Choosing the best 401k provider might be one of the prime yet critical strategic decisions for any business wanting to offer retirement benefits. A well-structured 401k scheme finds an indispensable place for attracting and retaining talent, providing tax advantages, and helping employees build long-term financial securities.

Yet, choosing the right provider can be overwhelming with all the available companies out there. Administrative fees, investment options, compliance support, and ease of administration and management are all critical in narrowing down the options to the provider that would best suit the needs of your company.

This guide will break down the most vital considerations to help businesses along in the selection process and ensure that they choose a 401k provider that offers significant value for employees and employers alike. There are also insights on employer matching and safe harbor options, curtailing the burden of recent regulatory changes to smooth your decision-making.

Understanding 401k Plans

A 401k plan is a retirement savings program where employees allocate a portion of their salary into an investment account, often supplemented by employer-matching contributions.

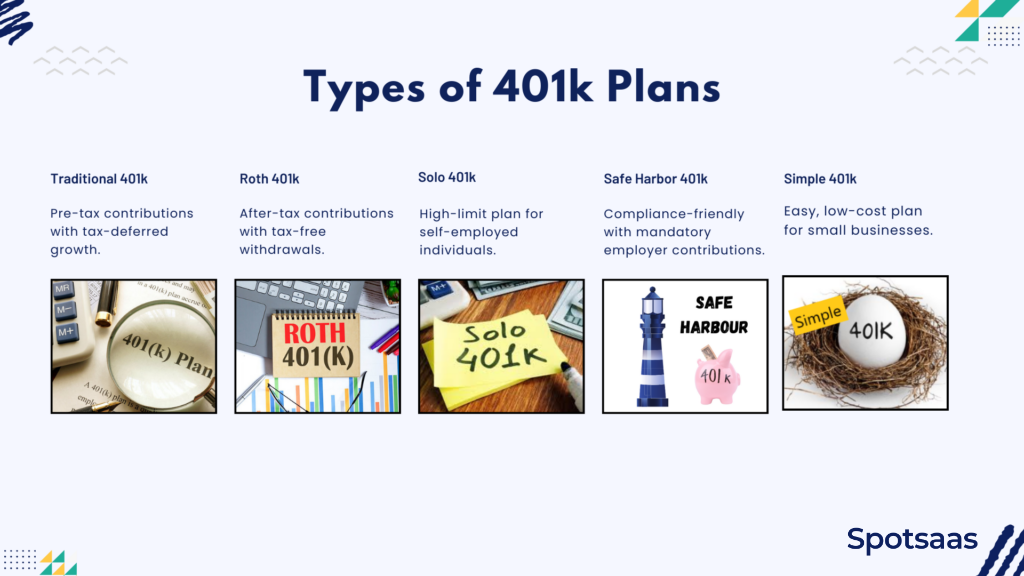

Traditional 401k

A Traditional 401k allows employees to contribute earnings before taxes, reducing their taxable income. Taxes on these contributions are deferred until funds are withdrawn in retirement, usually after age 59½. Many employers offer matching contributions, often with a vesting schedule that determines when employees gain full ownership.

This plan helps employees by lowering their current tax burden while building long-term savings. For businesses, it serves as a valuable benefit that promotes employee retention and financial well-being.

Examples:

- Fidelity 401k Services – Offers employer-sponsored plans with flexible contribution matching.

- Vanguard Retirement Plans – Provides tax-advantaged retirement solutions with low-cost investment options.

- Charles Schwab 401k Plans – Helps businesses set up traditional retirement plans with compliance support.

- Empower Retirement – Offers personalized investment advice and tax-deferred savings for employees.

Roth 401k

Roth 401k is funded with after-tax dollars, meaning withdrawals in retirement are tax-free. Unlike a Traditional 401k, contributions do not reduce taxable income, but the benefit lies in tax-free earnings growth.

This option is ideal for employees who expect to be in a higher tax bracket in the future. Businesses offering Roth 401k plans provide flexibility for employees who prefer paying taxes upfront rather than upon retirement withdrawals.

Examples:

- Betterment for Business – Offers automated personalized investment options.

- Fidelity Roth 401k – Provides tax-free growth and flexible withdrawal options in retirement.

- T. Rowe Price 401k Plans – Includes Roth and traditional options with professional fund management.

- Human Interest – A startup-friendly provider with low-cost investment choices.

