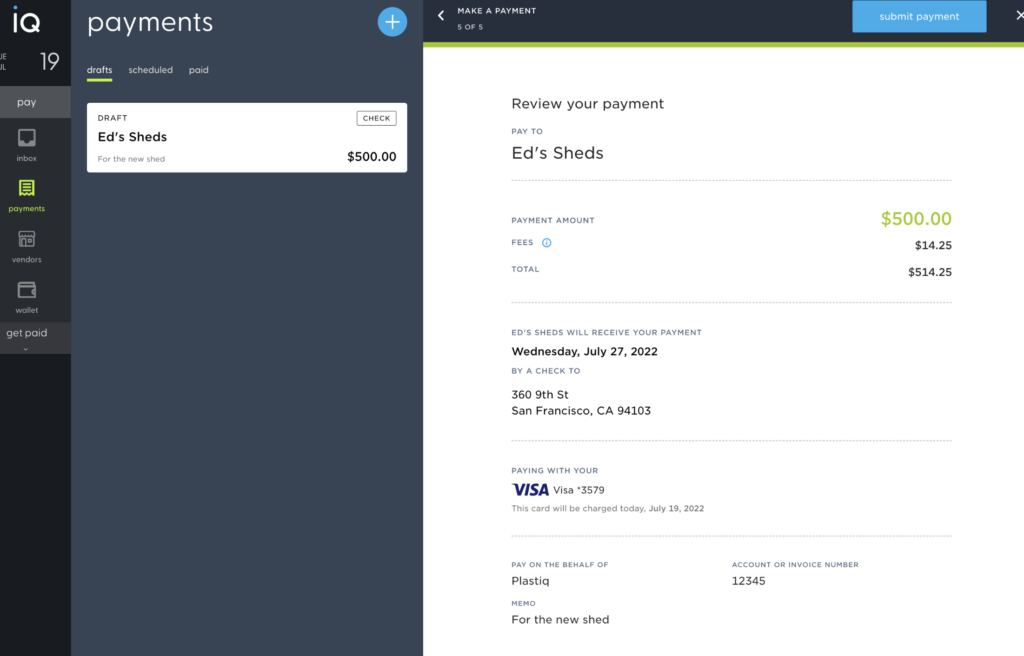

Plastiq enables bill payments with credit cards, making it suitable for both businesses and individuals looking to manage cash flow. The platform allows users to make secure and convenient payments using their preferred payment methods.

Enabling bill payments with credit cards

Enabling bill payments with credit cards just got easier, all thanks to services like Plastiq. This innovative platform bridges the gap for those who want to leverage their credit line to pay bills that traditionally don’t accept this form of payment.

Whether it’s your rent, utility bills, or even a car payment, you can charge it on your Visa, Mastercard, Discover, Diners Club, or JCB card through Plastiq.

Keep in mind that using your credit card for these transactions involves a processing fee of 2.9%. While some might balk at the extra cost, others find value in the convenience and potential reward points from their card providers.

Gone are the days when you had to miss out on earning miles or cash back just because some vendors didn’t accept credit cards for certain payments. With this service taking care of your nontraditional bill payment options online, managing finances becomes more streamlined and potentially more rewarding.

Suitable for businesses and individuals

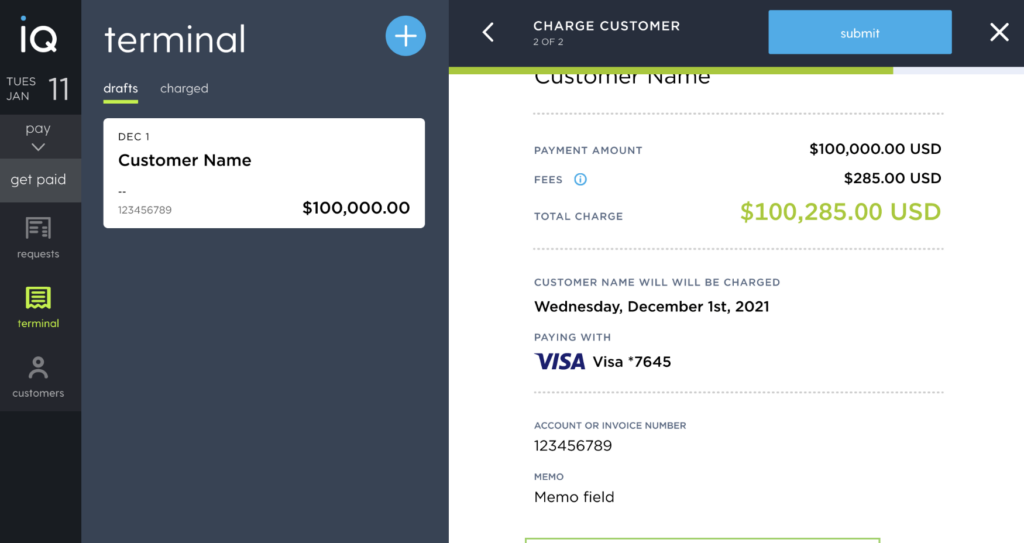

Plastiq expands your payment flexibility by turning your credit card into a tool for paying virtually any bill. Whether you’re running a small business and need to manage cash flow or an individual looking to maximize reward points on expenses, this service aligns with diverse financial strategies.

