Self-employed individuals have distinct tax responsibilities, including self-employment taxes and withholding their own payments. Unlike W-2 employees, they must track expenses, home office deductions, and mileage while making quarterly estimated tax payments to avoid penalties. Managing these obligations without the right tools can be complex.

Specialized tax software simplifies this process by accurately calculating liabilities, maximizing deductions, and offering guidance on estimated payments. It also helps ensure IRS compliance and reduces audit risks. With the right software, self-employed professionals can streamline tax management, minimize errors, and focus on growing their businesses without the burden of complex tax filing.

Key Takeaways

- Self-employed individuals need tax software that supports deductions, expense tracking, and income reporting.

- Features like automatic mileage tracking, integration with accounting tools, and real-time tax calculations simplify tax management.

- Cloud-based platforms provide accessibility, secure storage, and real-time updates for compliance with tax laws.

- Pricing depends on features, with some software offering free versions for basic filings and premium plans for advanced needs.

- Choosing software with strong customer support, audit assistance, and an easy-to-use interface ensures a smoother tax filing experience.

Key Features to Look for in Tax Software

Choosing the right tax software for your business requires understanding essential features that can simplify filing and maximize tax deductions. Here are five key features to consider:

Self-Employment Tax Calculation

Self-employed individuals must pay both the employer and employee portions of Social Security and Medicare taxes, which can be complex to calculate manually. Good tax software automatically determines self-employment tax liabilities, ensuring accurate payments and preventing underpayment penalties.

Expense & Deduction Tracking

Small businesses and freelancers have multiple deductible expenses, such as office supplies, travel, home office costs, and advertising. Tax software with built-in expense tracking allows users to categorize transactions and automatically apply deductions, reducing taxable income and maximizing savings.

Quarterly Estimated Tax Payment Support

Unlike W-2 employees, self-employed individuals must pay quarterly estimated taxes throughout the year. Missing these payments can lead to IRS penalties. Tax software with quarterly tax estimations and payment reminders ensures businesses stay compliant and avoid unexpected tax bills.

Integration with Accounting Software

Many businesses use accounting platforms like QuickBooks, Xero, or FreshBooks to manage their finances. Tax software that syncs with accounting tools eliminates manual data entry, automates expense imports, and provides seamless tax calculations based on real-time financial records.

Audit Support & Guidance

Receiving an IRS audit notice can be stressful, but tax software with audit assistance provides step-by-step guidance, helping users understand IRS inquiries, required documentation, and response deadlines. Some platforms even offer professional audit defense for added peace of mind.

Selecting tax software with these features can simplify tax preparation, reduce errors, and ensure compliance with IRS regulations, making the filing process more efficient for self-employed individuals and small businesses.

Top Tax Software for Self-Employed Individuals

| Tax Software | Best For | Key Features |

|---|---|---|

| TurboTax Self-Employed | Comprehensive features | Maximizes deductions, integrates with QuickBooks, expert support |

| H&R Block Self-Employed | Beginners & freelancers | Simple interface, in-person support, expense tracking |

| TaxAct Self-Employed | Budget-friendly | Affordable, good for freelancers & side gigs |

| FreeTaxUSA Self-Employed | Cost-conscious filers | Free federal filing, low-cost state returns, deduction support |

| Cash App Taxes | 100% free filing | No hidden costs, covers most self-employed tax needs |

TurboTax

TurboTax

- Pricing: Varies on Filing Options

- State Filing: $39 per state

- Best For: Comprehensive tax guidance

TurboTax is Best For

Individuals and small business owners looking for intuitive, guided tax preparation software with expert assistance, maximized deductions, and seamless filing options.

Pricing & Fees of TurboTax

TurboTax Free Edition

- Cost: $0 Federal, $0 State, $0 to File

- Best For: Simple tax situations (W-2 income only)

TurboTax Live Assisted

- Starting Cost: $39* Federal (State additional)

- Best For: Taxpayers seeking expert assistance while filing

TurboTax Live Full Service

- Starting Cost: $89* Federal (State additional)

- Best For: Individuals preferring a tax expert to handle the entire filing process

(*Prices are subject to change and may vary based on promotions. Starting prices are for federal returns; state returns may incur additional fees. For the most current information, visit TurboTax’s official pricing page.)

For more detailed information and to choose the plan that best fits your tax situation, visit TurboTax’s official website.

