Managing business expenses can often feel like navigating a complex maze. Divipay Weel stands out as a spend management platform that streamlines this process with ease and efficiency.

This article will explore how Divipay Weel’s innovative tools and features simplify expense reporting, offering solutions for seamless financial oversight.

Key Takeaways

- Divipay Weel offers virtual corporate cards that provide secure transactions with set spending rules to align with company policies, drastically cutting down on expense administration time.

- Businesses like Canva and Michael Hill have successfully used Divipay Weel to reduce hours spent on expense reporting by using its efficient approval processes and real-time transaction tracking.

- The platform includes a subscription management feature enabling businesses to easily manage and track their recurring expenses, contributing to better financial oversight.

- Divipay Weel’s bill payment features simplify managing subscriptions and filing reimbursement claims, endorsed by firms for its ease of use in handling financial operations securely.

- Integration with Payentry enhances payroll processes within Divipay Weel, automating payments, reducing errors, and offering robust security against fraud.

Overview of Divipay Weel

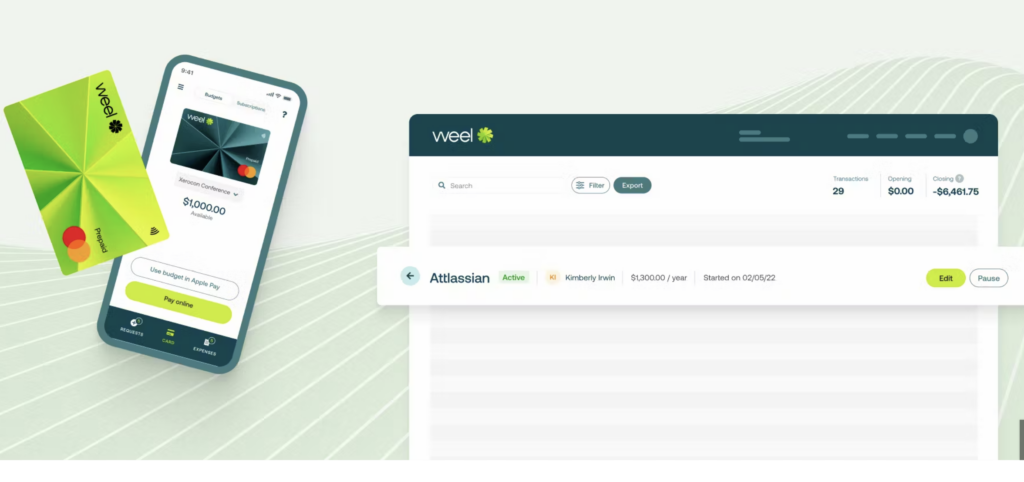

Divipay Weel is a streamlined spend management platform that provides virtual corporate cards, expense reporting, and reimbursement solutions for businesses. With its user-friendly software and smart corporate card features, Divipay Weel aims to simplify the process of managing expenses and business payments.

Streamlined Spend Management

Managing corporate spending efficiently is crucial, and Weel rises to the challenge by offering virtual corporate cards with customizable spending rules. These ensure all transactions are secure and adhere to company policies.

Weel’s system provides real-time transaction tracking, so financial teams can monitor expenditures as they happen. Coupled with custom approval processes, the platform ensures that every penny spent is both justified and accounted for.

Imagine having a powerful tool at your fingertips that slashes expense administration time dramatically—a 70% reduction in processing time as reported by users like Sarah Jennings of Michael Hill.

This translates into massive savings in hours; imagine saving up to 870 hours each month just on expense administration! By employing features like budget controls and seamless accounting integrations, Weel streamlines spend management so businesses can focus more on growth and less on tedious financial tasks.

Expense Reporting

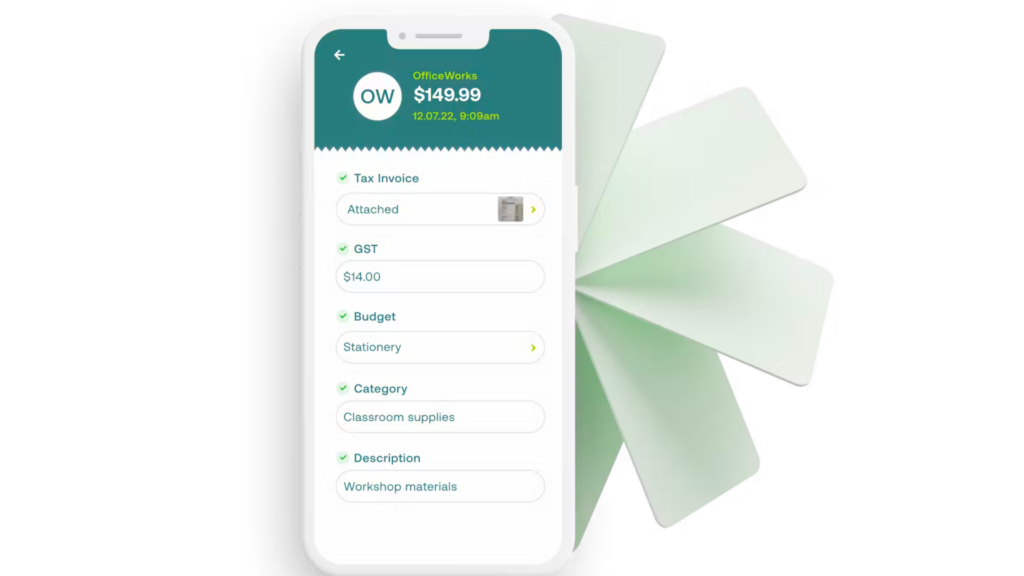

Expense reporting transforms from a tedious task into a streamlined process with Divipay Weel. Say goodbye to piles of receipts and manual entry, as the platform simplifies financial management by providing virtual corporate cards for business expenses.

