10 Best 401K Service provider in 2025

A well-structured 401(k)provider plays a significant role in helping employees build financial security for the future. Offering this benefit not only supports long-term savings but also strengthens a company’s ability to attract and retain top talent. Retirement planning is a priority for businesses that want to provide employees with financial stability while ensuring compliance with regulations and optimizing costs.

Selecting the right 401(k) provider involves evaluating multiple factors, including investment options, administrative services, and pricing structures. Some businesses may look for providers that offer a broad selection of funds and hands-on account management, while others may prefer automated platforms with simplified processes. Transparent fee structures, ease of integration with payroll systems, and accessible customer support also contribute to a smooth experience for both employers and employees.

With numerous providers offering a range of services, choosing the best one can be time-consuming. This guide highlights the top 401(k) providers in the U.S., outlining key features and pricing to help businesses make informed decisions. Whether setting up a new plan or refining an existing one, this resource provides clarity in evaluating the best options.

A quick overview

Explore the leading 401(k) providers in the U.S., offering competitive pricing, diverse investment choices, and user-friendly management tools. This guide simplifies the selection process by outlining key features, helping businesses find the right fit for their retirement plans.

Top 10 Best 401(k) Providers Shortlist (Bulleted List with One-Liner Descriptions)

- Fidelity Investments — Best for large businesses with comprehensive retirement solutions

- Vanguard — Best low-cost 401(k) provider for small businesses

- Charles Schwab — Best for flexible investment options

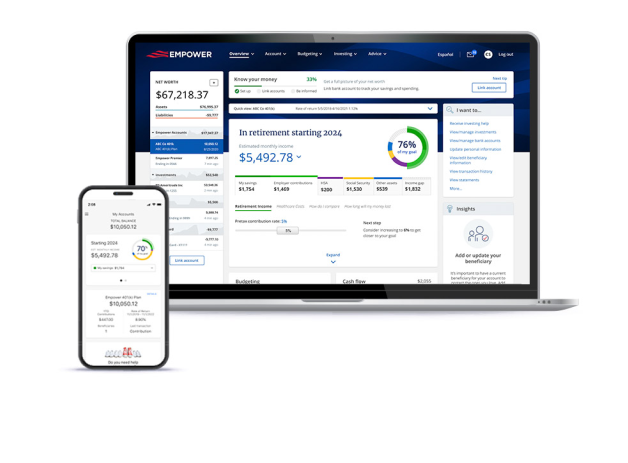

- Empower Retirement — Best for employee engagement tools

- ADP Retirement Services — Best for integrated payroll and retirement management

