Managing money wisely is a must for small businesses looking to thrive. Kabbage, once an innovative financial technology firm, offered tools designed to simplify cash flow management.

This guide will explore how these solutions could assist entrepreneurs in keeping their finances healthy and focused on growth.

Key Takeaways

- Kabbage Solutions provides a range of financial services including easy applications for loans, lines of credit up to $250,000, and insightful analytics accessible through their mobile app.

- American Express revived the innovative mission of Kabbage after its bankruptcy by launching American Express Business Blueprint™, which continues to support small businesses with comprehensive cash management tools.

- Employing Kabbage strategies such as real-time data analysis and automation can save time and reduce errors, helping entrepreneurs focus on growth rather than being bogged down by financial management tasks.

- Small businesses can grow their savings with a Kabbage high-yield savings account that offers a 1.3% APY on balances up to $500,000 while also managing daily finances effortlessly with a no-fee online business checking account.

- Businesses gain flexibility and agility in the market by using Kabbage’s advanced analytics for financial forecasting and round-the-clock access to business performance data for informed decision-making.

Overview of Kabbage Solutions

Transitioning from our introduction, let’s delve into the comprehensive suite of offerings provided by Kabbage. As an online financial technology company, Kabbage stepped onto the scene with a vision to empower small businesses—supplying them with much-needed funding through an innovative automated lending platform.

Their approach disrupted traditional financing models by providing quick access to capital for businesses eager to fuel growth and sustain operations.

Kabbage’s assortment of financial services tailored for small enterprises included straightforward loan applications, lines of credit, and insightful analytics—all accessible via their user-friendly mobile app.

While initially flourishing with a revenue surge to $200 million in 2017, their involvement in the Paycheck Protection Program brought unforeseen challenges that eventually led to bankruptcy proceedings in 2022.

Despite this setback, the robustness of its original mission was recognized by American Express during its acquisition and revival as American Express Business Blueprint—a testament to Kabbage’s innovation in the pursuit of supporting SMBs financially.

Managing Cash Flow with Kabbage

Kabbage offers efficient cash flow management solutions for small businesses through its growth-focused products and online lending platform. With Kabbage, businesses can access the funds they need to support their growth and manage their cash flow effectively.

Efficient cash flow management with Kabbage

Efficient cash flow management stands at the heart of a thriving small business. Kabbage harnesses technology to streamline financial operations with precision and ease.

- Access funds when needed with flexible lines of credit up to $250,000, ensuring businesses can cover expenses without interruption.

- Utilize real-time data analysis for informed decision-making; this feature allows entrepreneurs to understand their financial health instantly.

- Embrace automation in cash flow processes to reduce manual errors and save valuable time, freeing up resources for other aspects of business development.