These cards come with predefined spending controls that enforce company policies right at the moment of purchase, making sure every transaction aligns with budgeting solutions.

Approval processes have never been more efficient; custom approval flows to ensure that all expenditures go through the necessary checks quickly, reducing processing time significantly.

Corporate giants like Canva and Michael Hill are among those who’ve slashed hours off their reporting routines using these savvy tools. Streamline your business operations further by seamlessly moving to key features such as virtual corporate cards in Divipay Weel’s toolbox.

Divipay Weel Features

Divipay Weel offers a range of key features to streamline spend management and expense reporting, including virtual corporate cards, subscription management, bill payments, and integration with Payentry for simplified payroll processes.

With these tools, businesses can efficiently track expenses and manage financial transactions with ease.

Virtual Corporate Cards

Virtual corporate cards from Weel empower businesses with unparalleled financial control and streamlined spend management. These digital business cards introduce a new era of payment solutions, allowing employees to make secure transactions while adhering to company policies.

Picture your team making purchases with confidence, knowing that each card comes with custom spending rules to prevent any out-of-policy expenditure.

Companies such as Canva and Michael Hill have harnessed these virtual tools, ensuring every transaction aligns with their budget management strategies. With real-time tracking and seamless accounting software integration, financial teams can say goodbye to unwieldy expense reports.

The instant visibility into business spending plus robust approval processes transform how organizations handle their finances. Leading into our next feature promise – subscription management is just as efficient and impactful for ongoing cost control.

Subscription Management

Divipay Weel provides a comprehensive subscription management platform, allowing users to track and manage company subscriptions with ease. This feature streamlines the process of monitoring and paying for various business-related subscriptions, ensuring efficient expense management.

Additionally, Weel offers reimbursement claims for subscriptions on-the-go, simplifying the task of tracking and managing expenses associated with company subscriptions.

With Divipay Weel’s flexible spending and custom approval flows, businesses can ensure in-policy spending while maintaining control over subscription management processes. This empowers companies to maintain oversight of their subscription expenses while offering employees the convenience of tracking and managing their subscriptions effectively within established guidelines.

Bill Payments

The bill payment feature within Divipay Weel grants businesses the ability to effortlessly manage all company subscriptions and swiftly file reimbursement claims, offering a streamlined approach to expense management.

This functionality is particularly beneficial for small or medium enterprises, large corporations, not-for-profit organizations, and educational institutions seeking user-friendly solutions for their bill payment needs.

With positive feedback from renowned companies like Canva, Michael Hill, and C3 endorsing its services, Weel has established itself as an authorized representative of EML Payment Solutions Limited and Nium Pty Limited, providing secure and efficient bill payment capabilities.

Integrating with Payentry for Simplified Payroll Processes

Divipay Weel streamlines the payroll process by integrating with Payentry, making it more efficient and error-free. By automating payments and expense reporting, companies can ensure accurate and timely disbursement of funds to employees.

Payment automation in Divipay Weel eliminates the need for manual input and reconciliation, reducing the risk of errors and saving valuable time for payroll administrators. With seamless integration, businesses can easily manage subscriptions, track expenses, and streamline reimbursement processes within a single platform.

This not only simplifies the overall payroll management but also enhances transparency across financial transactions.

Conclusion

Unlock streamlined spend management and master expense reporting seamlessly with Divipay Weel. Elevate your financial efficiency by harnessing virtual corporate cards, enabling in-policy spending and secure transactions.

Simplify the complexities of expense tracking and streamline budget controls to keep your business moving forward. Join top finance teams who have experienced the benefits of this global-leading platform.

Take charge of your financial oversight with a two-week free trial today!

(Image Source: Collection)

Frequently Asked Questions

How does Divipay Weel streamline expense reporting?

Divipay Weel streamlines expense reporting by allowing users to capture receipts, categorize expenses, and generate detailed reports all within one platform.

What are the key features of Divipay Weel for spend management?

Divipay Weel offers features such as real-time spending visibility, budget controls, automated receipt scanning, and multi-currency support for efficient spend management.

Can Divipay Weel integrate with existing accounting software?

Yes, Divipay Weel can seamlessly integrate with various accounting software systems to simplify reconciliation and ensure accurate financial records.

Does using Divipay Weel require extensive training for employees?

No, using Divipay Weel is intuitive and user-friendly which minimizes the need for extensive training sessions for employees to adapt to the platform.

How does DiviPay’s virtual cards enhance expense control with its platform?

DiviPay’s virtual cards provide enhanced expense control by enabling preset spending limits per card and reducing the risk of unauthorized transactions or overspending.