- Guideline — Best for startups and small businesses

- Betterment for Business — Best robo-advisor 401(k) provider

- T. Rowe Price — Best for personalized retirement planning services

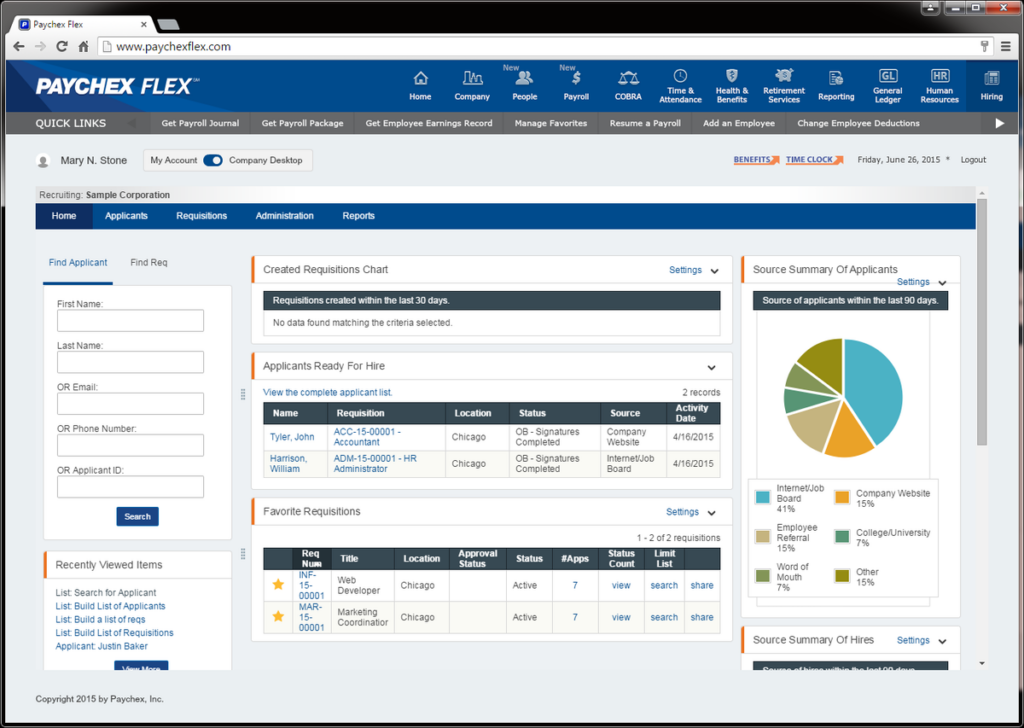

- Paychex — Best for businesses already using Paychex payroll services

- Human Interest — Best for automated 401(k) administration

401(k) Providers Pricing Comparison Chart

Here’s a comparison of ten prominent 401(k) providers, highlighting key features and fee structures to assist businesses in making informed decisions:

| Provider | Best For | Setup Fee | Annual Fees | Employee Fees |

|---|---|---|---|---|

| Fidelity | Large businesses | Varies | Low-cost options | 0.05% – 0.35% |

| Vanguard | Small businesses | None | $20–$30 per user/year | 0.04% – 0.15% |

| Guideline | Startups & SMBs | $0 | Starts at $39/month | 0.08% of assets |

| Empower | Employee tools | Varies | Custom pricing | 0.15% – 0.60% |

| Betterment | 401(k) automation | $500 (waived) | $6/month per employee | 0.25% of assets |

| ADP | Payroll & retirement | Varies | Custom pricing | Varies |

| Paychex | Paychex users | Varies | Custom pricing | Varies |

| T. Rowe Price | Retirement planning | Varies | Custom pricing | Varies |

| Charles Schwab | Investment flexibility | None | Varies | Varies |

| Human Interest | 401(k) administration | $499 | Starts at $120/month | 0.50% of assets |

Note: The information provided is based on available data and may vary depending on specific plan selections and business requirements. It’s advisable to contact providers directly for the most current and detailed information.

This comparison aims to offer a clear overview of each provider’s offerings, assisting businesses in selecting a 401(k) plan that aligns with their objectives and the needs of their employees.

Fidelity Investments

Best For

Businesses of all sizes are looking for a comprehensive and reliable 401(k) provider with a broad selection of investment options, strong administrative support, and extensive employee education resources.

Setup Fee & Annual Fees

For small businesses, Fidelity charges a one-time startup fee of $500 and an ongoing administration fee of $300 per quarter. Employees pay $25 per quarter for recordkeeping and 0.125% of their account balance per quarter for investment services.

Overview

Fidelity Investments is one of the most well-established financial services firms, offering a full suite of retirement solutions, including 401(k) plans, IRAs, and pension plans. Their 401(k) offerings cater to businesses of all sizes, from startups to large corporations. Employers benefit from a streamlined setup process, a dedicated customer support team, and advanced reporting tools that simplify plan management.

Employees gain access to a diverse range of investment options, allowing them to build portfolios that align with their risk tolerance and retirement goals. Fidelity’s long-standing reputation for strong financial performance and client-focused service makes it a preferred choice for businesses looking for a trusted retirement plan provider.

Why I Picked Fidelity Investments

Fidelity stands out as a 401(k) provider due to its balance of cost-effectiveness, investment flexibility, and customer support. Many businesses seek a provider that offers both robust investment options and easy plan administration, and Fidelity excels in both areas. The platform is designed to make plan management straightforward for employers while offering employees a rich selection of funds and financial wellness tools.

Additionally, Fidelity integrates seamlessly with many payroll providers, reducing the administrative burden for businesses managing contributions and compliance. The company’s long track record in the financial sector ensures stability and expertise, making it a strong choice for businesses that want a secure and reliable retirement plan provider.

