Finding the right business loan provider can be overwhelming, especially with so many lenders offering different terms, rates, and eligibility requirements. BestMoney.com simplifies the process by helping business owners compare top loan options in one place.

This guide is for entrepreneurs, small business owners, and startups who want to find the most suitable funding without wasting time or money. With the right platform, you can make informed financial decisions fast—and that’s where BestMoney.com comes in.

Key Takeaways

- BestMoney.com lets you compare top business loan providers quickly and easily.

- Lenders like BlueVine, Lendio, and Fundbox offer flexible loan types and fast funding.

- Many providers offer same-day or next-day business loan approvals.

- Using BestMoney won’t affect your credit thanks to soft credit checks.

- Choosing the right lender depends on your credit, loan type, and funding speed needs.

What is BestMoney.com?

BestMoney.com is a financial comparison site that helps users explore and choose from a variety of financial products—business loans being one of its core offerings.

The platform connects borrowers with reputable lenders, allowing for side-by-side comparisons of loan terms, interest rates, approval timelines, and more.

Unlike traditional banks, BestMoney.com offers

- Fast access to multiple loan providers

- A simple and streamlined online application

- Transparent details on rates, terms, and fees

Whether you’re expanding your business, managing cash flow, or investing in growth, BestMoney.com helps you find a loan that fits your needs—quickly and confidently.

Why Use Online Loan Comparison Tools?

Online loan comparison platforms like BestMoney.com make the loan search process easier, faster, and more transparent.

Instead of applying to each lender individually, business owners can explore multiple funding options in one place and make informed decisions without the guesswork. Here’s why these tools are especially valuable for small businesses looking to secure financing.

Speed and Efficiency

Using a loan comparison tool saves valuable time. With a single online form, you can receive offers from multiple lenders, reducing the need for repetitive paperwork or back-and-forth communication.

This streamlined process allows business owners to focus on running their company instead of managing multiple loan applications. Many platforms deliver results within minutes, helping you move quickly when funding is urgent.

Increased Transparency

These platforms provide clear, side-by-side details of each loan offer, including interest rates, repayment terms, total cost, and fees. This transparency helps you avoid hidden charges and misleading loan structures.

By having all the information upfront, you can confidently evaluate your options and choose the one that fits your financial goals. It also makes it easier to understand the true cost of borrowing.

A Better Fit for Your Business

Loan comparison tools tailor recommendations based on your business profile—credit score, revenue, industry, and time in operation.

This increases your chances of finding lenders who are actually willing to work with you, reducing the frustration of being declined. By filtering out irrelevant options, these tools ensure you only see loans that are a realistic match, improving efficiency and your odds of approval.

Cost Savings Over Time

Comparing offers helps you avoid overpaying for a loan. Even a small difference in interest rate or repayment term can have a big impact on the total cost of borrowing.

Online tools allow you to weigh those differences and select the most cost-effective option. This helps protect your cash flow and reduces the risk of taking on a loan that becomes a financial burden over time.

Fewer Credit Inquiries

Most comparison platforms use a soft credit check to pre-qualify you for loan offers, which doesn’t impact your credit score.

This is especially helpful for business owners who are exploring options and don’t want their credit score affected until they’re ready to commit. Once you choose a lender and apply directly, a hard inquiry may be made—but only at that point.

Peace of Mind and Control

Having access to multiple lenders in one place gives you more control over the loan selection process.

You can compare offers on your own terms, without pressure from sales reps or the limitations of a single lender. This builds confidence in your decision and reduces stress, knowing you’ve considered the best available options for your business needs.