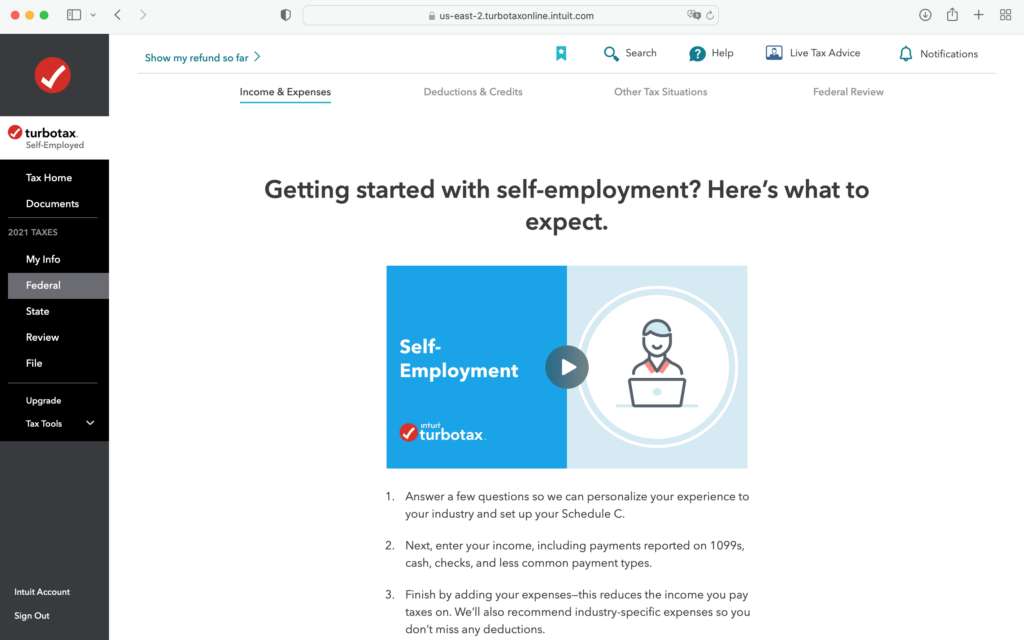

Overview of TurboTax

TurboTax is a leading tax preparation software designed to simplify the filing process for individuals, self-employed professionals, and small businesses. With an intuitive, step-by-step interface, it guides users through tax forms, helping them identify eligible deductions and maximize refunds.

The platform offers a range of options, from self-guided filing to expert-assisted and full-service tax preparation, ensuring users of all experience levels have the right support. Features like AI-powered audit detection, automatic error checks, and direct deposit refunds make TurboTax a comprehensive choice for hassle-free tax filing software.

Why Choose TurboTax

TurboTax stands out for its user-friendly design and expert-backed accuracy. Unlike some tax software that requires users to have prior tax knowledge, TurboTax simplifies the process with personalized guidance, real-time refund calculations, and audit protection.

Key Features of TurboTax

Audit support and accuracy check

TurboTax automatically scans for potential errors and inconsistencies before users submit their returns. The software provides explanations and suggestions for corrections to minimize audit risks.

Step-by-step tax guidance

TurboTax simplifies the filing process by breaking it down into easy-to-follow steps. Users answer simple questions about their income, deductions, and financial situation, and the software automatically fills out the necessary forms.

Max refund guarantee

TurboTax helps users maximize their tax refunds by identifying every eligible deduction and credit. The software analyzes income, expenses, and filing status to uncover potential savings.

Integrations of TurboTax

- Payroll Integrations – QuickBooks Payroll, Gusto, ADP, Paychex, OnPay

- HR Software Integrations – BambooHR, Workday, Zenefits, Rippling

- Accounting & Financial Management Integrations – QuickBooks, Xero, NetSuite, Wave

- Investment & Banking Integrations – Robinhood, Coinbase, Fidelity, Charles Schwab

Customers of TurboTax

TurboTax serves individuals, self-employed professionals, and small business owners, partnering with various payroll providers and financial institutions to simplify tax filing.

Pros and Cons of TurboTax

| Pros | Cons |

|---|---|

| User-friendly interface | Higher pricing for premium features |

| Step-by-step guidance | Limited customer support options |

| Maximizes deductions & credits | Extra fees for state filings |

| Integrates with financial apps | |

| Supports multiple tax situations |

Final Thoughts

TurboTax is a top choice for individuals and business owners who want a guided, easy-to-use tax filing software experience. With its step-by-step approach, refund maximization tools, and expert support, it ensures accuracy and peace of mind.

While premium plans can be costly, the software’s extensive features, audit protection, and live expert assistance make it a solid investment for stress-free tax preparation.