Key Features

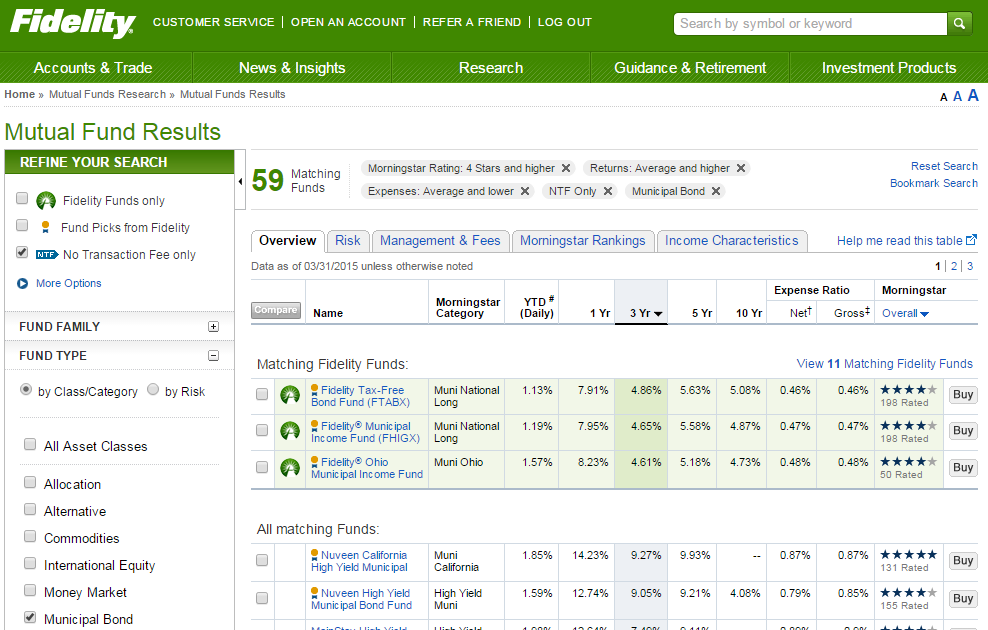

Investment Options

Fidelity provides a wide variety of investment choices, including low-cost index funds, actively managed funds, and target-date funds. Employees can diversify their retirement savings by selecting from an extensive portfolio of stocks, bonds, ETFs, and mutual funds. The ability to create custom investment strategies allows participants to align their retirement savings with their financial objectives and risk tolerance.

Administrative Tools

Employers benefit from a robust set of administrative tools designed to simplify the management of 401(k) plans. Fidelity offers automated payroll integration, which ensures that employee contributions are processed accurately and on time. The platform also provides compliance assistance, helping businesses stay aligned with IRS and Department of Labor regulations. Reporting tools allow employers to track plan performance, monitor contributions, and adjust plan settings as needed.

Employee Support

Fidelity places a strong emphasis on employee education and financial wellness. The platform provides extensive educational resources, including interactive retirement calculators, webinars, and one-on-one financial coaching. Employees can access personalized investment guidance, ensuring that they make informed decisions about their retirement savings. Fidelity also offers a mobile app that allows employees to monitor their accounts, adjust contributions, and review investment performance in real time.

Integrations

- Payroll Integrations – ADP, Paylocity, Gusto, QuickBooks, Rippling, OnPay

- HR Software Integrations – BambooHR, Zenefits, Namely, Workday

- Accounting & Financial Management Integrations – Xero, NetSuite

Customers

Fidelity Investments serves a diverse clientele, including individual investors, financial advisors, and institutions. While specific client names are not publicly disclosed, Fidelity’s extensive customer base reflects its reputation in the financial services industry.

Pros & Cons

Pros

Diverse Investment Options

Employees have access to a broad range of funds, including low-cost index funds, target-date funds, and actively managed portfolios. This variety allows individuals to tailor their investment strategy based on risk tolerance and retirement goals.

Comprehensive Administrative Support

Employers benefit from automated payroll integration, compliance tracking, and advanced reporting features. These tools help streamline plan management, reduce administrative burden, and ensure regulatory compliance.

Cons

Costs Can Be Higher for Small Businesses

While Fidelity’s pricing remains competitive for larger businesses, smaller companies may find administrative fees slightly higher than some alternative providers. This could be a drawback for startups and small enterprises looking for a cost-effective retirement solution.

Customization Options May Require Additional Fees

Fidelity offers a wide selection of funds, but some customization features may come at an additional cost. Businesses seeking tailored plan structures should consider potential extra charges when evaluating Fidelity’s offerings.

Final Thoughts

Fidelity Investments is a strong choice for businesses seeking a full-service 401(k) provider with a well-rounded selection of investment options, comprehensive administrative tools, and exceptional employee resources. Whether a business is just starting a retirement plan or looking to upgrade an existing one, Fidelity’s blend of expertise, technology, and customer support makes it a reliable option.

While costs may vary based on business size, the platform’s benefits in investment flexibility and ease of administration make it a worthwhile consideration for employers focused on long-term retirement planning.