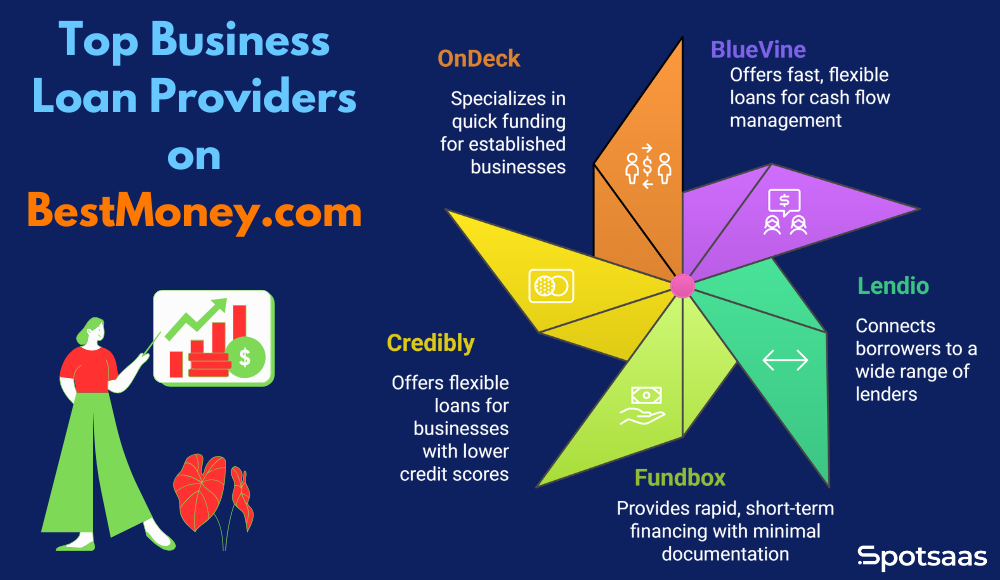

Top Business Loan Providers on BestMoney.com

BestMoney.com partners with a range of reputable lenders to help small businesses find the right financing quickly.

Below is a closer look at some of the top business loan providers featured on the platform, including what they offer, who they’re best for, and why they stand out.

BlueVine

BlueVine offers lines of credit and term loans with funding available in as little as 24 hours. With a minimum credit score of 625 and loans up to $250,000, it’s designed for businesses that need fast, flexible access to working capital. The application process is simple and completely online.

BlueVine is best for businesses with strong financials that want to manage cash flow efficiently without long-term borrowing commitments. It’s particularly useful for covering short-term expenses like payroll, inventory, or vendor payments. The flexibility of a revolving line of credit makes it ideal for ongoing financial needs.

Lendio

Lendio is a loan marketplace that connects borrowers to over 75 lenders, offering a wide range of options like SBA loans, term loans, and lines of credit. It has a low minimum credit score requirement of 560 and offers funding up to $500,000 or more. Lendio simplifies the process by doing the shopping for you, presenting multiple offers after one application.

It’s a great choice for business owners who want to compare rates and terms across a broad lender network. The platform provides personalized loan matches based on your business profile. Lendio also offers access to funding types that may not be easy to find directly.

Fundbox

Fundbox provides lines of credit with funding as fast as the next business day. With a minimum credit score of 600 and loan amounts up to $150,000, it’s ideal for small businesses looking for short-term financing.

Fundbox stands out for its quick approval process and minimal documentation requirements. It’s best suited for businesses that need fast, recurring access to funds without jumping through hoops.

The automated underwriting process helps speed up approvals significantly. It’s also a good fit for newer businesses that don’t yet qualify for traditional bank loans.

Credibly

Credibly offers working capital loans, merchant cash advances, and term loans, accepting credit scores as low as 500. It provides funding up to $400,000 in as little as 1–2 business days. This makes it a strong option for businesses with lower credit or inconsistent cash flow.

Credibly also looks beyond just credit score, considering overall business performance, which helps underserved businesses gain access to funding.

Their flexible repayment terms help businesses manage cash flow without feeling squeezed. It’s especially valuable for companies recovering from downturns or seasonal slumps.

OnDeck

OnDeck specializes in term loans and lines of credit with same-day funding available. With a minimum credit score of 625 and loan amounts up to $250,000, it’s designed for more established businesses with steady revenue. OnDeck is known for its repeat borrower perks and fast online process.

It’s best for businesses that need quick, ongoing access to capital and are comfortable with structured repayments.

They also offer loyalty benefits like lower rates and higher limits for returning customers. OnDeck has built a reputation for reliability and customer support in the online lending space.