Solo 401k (Self-Employed 401k)

A Solo 401k is tailored for self-employed individuals or business owners without employees, except for a spouse. It enables contributions as both an employer and employee, allowing for higher tax-deferred savings. This plan offers generous contribution limits and flexibility in investment choices.

It is an excellent option for entrepreneurs seeking to grow their retirement savings while lowering taxable income, making it a valuable financial tool for self-employed professionals and small business owners.

Examples:

- E*TRADE Solo 401k – Offers flexible investment options and no setup fees for self-employed professionals.

- Vanguard Individual 401k – Low-cost retirement plan with diverse fund choices.

- Fidelity Solo 401k – Provides easy online setup and investment management for small business owners.

- Schwab Individual 401k – Features a broad range of investments with no maintenance fees.

Safe Harbor 401k

A Safe Harbor 401k simplifies compliance with IRS regulations by requiring mandatory employer contributions. This ensures all employees benefit, regardless of their salary or tenure. In return, businesses avoid complex nondiscrimination testing, making plan administration easier.

This type of 401k is ideal for small to mid-sized businesses looking to offer retirement benefits without the risk of failing IRS compliance tests. It’s a structured way to boost employee participation while maintaining regulatory compliance.

Examples:

- ADP 401k Plans – Provides Safe Harbor plans with integrated payroll services.

- Paychex Safe Harbor 401k– Helps small businesses stay compliant while offering tax benefits.

- Guideline 401k– Automates compliance and simplifies plan administration for businesses.

- Ascensus Safe Harbor 401k – Supports flexible contribution structures for employers.

Simple 401k

A Simple 401k is a retirement plan for businesses with fewer than 100 employees, offering a more straightforward setup than a traditional 401k. Employers must provide mandatory contributions, but the plan has fewer administrative burdens.

Employees benefit from tax-deferred savings, while businesses avoid complex compliance requirements. It’s a good option for small businesses that want to offer a retirement plan with lower costs and minimal regulatory challenges. However, contribution limits are lower compared to other 401k plans.

Examples:

- Gusto – Offers SIMPLE 401k plans with seamless payroll integration.

- Zenefits – Provides an easy-to-use retirement plan solution for small businesses.

- Ubiquity Retirement + Savings – Affordable SIMPLE 401k plans designed for startups and SMBs.

- Paychex SIMPLE – Helps small employers set up and manage cost-effective retirement benefits.

Key Features to Look for in a 401k Provider

Choosing the right 401k provider involves more than just comparing costs—it’s about selecting a plan that aligns with your business size, employee needs, and long-term financial goals.

Investment Options

Employees need access to various investment choices to build a diversified retirement portfolio. A strong 401k provider should offer:

- Mutual Funds & ETFs – A mix of actively and passively managed funds tailored to different risk levels.

- Target Date Funds – Target Date Funds are investments that automatically adjust as an employee nears retirement.

- Managed Portfolios – Professionally managed plans that optimize returns based on market conditions.

- Self-Directed Investment Options – Some providers allow participants to invest in individual stocks, bonds, or alternative assets.

Providers‘ Example: Fidelity (extensive mutual fund selection), Vanguard (low-cost index funds), Betterment for Business (automated investment management).

Employer & Employee Contributions

A well-structured 401k plan should offer flexibility in contributions, allowing both employers and employees to maximize retirement savings.

- Employer Matching – Many businesses offer matching contributions as an incentive for employees to save. Providers should support various match structures (e.g., 100% of the first 3%, 50% of the next 2%).

- Vesting Schedules – Determines when employees gain full ownership of employer contributions, helping with retention.

- Catch-Up Contributions – Employees over 50 should have the option to contribute beyond standard IRS limits.

- Safe Harbor Contributions – Some providers offer automatic employer contributions to simplify compliance.

Providers‘ Example: ADP 401k (customizable matching), Paychex (flexible vesting options), Guideline (automated employer contributions).

Administrative Support

Managing a 401k plan requires ongoing administrative work, which can be overwhelming for businesses without dedicated HR teams. A reliable provider should handle:

- Plan Setup & Maintenance – Guided onboarding and continuous support.

- Regulatory Compliance – Ensuring adherence to IRS and Department of Labor rules, including nondiscrimination testing.

- Form 5500 Filing – Annual reporting to the IRS and Department of Labor.

- Employee Education – Webinars, FAQs, and retirement planning resources to help employees understand their benefits.