Vanguard

Best For

Small and mid-sized businesses seeking a low-cost 401(k) provider with a strong reputation for index funds, transparent fee structures, and a focus on passive investment strategies.

Setup Fee & Annual Fees

Vanguard does not charge a plan setup fee. There is a $20 annual fee for each Vanguard mutual fund held in an account. This fee is waived if at least one participant in the plan has $50,000 or more in qualifying Vanguard assets.

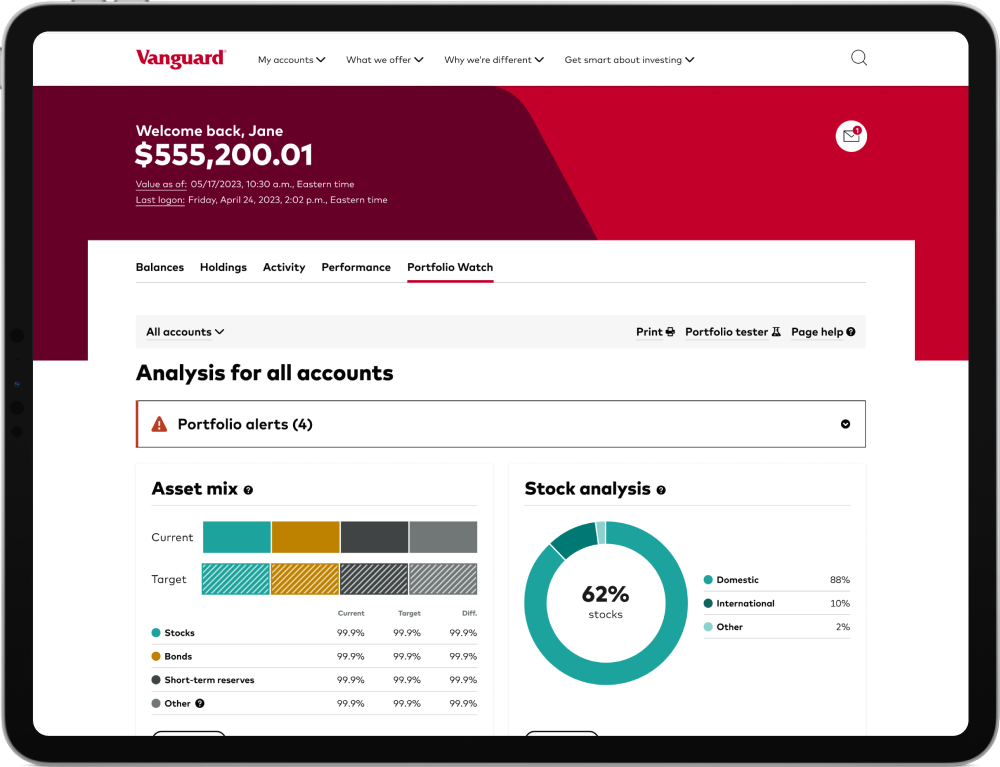

Overview

Vanguard is one of the most trusted financial firms, known for its investor-first philosophy and leadership in low-cost index funds. The company offers 401(k) plans designed to help businesses provide high-quality retirement benefits while keeping costs minimal. Employers benefit from Vanguard’s commitment to long-term investment growth, along with easy plan management tools that integrate with payroll systems.

Employees gain access to an extensive lineup of low-cost index funds, actively managed funds, and target-date retirement options. Vanguard’s reputation for cost efficiency and simple plan administration makes it a strong choice for businesses focused on providing employees with solid retirement savings opportunities.

Why I Picked Vanguard

Vanguard stands out for its dedication to low fees and passive investment strategies, making it a great option for businesses that prioritize cost-effectiveness. The provider offers a broad range of investment choices with some of the lowest expense ratios in the industry.

Vanguard’s transparent pricing model is particularly beneficial for small and mid-sized businesses looking for a budget-friendly yet high-quality 401(k) solution. Employers can manage their plans with ease using Vanguard’s digital tools, while employees can take advantage of expert-curated investment options without paying high management fees.

Key Features

Investment Options

Vanguard offers an impressive lineup of investment funds, with a strong emphasis on index funds and ETFs that come with some of the lowest expense ratios available.

Target-date funds allow employees to adjust their investment risk as they approach retirement automatically.

Administrative Tools

Employers benefit from Vanguard’s easy-to-use plan management platform, which integrates with payroll systems for seamless contribution processing. Compliance tracking tools help businesses stay aligned with IRS regulations.