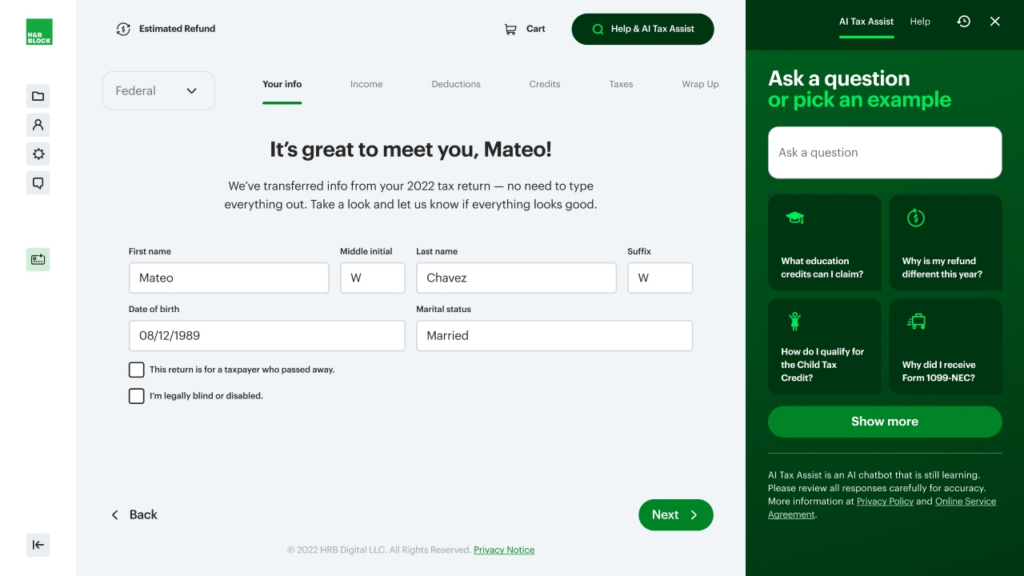

H&R Block

H&R Block

- Pricing: Varies on Filing Options

- State Filing: $37 per state

- Best For: In-person and virtual filing

H&R Block is Best For

Individuals and small business owners looking for a tax preparation software that offers a balance of affordability, ease of use, and expert-assisted filing options.

Pricing & Fees of H&R Block

H&R Block provides multiple pricing plans based on tax complexity and service H&R Block offers a variety of tax filing options to accommodate different tax situations and preferences. Here’s an overview of their current offerings:

H&R Block Free Online

- Cost: $0 Federal, $0 State, $0 to File

- Best For: Simple tax situations

H&R Block Deluxe Online

- Starting Cost: $35 (State additional)

- Best For: Taxpayers with credits and deductions

Assisted Tax Preparation Services

- Starting Cost: $89 + additional state fee

- Best For: Individuals seeking professional assistance

(*Prices are subject to change and may vary based on promotions. State returns may incur additional fees. For the most current information, visit H&R Block’s official website.)

For more detailed information and to choose the plan that best fits your tax situation, visit H&R Block’s official website.

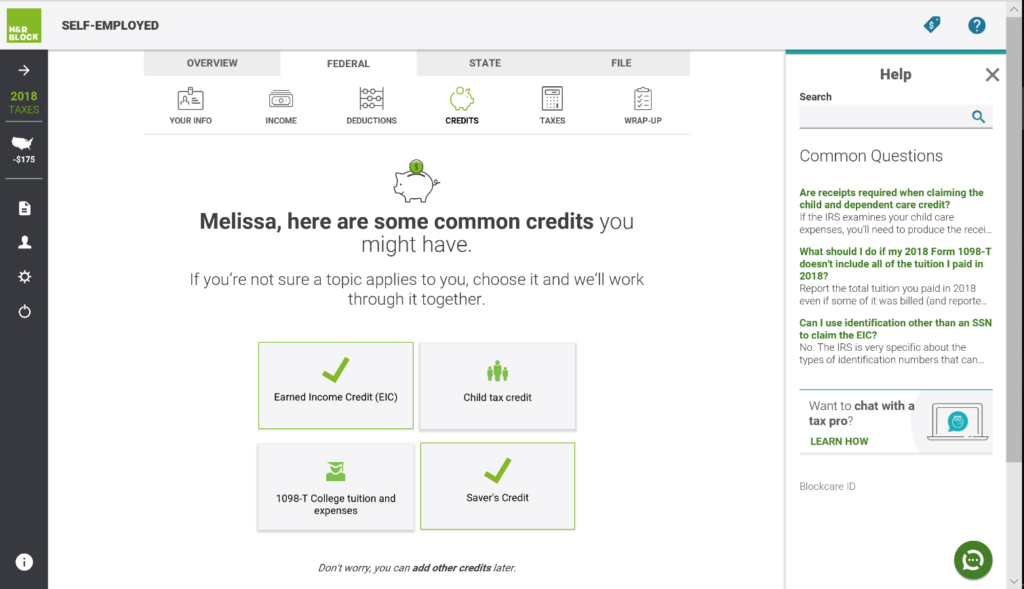

Overview of H&R Block

H&R Block is a trusted name in tax preparation, offering both DIY tax software and expert-assisted services. The platform provides a guided experience with an intuitive interface, helping users maximize deductions and file taxes accurately.

Users can choose between self-filing, expert review, or full-service tax preparation, depending on their needs. H&R Block also offers in-person tax assistance at physical locations, making it a flexible option for those who prefer professional support.

Why Choose H&R Block

H&R Block stands out for its combination of affordability, ease of use, and access to expert tax help. Unlike some tax software that is purely online, H&R Block gives users the option to visit local offices for in-person assistance.

Key Features of H&R Block

Max refund guarantee

H&R Block helps users maximize refunds by searching for every eligible deduction and credit. The software continuously checks for overlooked tax-saving opportunities and provides real-time refund updates.

Step-by-step guidance

H&R Block is a tax filing software that simplifies with an intuitive, question-based process that guides users through their returns. The platform ensures accuracy by automatically selecting the correct tax forms based on user input.