Charge rent, utilities, or even tax payments to your card hassle-free. Small business solutions just got more versatile as Plastiq simplifies handling business expenses while offering the chance to earn valuable Feefree payments through promotions or referrals.

Harnessing the power of Plastiq can turbocharge the way you accumulate credit card rewards. Imagine effortlessly collecting miles for that dream vacation simply by paying your monthly bills — something you would do anyway! Not only do users gain from this innovative bill payment service, but they can also tap into referral bonuses that multiply their benefits without extra effort.

Payment processing through Plastiq ensures every dollar spent works harder towards meeting both short-term needs and long-term financial goals.

Pros and Cons of Using Plastiq

Plastiq presents itself as a unique solution for managing payments with a credit card. It bridges the gap between credit card acceptance and merchants who typically require other forms of payment.

Pros of Using Plastiq

| Pros | Description |

|---|---|

| Extended Credit Periods | Users benefit from their credit card’s grace period, which can be a strategic advantage for cash flow management. |

| Reward Points Accumulation | Paying through Plastiq allows individuals to earn rewards, points, or cash back on their credit cards, which could be valuable if they outweigh the service fee. |

| Versatility in Payments | The platform supports a wide range of bill payments including rent, utilities, and even taxes, making it a versatile tool for those who prefer using their credit card for all expenditures. |

| Simplified Business Transactions | Small businesses find Plastiq useful for simplifying transactions, as it enables them to accept credit card payments without the need to set up merchant accounts. |

| Fee-Free Dollars | Via referrals and promotions, users can acquire Fee-Free Dollars (FFDs), which allow them to make payments without incurring the service fee, though these do have an expiration date. |

Cons of Using Plastiq

| Consideration | Description |

|---|---|

| Service Fees | Each transaction includes a 2.9% fee, which can add up and potentially negate the benefits of rewards earned from credit cards. |

| American Express Limitations | The inability to use American Express cards for payments restricts options for those who primarily rely on this credit card provider. |

| Cost vs. Reward Balance | It’s essential to calculate whether the rewards earned from using a credit card will surpass the costs associated with Plastiq’s fees. |

| Expired Incentives | Although FFDs can offset the service fee, they expire after 90 days, requiring users to keep track and utilize them within a limited timeframe. |

| Not Universally Beneficial | The service might not be cost-effective for those who do not earn substantial rewards from their credit card provider or for those who can pay bills without a service fee through other means. |

Understanding the costs associated with Plastiq is the next step in evaluating whether this payment platform aligns with your financial strategies.

Understanding Plastiq Fee

After evaluating the pros and cons of using Plastiq, it is crucial to comprehend the costs associated with this payment platform. Here’s a detailed look at the different cost elements involved in utilizing Plastiq:

| Cost Element | Description |

|---|---|

| Payment Processing Fees | Plastiq charges a 2.9% processing fee for credit card payments, affecting both individuals and businesses. |

| Promotional Offers and Referral Bonuses | Users can acquire Fee-Free Dollars (FFDs) through promotions or referrals; however, these FFDs expire after 90 days. |

| Small Business and Medium-Sized Business Fees | For small- and medium-sized businesses, there is a standard 2.9% fee for credit card payments through Plastiq. |

| Consideration of Credit Card Rewards Rate | Individuals should assess whether the 2.9% credit card payment fee exceeds their credit card rewards rate before opting for Plastiq as a payment method. |

| Cash Flow Management Costs | Although users can manage cash flow by paying bills with a credit card before having actual funds available, they must consider the accompanying 2.9% processing fee. |

Conclusion

As we wrap up, it’s essential to understand that Plastiq offers a convenient way to pay bills with credit cards. It provides flexibility for individuals and small businesses when managing cash flow.

While there are costs involved, the platform can be beneficial for those seeking short-term financing options or looking to earn credit card rewards. Whether you’re an individual needing extra time before making payments or a small business owner seeking efficient payment methods, Plastiq may offer the solutions you need.

FAQs

How do I sign up for a Plastiq account?

To sign up for a Plastiq account, visit the official website and click on the “Sign Up” button. Fill out the required details to create your account.

Can I use any credit card with Plastiq?

Plastiq accepts most major credit cards including Visa, Mastercard, and American Express for bill payments.

Are there fees associated with using Plastiq?

Yes, Plastiq charges a fee for processing payments via credit card. The fee varies depending on the type of payment being made.

How long does it take for my bill payment to be processed through Plastiq?

The processing time for bill payments through Plastiq can range from 2-5 business days depending on the recipient and payment method used.

What types of bills can I pay using Plastiq?

You can use Plastiq to pay various bills such as rent, mortgage, utilities, insurance premiums, taxes, and more using your preferred credit card.