The reporting dashboard provides insights into plan performance, contribution trends, and employee participation rates, allowing employers to make informed adjustments when necessary.

Employee Support

Vanguard provides a range of educational materials, including financial planning guides, webinars, and retirement calculators, helping employees make well-informed investment decisions.

Employees can manage their 401(k) contributions online or through Vanguard’s mobile app, adjusting allocations as needed. Vanguard’s investment advisors also provide general guidance on retirement savings strategies.

Pros and Cons

Pros

Low-Cost Investment Options

Vanguard’s focus on index funds ensures that expense ratios remain among the lowest in the industry. This cost-effective approach helps employees maximize their long-term retirement savings.

Transparent Pricing

With no hidden fees, businesses can easily manage plan costs and budget effectively. Vanguard’s straightforward pricing model enhances financial clarity for employers.

Seamless Plan Management

Employers can efficiently manage contributions, track performance, and automate compliance tasks. The platform’s streamlined tools make plan administration simple and hassle-free.

Cons

Limited Actively Managed Investment Choices

Vanguard primarily offers passive investment strategies, which may not appeal to businesses or employees looking for actively managed options. Those seeking a more hands-on investment approach may find the selection restrictive.

Limited Personalized Advisory Services

While general financial guidance is available, personalized investment advice often requires additional services. Businesses and employees looking for tailored financial planning may need to explore third-party advisory solutions.

Fewer Customization Options

Vanguard’s plan structures are more standardized than those of some competitors. Therefore, companies seeking highly customized retirement solutions may find fewer flexible options available.

Integrations

- APS Payroll: Vanguard integrates with APS Payroll, facilitating efficient management of employee retirement contributions. slashdot.org

- iSolved: Integration with iSolved allows for streamlined human capital management, including retirement plan administration. slashdot.org

- The Dividend Tracker: Vanguard’s integration with The Dividend Tracker enables investors to monitor dividend income effectively. slashdot.org

Customers

While specific client names are not publicly disclosed, Vanguard manages substantial investments in major companies. As of September 2024, Vanguard’s top holdings include Apple Inc., Microsoft Corporation, NVIDIA Corporation, Amazon.com, Inc., and Meta Platforms, Inc.

Additionally, Vanguard has collaborated with Amazon Web Services (AWS) to modernize its technology infrastructure, enhancing its service offerings.

Final Thoughts

Vanguard is an excellent choice for businesses seeking a cost-effective, transparent, and reliable 401(k) provider. Its focus on low-cost index funds and straightforward fee structures makes it an appealing option for small and mid-sized businesses looking to provide employees with long-term growth opportunities.

While Vanguard’s offerings are heavily geared toward passive investment strategies, its reputation for financial stability and investor-first approach make it a dependable solution for companies that want a no-frills, high-value retirement plan.

Guideline

Best For

Startups and small businesses looking for a fully automated 401(k) solution with low fees, seamless payroll integration, and simplified plan management.

Setup Fee & Annual Fees

Guideline offers 401(k) plans with no setup fees. Employers pay a monthly base fee starting at $39, plus $4 per active participant per month. Employees are charged an annual account fee ranging from 0.15% to 0.35% of their account balance, depending on the plan tier selected by the employer.

Overview

Guideline is a modern, technology-driven 401(k) provider that simplifies retirement plan management for small businesses. Unlike traditional providers, it eliminates middlemen by offering an all-in-one automated solution for plan administration, investment management, and compliance. Its seamless payroll integration ensures that contributions are processed accurately and on time.

Employees benefit from a user-friendly platform that provides access to low-cost index funds managed by Vanguard. The platform automatically adjusts investment portfolios based on an individual’s risk tolerance and retirement goals. Guideline is an excellent choice for businesses that want a low-maintenance, cost-effective retirement solution without high administrative overhead.

Why I Picked Guideline

Guideline is designed with automation and affordability in mind. Small businesses often struggle with the complexity of 401(k) administration, and Guideline simplifies this process through a fully managed solution that integrates seamlessly with payroll providers. The provider’s transparent pricing model ensures businesses are aware of all costs upfront, with no transaction fees or hidden charges. This makes it an excellent choice for companies looking to offer a retirement benefit without taking on excessive administrative work.

Key Features

Investment Options

Guideline provides employees with a diversified range of investment opportunities designed for long-term growth. The platform primarily offers index funds managed by Vanguard, which is known for its low-cost, passive investment strategies. Employees can choose from a mix of equity and bond funds, allowing them to balance risk according to their personal financial goals.