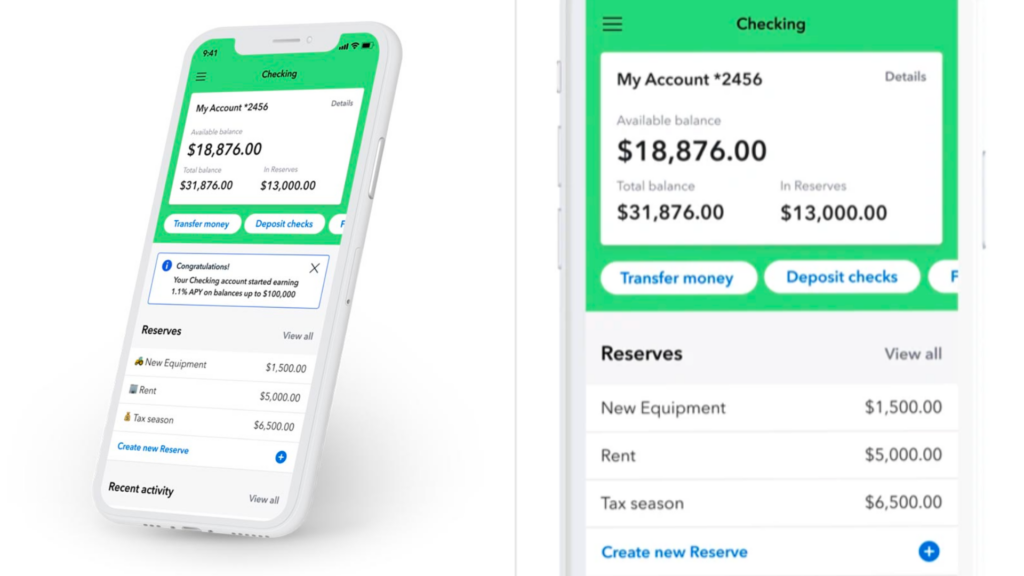

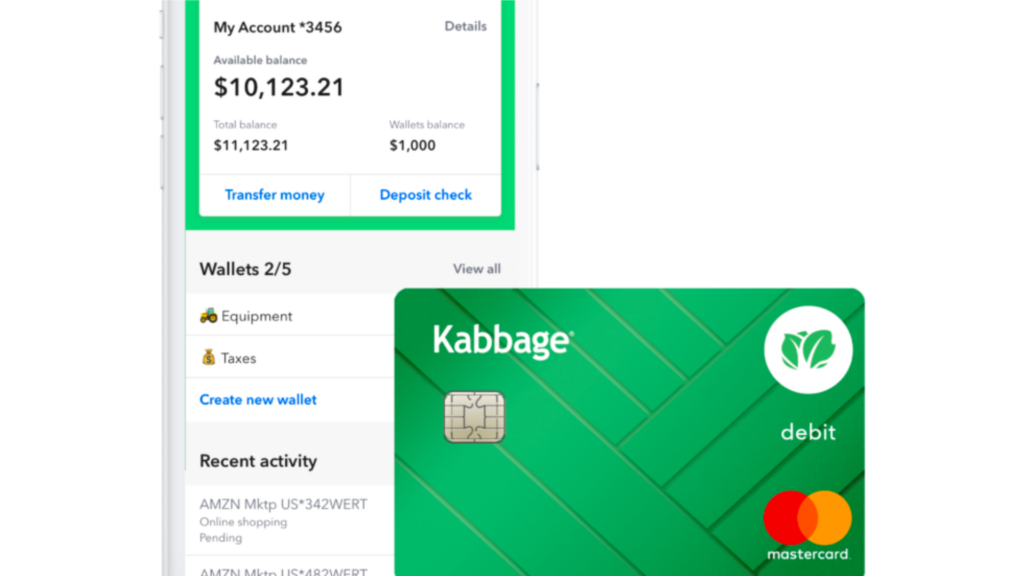

- Harness the power of American Express Business Blueprint™, a digital hub designed to provide comprehensive cash management solutions.

- Adapt quickly to changing market conditions by leveraging financial tools that respond dynamically to your company’s performance data.

- Foster growth and prepare for scale with products tailored to support increased revenue ambitions efficiently.

- Benefit from integrated financial services that consolidate various management tasks into a unified platform for simplicity and control.

Growth-focused products for business needs

Kabbage recognizes the unique financial needs of small businesses aiming for growth. Their suite of products is designed to fuel expansion and optimize cash flow.

| Product | Description |

|---|---|

| Lines of Credit | Kabbage extends flexible credit options with lines of credit up to $250,000, empowering small businesses to manage cash flow efficiently and handle unexpected expenses without a hitch. |

| Highyield Savings Accounts | Offering a high yield savings account with a 1.3% APY on balances up to $500,000 gives companies the ability to grow their reserves while earning competitive returns. |

| Business Checking Account | Kabbage’s no-fee online business checking account integrates seamlessly with other financial tools, ensuring that managing day-to-day finances is straightforward and cost-effective. |

| Financial Forecasting Tools | Utilizing advanced analytics, Kabbage aids in predicting cash flow trends, helping businesses strategize effectively and make data-driven decisions. |

| Business Analytics | Round-the-clock access to business analytics with Kabbage means entrepreneurs can stay informed about their financial standing and plan ahead with greater precision. |

Kabbage Benifits for Business

Kabbage offers numerous benefits for small businesses. Its digital financial solutions provide real-time insights and automated tools, allowing business owners to efficiently manage their cash flow.

From online payments to flexible lines of credit, Kabbage’s integrated suite of financial products empowers small businesses to streamline their operations and focus on growth. With access to working capital funding and growth capital options, businesses can secure the funds they need without the hassle often associated with traditional financing.

Moreover, Kabbage’s small business banking solutions offer convenience and accessibility, enabling entrepreneurs to make informed financial decisions based on real-time data. This ensures that businesses have the flexibility and agility required in today’s fast-paced market landscape.

Overall, Kabbage provides a comprehensive set of resources that cater directly to the needs of modern small businesses, equipping them with the tools necessary to thrive in an increasingly competitive environment.

Conclusion

In conclusion, entrepreneurs can effectively manage cash flow for their small businesses by utilizing Kabbage solutions. These growth-focused products cater to the specific needs of businesses, providing efficient cash flow management through an automated lending platform.

Small business owners can benefit from these financial tools and spend less time on administrative tasks while focusing on building thriving businesses. By leveraging real-time data and automation, small business owners can gain practical advantages in working capital management and cash flow forecasting, empowering them to achieve their business goals with confidence.

(Image Source: Collection)

Frequently Asked Questions

How can I improve my small business’s cash flow?

You can enhance your cash flow by negotiating extended payment terms with vendors, incentivizing early payments from customers, and monitoring expenses closely.

What are the benefits of using Kabbage solutions for managing cash flow?

Kabbage solutions offer flexible access to funds, streamlined application processes, and quick funding, empowering small businesses to manage their cash flow efficiently.

Can I qualify for Kabbage solutions with a less-than-perfect credit score?

Yes, Kabbage considers various factors beyond credit scores when evaluating eligibility for their solutions, providing opportunities for businesses with diverse financial profiles.

How quickly can I access funds through Kabbage solutions?

Through Kabbage technology and automated processes, eligible businesses can often access funds within minutes of approval.

Are there any hidden fees or obligations associated with using Kabbage solutions?

Kabbage offers transparency in its fee structure without long-term commitments or prepayment penalties*, providing clarity and flexibility to small businesses.