Expert tax assistance

Users have access to tax professionals through live chat, expert reviews, and full-service tax filing software. Whether needing a quick answer or a professional to review a return before submission, H&R Block ensures that expert help is always available. In-person assistance is also an option at nationwide retail locations.

Integrations of H&R Block

- Payroll Integrations – ADP, Gusto, Paychex, QuickBooks Payroll, Paycor

- HR Software Integrations – BambooHR, Workday, Zenefits, Rippling

- Accounting & Financial Management Integrations – QuickBooks, Xero, NetSuite, Wave

- Investment & Banking Integrations – Robinhood, Coinbase, Fidelity, Charles Schwab

Customers of H&R Block

H&R Block serves a diverse clientele, including individuals, self-employed professionals, and small business owners. In the fiscal year 2022, the company prepared 20.5 million U.S. tax returns, with 8.5 million clients utilizing their DIY products.

While specific client names are not publicly disclosed, H&R Block’s extensive network of tax professionals and comprehensive service offerings make it a trusted choice for a wide range of taxpayers seeking reliable tax preparation assistance.

Pros & Cons of H&R Block

| Pros | Cons |

|---|---|

| Easy-to-use interface | Extra fees for advanced features |

| In-person & online filing options | Limited support for complex tax situations |

| Affordable pricing for basic plans | Upsells for additional services |

| Strong customer support | |

| Accurate tax calculations |

Final Thoughts

H&R Block is a solid choice for individuals and small business owners who want easy-to-use tax software with the option for professional assistance. While premium features can add to the cost, the platform’s extensive support and refund optimization tools make it a valuable investment.

Its combination of online and in-person tax support, along with a strong accuracy guarantee, makes it a reliable option for those seeking a stress-free tax filing experience.

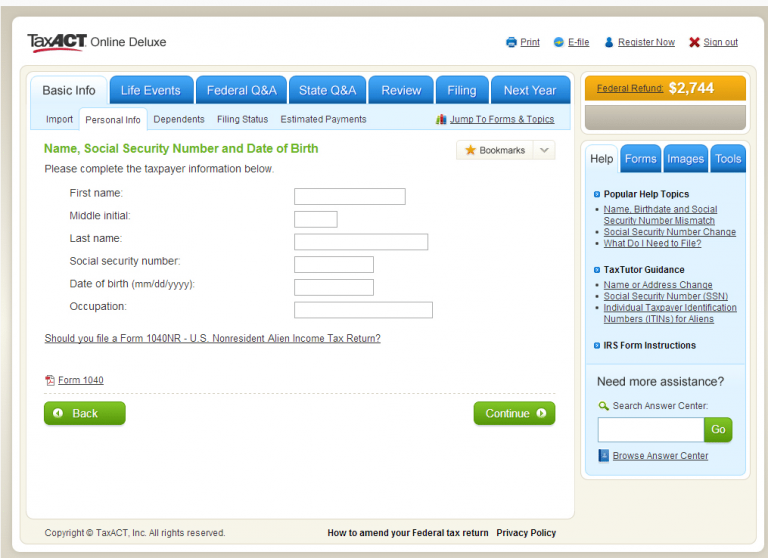

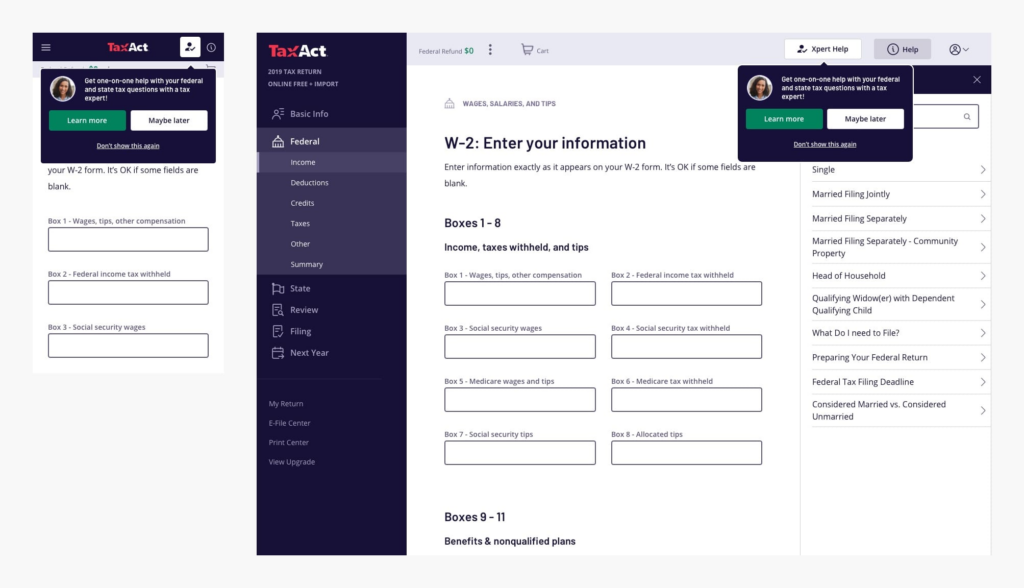

TaxAct

TaxAct

- State Filing: $39.95 per state

- Federal Filing: Free

- Best For: Maximizing Deductions

TaxAct is Best For

TaxAct is an online tax preparation service tailored for individuals and small business owners seeking an affordable and comprehensive solution for filing federal and state taxes. It offers a range of features to accommodate various tax situations, ensuring accuracy and maximizing refunds.