Administrative Tools

One of Guideline’s biggest advantages is its fully automated administration. Businesses benefit from a streamlined system that handles nearly every aspect of 401(k) management, reducing the need for manual oversight. The platform integrates directly with popular payroll providers, ensuring that employee contributions are deducted and deposited accurately without requiring additional steps from employers.

Employee Support

Guideline offers a user-friendly experience for employees, with an intuitive online dashboard and mobile access that allows them to manage their 401(k) accounts easily. Employees can track their contributions, adjust their investment preferences, and review their projected retirement savings at any time.

Pros and Cons

Pros

Flat-Fee Pricing

No hidden fees, making costs predictable for small businesses. This transparent pricing structure helps businesses manage expenses effectively without unexpected charges.

Fully Automated 401(k) Plan

Payroll integration and compliance management reduce the administrative burden. Employers can streamline contributions and ensure regulatory compliance with minimal effort.

Ideal for Small Businesses & Startups

Designed for businesses that want a hands-off, easy-to-manage plan. The automation and simplicity make it a great fit for growing companies with limited HR resources.

Cons

Limited Investment Selection

Only offers index funds, with no actively managed fund options. This may not appeal to employees seeking a more diversified investment strategy.

No Dedicated Financial Advisors

Employees do not receive one-on-one investment advice. Those looking for personalized financial planning may need to seek external advisory services.

Not Ideal for Large Companies

Larger businesses may require more customization and flexibility. This plan’s standardized structure may not meet the complex needs of bigger organizations.

Integrations

Guideline integrates with various payroll and HR systems to streamline contributions and plan administration.

- Payroll Integrations – QuickBooks, Gusto, ADP, Paychex, Rippling, Square Payroll

- HR & Accounting Integrations – BambooHR, Zenefits, Xero, OnPay

Customers

Guideline serves a diverse range of small and mid-sized businesses across industries. While specific client names are not publicly disclosed, the company has established itself as a leading choice for startups and growing businesses looking for a simplified 401(k) solution.

Final Thoughts

Guideline is a top option for small businesses and startups seeking a modern, fully automated 401(k) solution. Its low-cost, technology-driven approach removes much of the complexity associated with retirement plan administration. While it may not provide the customization larger companies need, its ease of use, seamless payroll integration, and transparent pricing make it a strong choice for companies focused on providing employees with an accessible and cost-effective retirement savings plan.

Empower Retirement

Best For

Businesses of all sizes looking for a full-service 401(k) provider with customizable investment options, advanced plan administration tools, and strong employee engagement features.

Setup Fee & Annual Fees

Empower Retirement’s fees vary based on plan specifics and company size. They offer customized pricing, and it’s recommended to contact Empower directly for a detailed quote tailored to your business needs.

Overview

Empower Retirement is one of the largest retirement plan providers in the U.S., serving millions of participants across various industries. The company offers a flexible suite of retirement solutions, including 401(k) plans designed to accommodate businesses of all sizes, from small companies to large enterprises. Employers benefit from a well-rounded platform that combines digital tools with personalized financial guidance, helping them manage plans efficiently while ensuring compliance with regulatory requirements.

Employees have access to a range of investment choices, including target-date funds, managed accounts, and self-directed brokerage options. Empower’s emphasis on financial wellness ensures that participants receive personalized insights and guidance to make informed retirement planning decisions. With its blend of technology, expert support, and comprehensive investment solutions, Empower Retirement stands out as a strong option for businesses seeking a well-rounded 401(k) provider.

Why I Picked Empower Retirement

Empower Retirement provides a balance of customization, technology, and human advisory support, making it an attractive choice for businesses that want a mix of automation and expert guidance. Unlike providers that focus solely on digital management, Empower combines advanced online tools with real-time access to financial professionals, ensuring that both employers and employees receive the assistance they need.

The provider also prioritizes financial education, equipping employees with personalized recommendations and goal-based investing strategies. Businesses can tailor their 401(k) offerings with a mix of passive and actively managed investment funds, making it a suitable choice for companies with diverse workforces and varying retirement planning needs.

Key Features

Investment Options

Empower Retirement offers a wide selection of investment choices, allowing businesses to customize their 401(k) plans to meet the needs of their employees. Target-date funds automatically adjust asset allocation as participants approach retirement, making long-term investing simple.