Business Loan Providers Compared on BestMoney.com

To help you decide which lender best suits your business needs, here’s a side-by-side comparison of the top business loan providers featured on BestMoney.com.

This table highlights key factors such as loan types, credit requirements, funding speed, and ideal use cases.

| Provider | Loan Types | Min. Credit Score | Max Loan Amount | Funding Time | Best For |

|---|---|---|---|---|---|

| BlueVine | Line of Credit, Term Loan | 625+ | Up to $250,000 | As fast as 24 hours | Fast funding and flexible cash flow needs |

| Lendio | SBA, Term Loan, Line of Credit | 560+ | $500,000+ | 1–3 business days | Comparing offers from a wide lender network |

| Fundbox | Line of Credit | 600+ | Up to $150,000 | Next business day | Quick short-term access with low paperwork |

| Credibly | Term Loan, MCA, Working Capital | 500+ | Up to $400,000 | 1–2 business days | Businesses with lower credit or cash flow |

| OnDeck | Term Loan, Line of Credit | 625+ | Up to $250,000 | Same day | Reliable funding for established businesses |

BestMoney.com User Experience & Reviews

BestMoney.com is a trusted financial comparison platform built to simplify the business loan search.

With its clean interface and fast loan-matching system, it’s a favorite among small business owners who want to compare offers quickly without the stress of lengthy applications.

How the Process Works

This guided process helps you find personalized loan options based on your business details. It’s fast, easy, and designed for busy entrepreneurs who need funding without the paperwork overload.

Step 1: Choose a Loan Category

Start by selecting the loan type you’re interested in—such as business loans. This filters the results to match your specific funding needs and excludes unrelated offers.

Choosing the right category up front ensures you’re only shown lenders that are relevant to your situation.

Step 2: Answer a Few Questions

You’ll enter basic business information including revenue, years in operation, and estimated credit score.

The form is short and intuitive, taking just a couple of minutes to complete. These inputs help the platform match you with lenders that you’re most likely to qualify for.

Step 3: Get Matched with Lenders

After submitting your details, you’ll instantly see a list of potential lenders tailored to your business profile. Each match includes highlights like loan amounts, funding time, and repayment terms. This side-by-side view makes comparing offers clear and convenient.

What Users Like About BestMoney.com

BestMoney is praised for delivering fast results and a seamless loan comparison experience. It’s especially useful for small business owners who want multiple loan options without dealing with multiple applications or complex paperwork. The platform is built to be efficient and beginner-friendly.

Quick and Easy Process

Users love how quickly they can receive loan matches without getting bogged down by paperwork. The process takes just minutes and doesn’t require financial statements or tax returns.

It’s designed to reduce friction and keep things moving. Even those with limited experience in business finance find it easy to navigate. You get immediate lender suggestions tailored to your business profile, making it a time-saver when funding is urgent.

Soft Credit Checks Only

BestMoney uses a soft credit inquiry during prequalification, so your credit score won’t be affected. This gives users the confidence to explore options without committing to a hard pull.

It’s ideal for cautious borrowers or those still evaluating their options. For users concerned about protecting their credit while loan shopping, this is a major plus. It also allows comparison shopping without financial risk.

Transparent Comparisons

The platform lays out each lender’s offer clearly so users can see interest rates, terms, and funding timelines side by side. This helps avoid confusion and cuts down the time spent researching each lender individually.

You can quickly spot which loan is the best fit. The comparison view includes filters and highlights, which simplify decision-making and make the process feel more in control.

User-Friendly Design

The interface is clean, intuitive, and easy to navigate—even for users who aren’t tech-savvy. Whether on desktop or mobile, the experience remains smooth and accessible.

Everything is laid out clearly, with no unnecessary steps or distractions. Buttons, forms, and categories are clearly labeled, and progress through the loan match process is visually guided. This makes it simple for users of all levels to find their way around.

Common Complaints from Users

While BestMoney delivers a solid experience overall, a few users have pointed out areas where the platform could improve.