Pricing & Fees of TaxAct

TaxAct provides multiple pricing tiers based on the complexity of tax returns:

- Free – $0 federal filing; $39.95 per state return. Suitable for simple tax situations, including W-2 income, unemployment income, and retirement income.

- Deluxe – $24.95 federal filing; $44.95 per state return. Includes all Free features plus itemized deductions, child and dependent care expenses, and health savings accounts (HSAs).

- Premier – $34.95 federal filing; $44.95 per state return. Adds support for investments, rental property income, and foreign bank accounts.

- Self-Employed – $64.95 federal filing; $44.95 per state return. Designed for freelancers, contractors, and small business owners, covering business income and expenses, Schedule C, and home office deductions.

(Prices are subject to change and may vary based on promotions.)

Overview of TaxAct

TaxAct simplifies the tax filing process with an intuitive, step-by-step interface that guides users through each section of their return. It supports a wide range of tax situations, from simple W-2 income to complex self-employment income and investments.

The platform offers various support options, including access to tax professionals through Xpert Assist, ensuring users receive expert guidance when needed.

Why Choose TaxAct

TaxAct stands out for its affordability and comprehensive features. Unlike some tax software that charges extra for certain forms or schedules, TaxAct includes all necessary forms in its packages.

The platform also offers Xpert Assist, allowing users to consult with tax professionals for personalized guidance. Its user-friendly design and commitment to maximizing refunds make it a compelling choice for a wide range of taxpayers.

Key Features of TaxAct

Xpert Assist

TaxAct provides access to tax professionals through its Xpert Assist feature, offering personalized guidance for users with complex tax questions. This service ensures accuracy, compliance with IRS rules, and a final review of the return before filing.

Comprehensive tax filing

TaxAct supports all major IRS forms and schedules, making it suitable for various tax situations, including W-2 income, self-employment earnings, rental properties, and investments. The software also includes built-in error checks and deduction tools to help users optimize their tax savings.

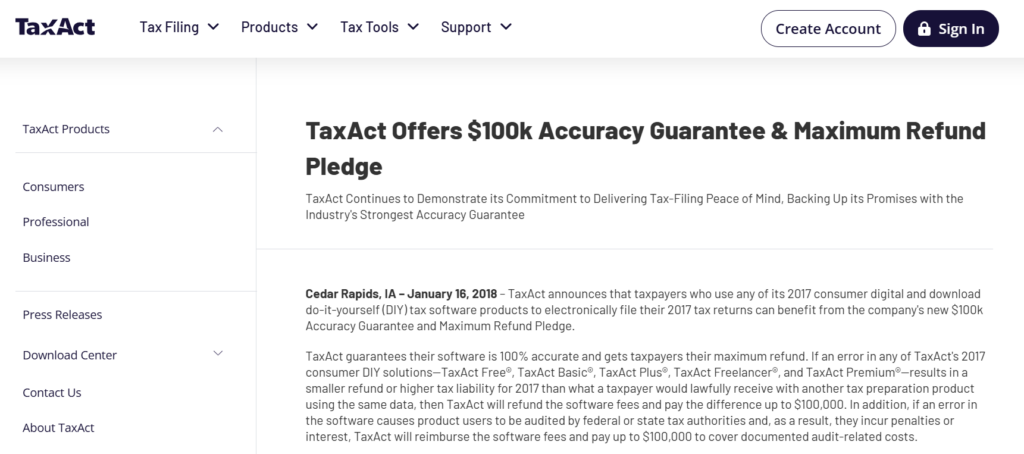

Maximum refund and $100K accuracy guarantee

TaxAct guarantees that users receive the maximum refund possible, or their filing fees will be refunded. Additionally, the platform offers a $100,000 Accuracy Guarantee, ensuring that calculations are correct and cover any penalties and interest resulting from a TaxAct miscalculation.

Integrations of TaxAct

TaxAct offers several integrations to enhance the tax preparation experience:

- Accounting & Financial Management Integrations – QuickBooks Online, Xero

- Tax Document Management – Import of prior year tax returns from other tax software platforms

Customers of TaxAct

TaxAct serves a wide range of individual taxpayers and small business owners seeking affordable and efficient tax preparation solutions. While specific client names are not publicly disclosed, the platform has garnered positive feedback from numerous users.

For example, TaxAct has over 29,000 customer testimonials published on its website, with 85% of them featuring 4-star or 5-star ratings.