Administrative Tool

Empower Retirement simplifies plan management with automation and compliance support, reducing the administrative workload for businesses. Automated payroll integration ensures that employee contributions are deducted and deposited accurately. Built-in compliance monitoring helps businesses meet IRS regulations, including nondiscrimination testing and annual reporting.

Employee Support

Empower Retirement emphasizes financial wellness and long-term retirement planning with a suite of personalized tools. Employees have access to one-on-one financial coaching with expert advisors who guide them based on their individual retirement goals.

Integrations

Empower Retirement integrates with various payroll and HR software solutions to streamline administrative processes and ensure seamless contribution management.

- Payroll Integrations – ADP, Paychex, QuickBooks, Gusto, Rippling, Workday

- HR Software Integrations – BambooHR, Zenefits, Namely, UKG

Customers

Empower serves a diverse range of clients across various sectors, including corporate, government, healthcare, education, and faith-based organizations. While specific client names are not publicly disclosed, Empower provides retirement plans and services to over 12 million Americans participating in plans of various sizes.

Pros and Cons of This 401(k) Plan

Pros

Customizable Investment Plans

Employers can choose from target-date funds, index funds, actively managed portfolios, and brokerage accounts. This flexibility allows businesses to tailor investment options to meet employee needs.

Comprehensive Administrative Tools

Automated payroll sync, compliance monitoring, and advanced reporting features streamline plan management. These tools reduce administrative workload and help maintain regulatory compliance.

Employee-Focused Financial Education

Employees receive one-on-one financial coaching and personalized retirement planning insights. This added support can help participants make informed investment decisions.

Cons

Pricing Varies by Plan

Costs are customized based on business size and needs, requiring direct consultation for accurate estimates. Businesses may need to compare options carefully to ensure cost-effectiveness.

May Be Complex for Small Businesses

The level of customization and available options might be more than some smaller businesses need. Those looking for a simple, hands-off plan may find the features excessive.

Some Plans May Have Higher Fees

Actively managed fund options may come with higher expense ratios. Businesses should weigh the benefits of active management against the additional costs.

Final Thoughts

Empower Retirement is a strong choice for businesses looking for a fully customizable and feature-rich 401(k) provider. With a combination of automated tools, expert advisory services, and extensive employee education resources, it offers a comprehensive retirement planning solution.

While the level of customization and pricing may vary based on plan selection, businesses that value a mix of technology and human support will find Empower Retirement to be a valuable partner in helping employees achieve long-term financial security.

Betterment for Business

Best For

Businesses looking for a modern, technology-driven 401(k) provider with automated investment management, low fees, and personalized financial planning tools for employees.

Setup Fee & Annual Fees

Betterment for Business charges a platform fee of 0.25% of plan assets annually. There is also a $500 one-time setup fee for new plans. Employees pay fund-level fees averaging 0.07% for the underlying investments.

Overview

Betterment for Business is a tech-focused 401(k) provider that leverages automation and data-driven investing to simplify retirement savings. Designed for companies that want a low-maintenance yet high-value retirement solution, Betterment offers an intuitive digital platform that manages employee contributions, portfolio allocations, and long-term investment strategies.

Employers benefit from a streamlined administrative experience, with payroll integration, automated compliance tracking, and real-time analytics that provide insight into employee participation and plan performance. Employees, on the other hand, gain access to personalized investment portfolios that are automatically rebalanced based on individual goals and risk tolerance.

Betterment’s approach focuses on affordability and accessibility, making it an ideal choice for businesses that want a modern 401(k) solution without the complexity of traditional providers.

Why I Picked Betterment for Business

Betterment stands out as a 401(k) provider due to its focus on automation and low-cost investing. Unlike traditional financial firms, Betterment operates as a robo-advisor, using AI-driven portfolio management to ensure optimal asset allocation and growth over time.

Its fully managed system eliminates the need for manual oversight, making it a strong option for businesses that prefer a hands-off retirement plan. Additionally, Betterment’s cost structure is transparent, with low management fees and no hidden costs, ensuring that employees retain more of their investment returns.

Key Features

Automated Portfolio Management

Betterment for Business leverages AI-driven technology to manage employee retirement portfolios with minimal effort from employers. The platform continuously monitors market conditions and automatically rebalances portfolios to keep them aligned with each participant’s risk tolerance and financial goals.

Seamless Payroll Integration

Betterment integrates directly with major payroll providers, ensuring that 401(k) contributions are deducted, processed, and deposited without delays. This eliminates the need for employers to manually manage deductions, reducing administrative errors and streamlining compliance.