These are mostly tied to transparency and lender communication. Though not deal breakers for most, they are worth being aware of before applying.

Limited Rate Visibility

Some lenders don’t display full APR or fees until you go to their site or complete a longer application. This can make it harder to compare true costs upfront. Still, the platform provides enough data to narrow down your best options initially.

Users may find they need to dig deeper with the lender directly to get the full cost picture. This lack of detail could lead to some surprises down the line if not reviewed carefully.

Inconsistent Final Offers

The rates and terms shown during prequalification may change after a deeper review by the lender. Final approval depends on a full credit check and financial documentation. Users are encouraged to view prequal offers as starting points, not guarantees.

While this is common in lending, it can be frustrating for those expecting the same terms shown upfront. Loan terms may shift based on updated credit scores, debt-to-income ratios, or revenue verification.

Follow-Up Marketing

After using the site, users may receive emails or follow-ups from lenders or BestMoney’s partners. While some appreciate ongoing loan suggestions, others find it excessive. Fortunately, there are options to unsubscribe or adjust notification settings.

Email frequency may vary depending on the number of lenders you interact with through the platform. Some users also report occasional calls or texts, depending on contact preferences shared during signup.

Pros & Cons of BestMoney.com

Before using any financial platform, it’s important to weigh the benefits and limitations.

BestMoney.com offers a fast, transparent way to compare business loan providers, but like any tool, it has its trade-offs. Based on user feedback and platform performance, here’s a quick breakdown of what stands out—and what to be aware of.

| Pros | Cons |

|---|---|

| ✅Completely free to use | ❌Not all lenders disclose full APRs upfront |

| ✅Soft credit check won’t affect your credit score | ❌Pre-qualification doesn’t guarantee approval |

| ✅Compare multiple lenders and loan types in one place | ❌Fewer lender options for very poor credit |

| ✅Fast, user-friendly loan comparison process | ❌Some offers may require follow-up with individual lenders |

| ✅Transparent loan terms and eligibility filters | ❌Occasional marketing emails or lender follow-ups |

How to Choose the Right Lender

Not all lenders are created equal—and the best option for one business might not be right for another.

Choosing the right lender depends on your current financial situation, business goals, and how quickly you need the money. Below is a simple but powerful checklist to help you filter the options and find a lender that fits your specific needs.

Speed vs. Rate

Some lenders offer same-day or next-day funding, but the trade-off may be higher interest rates. Others offer lower-cost loans but take longer to process.

If your business needs fast cash for emergencies or short-term gaps, speed might be your top priority. However, if you’re planning for long-term growth and can wait a few days or weeks, securing a better rate could save you significantly over time.

Credit Score

Your credit score plays a major role in which lenders will approve you—and on what terms. If your score is excellent (700+), you’ll likely qualify for lower rates and higher amounts.

A fair or average score (600–699) opens up more mid-tier lending options, while a lower score (below 600) may limit you to alternative lenders or products with higher costs. Knowing where you stand helps you focus your search realistically.

Loan Type

Different lenders specialize in different types of financing—term loans, lines of credit, SBA loans, merchant cash advances, equipment loans, and more.

A line of credit is great for flexible spending, while term loans suit specific one-time needs. Equipment loans are ideal for purchasing machinery or tools. Understanding your use case will guide you toward lenders that offer the right structure for your goal.

Repayment Terms

Lenders offer different repayment schedules—daily, weekly, biweekly, or monthly. Some alternative lenders use daily repayments, which can be tough on cash flow if you’re not prepared.

Traditional lenders often offer monthly payments, which may be easier to manage. Choose terms that align with your revenue cycle to avoid financial strain.

Loan Amount

Are you seeking $10,000 to handle a short-term expense, or $250,000+ for expansion or major inventory investments?

Some lenders specialize in small working capital loans, while others cater to large-scale funding. Applying to the wrong lender for your desired amount could waste time or result in unfavorable terms.

Match Your Priorities

Ultimately, the right lender will align with what matters most to you—whether that’s speed, flexibility, loan size, or the total cost of borrowing.