Pros & Cons of TaxAct

| Pros | Cons |

|---|---|

| Affordable pricing compared to premium tax software | State filing costs extra |

| Supports a wide range of tax situations | Limited customer support in free/basic plan |

| Accuracy guarantee with a $100K protection | Upsells for additional features |

| Offers Xpert Assist for professional tax help | |

| Prior-year return import for easy filing |

Final Thoughts

TaxAct is an excellent option for individuals and small business owners seeking affordable, comprehensive, and user-friendly tax preparation software. Its range of features, competitive pricing, and robust support options make it a strong contender in the tax software market.

While it may lack in-person support, its Xpert Assist feature and built-in

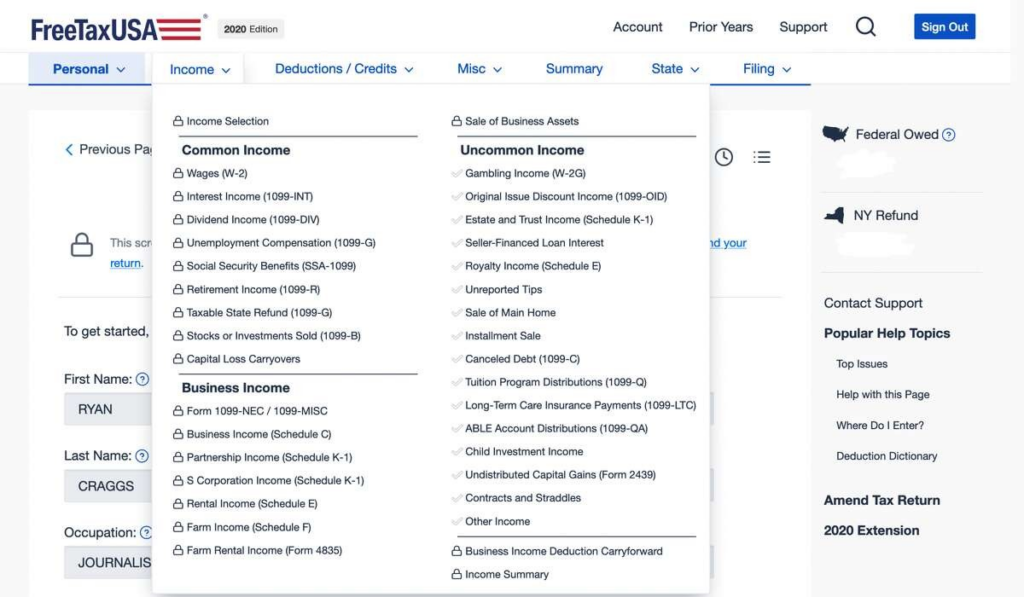

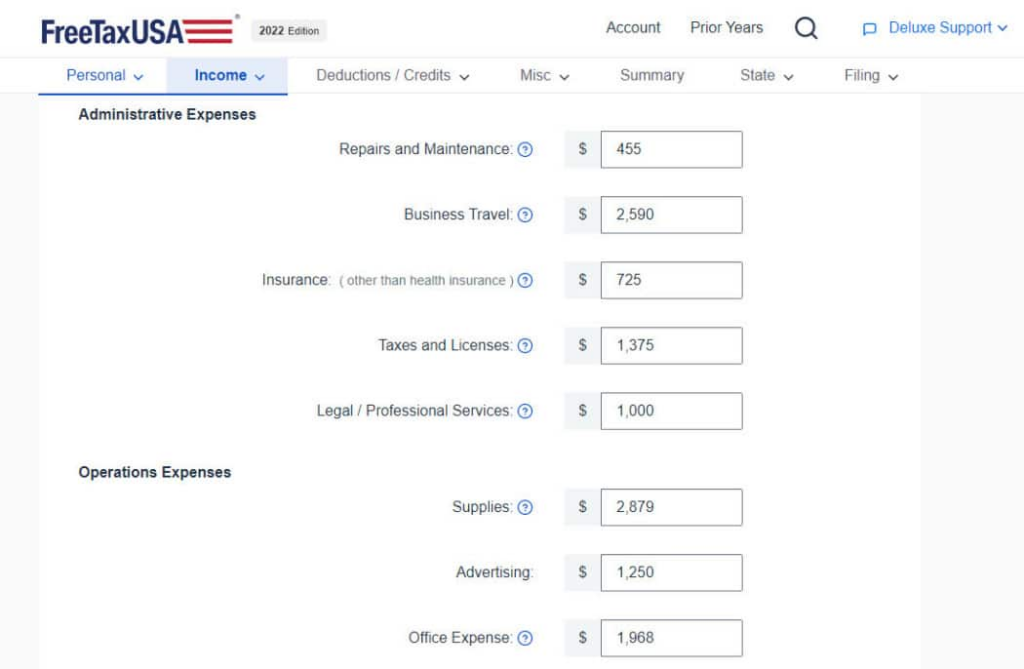

FreeTaxUSA

FreeTaxUSA

- State Filing: $14.99 per state

- Federal Filing: Free

- Best For: Affordable and easy online tax filing

FreeTaxUSA is Best For

FreeTaxUSA is an online tax preparation software designed for individuals and self-employed professionals looking for an affordable and straightforward way to file their taxes. It offers a full suite of tax filing features at a fraction of the cost of competitors while ensuring accuracy and maximizing refunds.