Providers‘ Example: Guideline (automated plan administration), Ascensus (comprehensive compliance support), Human Interest (dedicated customer service and HR integrations).

Cost & Fees

Cost is one of the most important factors when selecting a 401k provider, as high fees can significantly reduce retirement savings over time. Businesses should carefully evaluate:

- Setup Fees – One-time charges for launching a new plan.

- Ongoing Management Fees – Annual or monthly costs for maintaining the plan, often a percentage of assets under management (AUM) or a flat fee.

- Expense Ratios – The percentage of fund assets used for management expenses. Lower ratios mean higher returns for employees.

- Hidden Fees – Extra costs for things like fund transfers, recordkeeping, plan terminations, or IRS filings.

Providers‘ Example: Ubiquity Retirement + Savings (flat-rate pricing model), Empower Retirement (low administrative costs), Human Interest (affordable small-business-friendly fees).

Fiduciary Responsibilities

When managing a 401k plan, employers should act in the best interests of their employees when managing a 401k plan. Some providers offer fiduciary services, which reduce the liability for business owners by taking on compliance and investment selection responsibilities.

Key fiduciary services include:

- 3(16) Fiduciary – Manages plan administration, compliance, and filings.

- 3(21) Fiduciary – Provides investment recommendations but leaves the final decision to the employer.

- 3(38) Investment Fiduciary – Assumes full responsibility for selecting and monitoring investments.

Providers‘ Example: Empower Retirement (full fiduciary services), T. Rowe Price (investment management fiduciary support), Charles Schwab (ERISA-compliant fiduciary services).

Integration with Payroll & HR Software

A 401k plan should seamlessly integrate with a company’s existing payroll and HR software to automate deductions and ensure compliance. Look for providers that offer:

- Automatic Payroll Deductions – Ensures employee contributions are processed accurately.

- Tax Reporting & Compliance – Handles IRS reporting, including W-2 preparation and tax filings.

- Employee Onboarding & Eligibility Tracking – Integrates with HR platforms to manage enrollments and eligibility.

- Third-Party Software Compatibility – Works with leading payroll providers like Gusto, ADP, QuickBooks, Paychex, and Zenefits.

Providers‘ Example: Gusto 401k (native payroll integration), Zenefits (HR & benefits platform with 401k support), Paychex (comprehensive payroll and retirement benefits).

Comparing 401k Providers: Key Factors

Selecting the right 401k provider requires careful evaluation of several key factors that impact both employers and employees. From the ease of onboarding to compliance and reputation, businesses must ensure they choose a provider that aligns with their needs.

Ease of Setup & Onboarding Process

A smooth onboarding process allows businesses to set up a 401k plan without complications. The best providers, like Fidelity and ADP Retirement Services, offer guided support, intuitive online registration, and seamless payroll integration.

The quick implementation allows businesses to focus on their operations while ensuring employees can start saving for retirement without delays.

User Experience & Support

A user-friendly 401k platform ensures both employers and employees can efficiently manage their accounts. The best providers offer round-the-clock customer service, mobile accessibility, and access to financial education tools.

Platforms like Charles Schwab and Vanguard prioritize ease of use, providing intuitive dashboards and helpful resources for participants. A responsive and well-supported system encourages higher employee participation and engagement.

Plan Customization & Scalability

Businesses of different sizes require flexible retirement plan options. A good 401k provider should offer various plan types, employer matching flexibility, and investment choices that cater to different risk levels.

Providers like Empower Retirement and Guideline stand out for their scalable solutions, making them suitable for both startups and large enterprises looking to expand their plans as their workforce grows.

Regulatory Compliance & Security

Ensuring compliance with IRS and Department of Labor regulations is essential to avoid penalties. The best 401k providers handle ERISA compliance, nondiscrimination testing, cybersecurity measures, and automated tax reporting.

Fidelity and ADP offer robust compliance support, ensuring businesses remain in good standing with regulatory requirements. Strong security protocols protect sensitive financial data and maintain trust among plan participants.

Reputation & User Reviews

A provider’s reputation is a key indicator of reliability and service quality. Businesses should consider third-party ratings, customer testimonials, and reviews highlighting investment performance, pricing transparency, and customer service.

Vanguard and Charles Schwab consistently receive positive feedback for their cost-effective investment options and strong customer satisfaction ratings. Evaluating real user experiences helps businesses make informed decisions and choose a provider with a proven track record.