By walking through these key points, you’ll filter out options that don’t fit and focus only on the lenders that make sense for your business goals.

Who Should Use BestMoney.com?

BestMoney.com is designed to serve a wide range of business owners, especially those looking for a faster, easier way to explore funding options online.

It’s best suited for entrepreneurs who want quick comparisons without getting caught up in complex or time-consuming loan applications.

| BestMoney.com is a Good Fit If… | BestMoney.com May Not Be Ideal If… |

|---|---|

| ✅You’re comparing loan offers for the first time | ❌You prefer traditional, in-person banking |

| ✅You want to save time with one application | ❌Your credit is very poor (sub-500) |

| ✅You have fair to excellent credit and want fast funding | ❌You already work with a trusted lender or advisor |

| ✅You’re comfortable applying online | ❌You need large-scale or highly customized financing |

| ✅You want to compare multiple lenders and loan types |

Tips for Getting Approved for a Business Loan

Getting approved for a business loan isn’t just about applying—it’s about preparation. Lenders look at multiple factors to determine if you’re a safe investment.

The more you understand and align with their criteria, the better your chances of not just getting approved, but securing favorable rates and terms.

Check and Improve Your Credit Score

Your personal and business credit scores are one of the first things lenders evaluate.

A higher score shows you’ve managed debt responsibly in the past. Before applying, review your credit reports, dispute any errors, and pay down outstanding debts if possible. Even a small score improvement could lead to better offers.

Organize Your Financials

Lenders want to see that your business is financially stable and well-managed. Make sure your profit and loss statements, tax returns, and any existing debt documentation are up to date.

A solid business plan can also help, especially if you’re applying for a larger loan or you’re a newer business. Being organized shows lenders that you’re serious and financially responsible.

Know Your Numbers

Before applying, have a clear understanding of your business’s financial picture. This includes your annual revenue, monthly expenses, profit margins, and the exact loan amount you need.

Being able to explain why you need the funds—and how you plan to repay them—instills confidence in lenders and speeds up the approval process.

Apply for the Right Type of Loan

Different loan types are designed for different business needs. For example, a line of credit is ideal for ongoing expenses, while a term loan is better for one-time investments.

If you apply for a loan type that doesn’t match your use case, you risk being declined or offered poor terms. Choose financing that aligns with your specific goal and business stage.

Compare Offers Carefully

Don’t settle for the first offer you receive—compare interest rates, repayment terms, fees, and funding times. Even if multiple lenders approve you, the cost and conditions can vary significantly.

Use platforms like BestMoney.com to view side-by-side comparisons and pick the loan that gives you the best value, not just the fastest response.

Conclusion

Choosing the right business loan shouldn’t be confusing, time-consuming, or risky. BestMoney.com makes the process simpler by connecting you with top lenders, personalized to your business needs—all through a single, easy-to-use platform.

From flexible credit lines to fast funding options, BestMoney’s lets you compare multiple offers without affecting your credit. Whether you’re launching, expanding, or just covering short-term cash flow, it’s a smart starting point for finding reliable financing.

Ready to explore your options? Visit BestMoney.com and get matched with lenders today—no stress, no strings attached.

Frequently Asked Questions

Is BestMoney.com free to use?

Yes, BestMoney.com is completely free for users. You can compare lenders, review offers, and apply—all without paying any fees. The platform earns from referral partnerships with lenders, not from you.

Will using BestMoney.com affect my credit score?

No. BestMoney.com only performs a soft credit check during the prequalification stage, which does not impact your credit score. A hard inquiry only happens if you move forward with a lender directly.

How fast can I get a loan through BestMoney.com?

Many lenders on BestMoney offer same-day or next-day funding. Most approvals happen within 24 to 72 hours, depending on your credit profile, documentation, and the lender’s process.

What credit score do I need to get approved?

Some lenders accept scores as low as 500, while others require 600+ for better terms. A higher score increases your chances of approval and helps secure lower interest rates.

What types of business loans can I compare on BestMoney.com?

You can compare term loans, lines of credit, SBA loans, merchant cash advances, and working capital loans, depending on your business needs and qualifications.