Pricing & Fees of FreeTaxUSA

FreeTaxUSA provides a transparent pricing structure:

- Federal Tax Return – $0.00 – All federal tax forms are free, regardless of complexity.

- State Tax Return – $14.99 per state return.

- Deluxe Edition – $7.99 – Includes priority support, unlimited amended returns, and audit assistance.

- Pro Support – $39.99 – Offers personalized advice from tax specialists via phone, live chat, or screen share.

(*Prices are subject to change and may vary based on promotions.)

Overview of FreeTaxUSA

FreeTaxUSA makes tax filing simple with a step-by-step interface that guides users through every section of their return. It supports various tax situations, from basic W-2 filings to more complex self-employment, investment, and rental income cases.

With robust features and affordable pricing, it provides an excellent alternative to higher-cost tax software without compromising accuracy. The platform ensures users can maximize deductions, track potential errors, and file their taxes efficiently, whether filing independently or with professional assistance.

Why Choose FreeTaxUSA

FreeTaxUSA stands out due to its cost-effectiveness and comprehensive support for tax forms. Unlike some competitors that charge extra for additional forms, FreeTaxUSA allows all users to access federal filing for free, no matter their tax situation.

Key Features of FreeTaxUSA

Comprehensive tax filing

FreeTaxUSA supports all major IRS forms and schedules, ensuring users can file tax returns for various financial situations, including self-employment, investments, and rental income. Whether filing a basic return or reporting business deductions, the platform covers everything without additional costs.

Maximum refund guarantee

The platform helps users claim every eligible deduction and credit to ensure they receive the highest refund possible. FreeTaxUSA continuously scans for tax-saving opportunities based on income, expenses, and filing status.

Audit assistance

FreeTaxUSA includes audit assistance in its Deluxe package, providing users with guidance in case of an IRS inquiry. This service offers step-by-step explanations of the audit process and instructions on how to respond effectively.

Integrations of FreeTaxUSA

FreeTaxUSA offers limited direct integrations but allows users to import prior year tax data from other tax software platforms, making it easier for returning users to transition seamlessly.

Customers of FreeTaxUSA

FreeTaxUSA serves a wide range of individual taxpayers and self-employed professionals seeking affordable and efficient tax preparation solutions. While specific client names are not publicly disclosed, the platform has garnered positive feedback from numerous users.

Pros & Cons of FreeTaxUSA

| Pros | Cons |

|---|---|

| Free federal tax filing for all users | Limited customer support (no phone support in free version) |

| Low-cost state tax filing | Basic user interface compared to premium competitors |

| Supports all major tax forms and schedules | No direct W-2 or 1099 import from employers |

| Accuracy and maximum refund guarantee | |

| Affordable Deluxe edition with audit support |

Final Thoughts

FreeTaxUSA is an excellent choice for individuals and self-employed professionals looking for an affordable, feature-rich tax preparation software. Its low-cost pricing, support for all major tax forms, and user-friendly approach make it a standout option in the tax software market.

While it may lack some of the advanced integrations and high-end customer support of premium competitors, its focus on cost-effectiveness, accuracy, and audit support makes it a valuable option for anyone looking for a straightforward and budget-friendly tax filing experience.

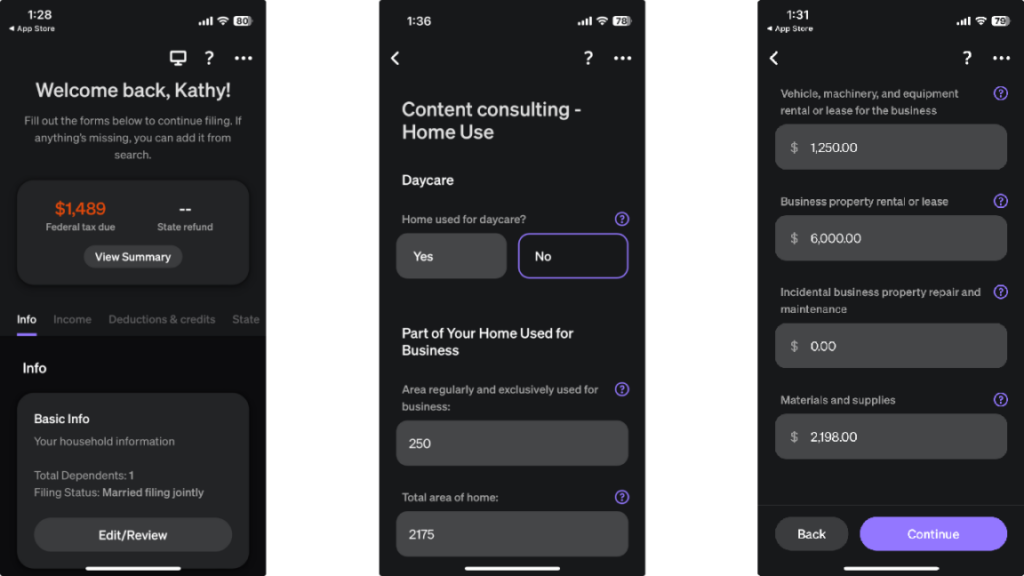

Cash App Taxes

Cash App Taxes

- State Filing: Free

- Federal Filing: Free

- Best For: Completely free tax filing

Cash App Taxes is Best For

Cash App Taxes is an online tax preparation service designed for individuals and self-employed professionals seeking a completely free and straightforward way to file their federal and state taxes. It offers a comprehensive suite of features without any hidden fees, ensuring accuracy and maximizing refunds.