Top 401k Providers for Businesses

Here’s a concise comparison of the top 401k providers for businesses, highlighting their strengths and ideal business types:

| Provider | Best For | Key Strengths | Support & Integration |

|---|---|---|---|

| Fidelity Investments | Large businesses | Wide investment options, 24/7 support | Integrates with ADP, Workday, QuickBooks |

| Vanguard | Small businesses | Low fees, strong mutual fund options | Compatible with payroll & HR software |

| Charles Schwab | Businesses needing investment flexibility | Diverse fund choices, easy administration | Phone, email, live chat support |

| Empower Retirement | Companies focusing on engagement | Interactive planning tools, scalable plans | Integrates with HR & benefits platforms |

| ADP Retirement Services | Businesses needing payroll integration | Seamless payroll & 401k management | Phone and email support |

| Guideline | Startups and small businesses | Affordable, automated 401k solution | Email and phone support |

| Betterment for Business | Companies preferring automation | Robo-advisor investment management | Integrates with payroll platforms |

Steps to Implement a 401k Plan for Your Business

Setting up a 401k plan requires careful planning to ensure it aligns with business goals and employee needs. Following a structured approach helps simplify implementation while ensuring compliance and long-term success.

Step 1: Define Business Needs and Employee Expectations

Assess company goals, budget, and employee preferences for retirement benefits. Determine contribution structure, vesting schedules, and eligibility criteria.

Step 2: Shortlist and Evaluate Providers

Compare providers based on costs, investment options, and administrative support. Look for seamless payroll integration and strong compliance assistance.

Step 3: Set Up the Plan and Onboard Employees

Finalize plan details, including employer contributions and enrollment rules. Educate employees about plan benefits through clear communication and training.

Step 4: Ensure Compliance and Ongoing Management

Stay compliant with IRS and labor regulations by conducting required filings. Use providers with automated compliance tools to simplify audits and reporting.

Step 5: Monitor and Optimize Plan Performance Over Time

Review participation rates, investment performance, and fees regularly. Adjust matching contributions and plan features to improve employee engagement.

Common Mistakes to Avoid When Choosing a 401k Provider

Selecting the right 401k provider is a crucial decision impacting the business and its employees. Avoiding these common mistakes can help businesses ensure a cost-effective and compliant retirement plan.

Overlooking Hidden Fees

Many plans include administrative, investment, and transaction fees that reduce savings. Reviewing all costs upfront helps businesses avoid unexpected expenses.

Ignoring Fiduciary Responsibilities

Employers must ensure compliance and act in employees’ best interests. Choosing a provider with fiduciary services reduces legal and financial risks.

Choosing Limited Investment Options

A restricted fund selection limits employees’ ability to diversify investments. Providers offering mutual funds, ETFs, and managed portfolios provide more flexibility.

Failing to Consider Employee Engagement and Education

Employees engage more when they understand the benefits of a 401k plan. Providers with financial education tools and retirement planning resources improve participation.

Conclusion

Choosing the right 401k provider allows a retirement plan that is cost-effective, compliant, and valuable to engage. Employers should evaluate providers by fee assessment, fiduciary services, investment options, employer matching, safe harbor 401k plans, and employee engagement tools to help reduce the cost of the plan while ensuring flexibility for employees in options such as 401k loans.

For the hiring and retention of employees while ensuring the long-term financial security of the employees, a well-designed 401k scheme does work wonders. Recently enacted 401k rule changes allow tax incentives and simplified administration for small businesses with regard to their offering competitive benefits. By evaluating multiple providers, a business ensures that they find a solution suitable for their workforce and competent with the business’s financial goals.

Today, we can compare a host of 401k providers to design a retirement plan that helps a business while empowering employees, freelancers, and gig workers with the tools to build a secure financial future.

Frequently Asked Questions

How do I choose the right 401k provider for my business?

Evaluate fees, investment options, compliance support, and payroll integration to match your business needs.

What are the typical fees associated with a 401k plan?

Fees include administrative costs, investment expense ratios, transaction fees, and potential hidden charges.

What is a fiduciary, and why is it important?

A fiduciary manages the plan in employees’ best interests, ensuring compliance and reducing employer liability.

Can small businesses afford to offer a 401k plan?

Yes, 401k providers like Guideline, Betterment, and Ubiquity offer affordable, automated 401k solutions for small businesses.

How can I encourage employees to participate in the 401k plan?

Offer financial education, employer matching, and easy enrollment to boost participation and engagement.