Pricing & Fees of Cash App Taxes

- Federal Tax Return: $0.00 – All federal tax forms are free, regardless of complexity.

- State Tax Return: $0.00 – File state returns at no cost.

Cash App Taxes does not offer paid tiers; all features are available for free.

Overview of Cash App Taxes

Cash App Taxes simplifies tax filing with an intuitive, step-by-step interface accessible via both computer and mobile devices. It supports various tax situations, including self-employment, investments, and cryptocurrency transactions. The platform ensures users can maximize deductions, automatically checks for errors, and provides free audit defense, making tax filing efficient and accurate.

Why Choose Cash App Taxes

Cash App Taxes stands out due to its genuinely free service for both federal and state filings, covering a wide range of tax situations without hidden fees. Its user-friendly design allows for quick filing, often in minutes, with features like W-2 photo import enhancing convenience.

Key Features of Cash App Taxes

Comprehensive tax filing

Cash App Taxes supports all major IRS forms and schedules, accommodating various financial situations, including self-employment, investments, and cryptocurrency transactions. The platform provides a streamlined workflow, reducing errors by automatically checking for inconsistencies before submission.

Maximum refund guarantee

Cash App Taxes helps users claim every eligible deduction and credit to ensure the highest possible refund. If another service calculates a higher refund using the same inputs, Cash App Taxes will refund any applicable software fees.

Audit Defense

Cash App Taxes include free audit defense, offering users guidance in case of an IRS inquiry. This service provides step-by-step explanations of the audit process and instructions on how to respond effectively, giving users peace of mind by ensuring they are prepared.

Integrations of Cash App Taxes

Cash App Taxes offers limited direct integrations but allows users to import prior year tax data from other tax software platforms, making it easier for returning users to transition seamlessly.

Customers of Cash App Taxes

Cash App Taxes serves a wide range of individual taxpayers and self-employed professionals seeking an affordable and efficient tax preparation solution. While specific client names are not publicly disclosed, the platform has garnered positive feedback from numerous users.

Pros & Cons of Cash App Taxes

| Pros | Cons |

|---|---|

| Completely free federal and state tax filing | Limited support for complex tax situations (e.g., self-employed deductions) |

| Supports most tax situations, including investments & crypto | No live customer support via phone |

| User-friendly mobile and web experience | No option for professional tax assistance |

| Maximum refund guarantee | |

| Free audit defense included |

Final Thoughts

Cash App Taxes is an excellent choice for individuals and self-employed professionals looking for a completely free, feature-rich tax preparation software. Its no-cost pricing, support for all major tax forms, and user-friendly approach make it a standout option in the tax software market.

While it may lack some advanced integrations and high-end customer support of premium competitors, its focus on cost-effectiveness, accuracy, and audit defense makes it a valuable option for anyone seeking a straightforward and budget-friendly tax filing experience.

Conclusion

Choosing the right tax software for self-employed individuals ensures accurate filings, maximized deductions, and a hassle-free tax season. Whether you’re a freelancer, gig worker, or small business owner, selecting software with expense tracking, self-employment tax calculations, and audit support can simplify the process.

Free options like Cash App Taxes and FreeTaxUSA work well for basic needs, while TurboTax and H&R Block provide more comprehensive support for complex returns. By evaluating your tax situation, comparing features, and considering ease of use, you can confidently file your taxes while keeping more of your hard-earned income.

Frequently Asked Questions

What is the best tax software for self-employed individuals?

TurboTax Self-Employed and H&R Block Self-Employed offer robust features, including deduction tracking, QuickBooks integration, and audit support.

Can I file my taxes for free if I’m self-employed?

Yes, FreeTaxUSA and Cash App Taxes offer free federal filing for self-employed individuals, though state filing may have a small fee.

What features should I look for in tax software as a freelancer?

Key features include expense tracking, 1099 income support, self-employment tax calculations, and audit protection for added security.

Do I need separate tax software if I own a small business?

If you operate as an LLC or sole proprietor, self-employed tax software should be sufficient. However, businesses with employees may benefit from software with payroll and bookkeeping integration.

How do I know if I should itemize deductions or take the standard deduction?

Most tax software automatically compares both options and selects the most beneficial one based on your expenses, income, and tax situation.

Author

-

Chandrasmita is a former educator who spent four years teaching before transitioning into digital content creation. With a keen eye for breaking down complex topics into easy-to-understand insights, she ensures content is not only informative but also ranks well on search engines. For the past three years, she has been helping people through in-depth research and SEO-driven content that educates and informs.

View all posts