Personalized Investment Advice

Employees receive tailored investment recommendations based on their income, age, savings rate, and retirement timeline. Betterment’s AI-powered financial planning tools analyze individual financial situations and suggest optimal contribution levels and investment allocations.

Integrations

Betterment for Business integrates with various payroll and HR systems to streamline contribution management and compliance tracking.

- Payroll Integrations – ADP, Paychex, QuickBooks, Gusto, Rippling

- HR Software Integrations – BambooHR, Zenefits, Namely, Workday

Customers

Betterment for Business serves a wide range of companies, from startups to mid-sized businesses, that want a cost-efficient and automated retirement plan. While specific client names are not publicly disclosed, its user-friendly model has made it a popular choice among tech companies, service businesses, and remote-first organizations.

Pros and Cons

Pros

Low-Cost, Transparent Pricing

Lower fees than traditional providers, with a flat-rate employer fee and low expense ratios for employees. This cost-efficient model makes retirement planning more affordable for businesses and employees.

Fully Automated 401(k) Management

Reduces administrative workload with payroll sync and automated compliance tracking. Employers can streamline plan management with minimal manual intervention.

Personalized Retirement Planning Tools

AI-driven portfolio management with personalized goal tracking. Employees receive tailored investment strategies to help them stay on track with their retirement savings.

Cons

No Actively Managed Fund Options

Employees only have access to Betterment-managed ETF portfolios. Those looking for actively managed investments may find the selection limited.

Limited Customization for Employers

Fewer plan design options compared to larger traditional providers. Businesses needing highly tailored plans may need to explore alternative providers.

Lack of In-Person Support

Customer service is primarily digital, with limited access to dedicated account managers. Employers and employees who prefer direct, personalized support may find this limiting.

Final Thoughts

Betterment for Business is an excellent choice for companies looking for a modern, cost-effective 401(k) solution. With its fully automated investment management, payroll integration, and AI-driven financial planning, it simplifies retirement savings for both employers and employees. While it may not provide the level of customization that larger enterprises need, its affordability and ease of use make it a strong option for businesses focused on providing a hassle-free, tech-powered retirement plan.

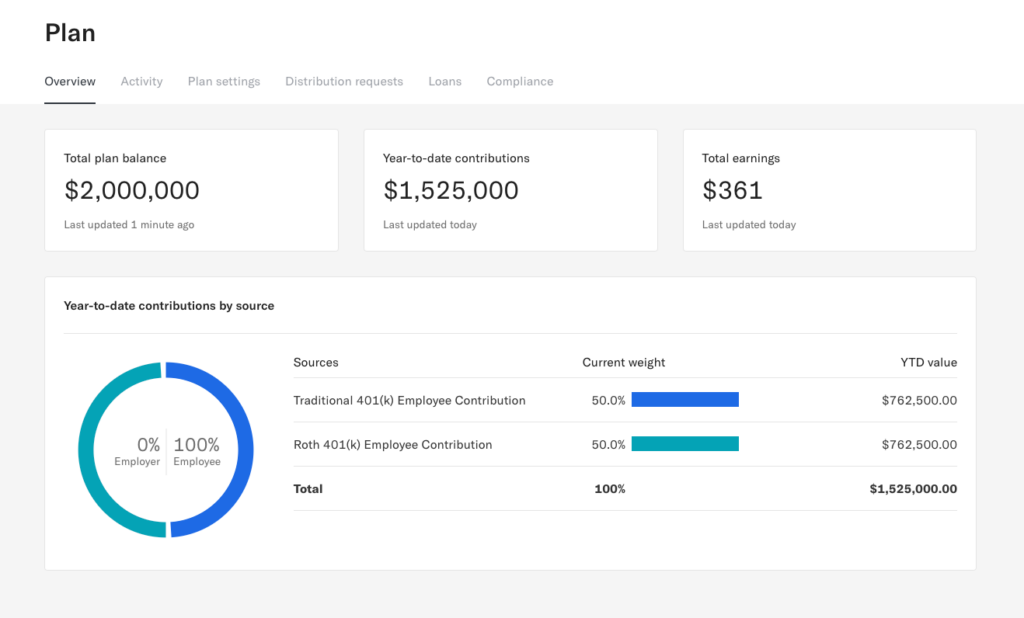

ADP Retirement Services

Best For

Businesses of all sizes looking for a 401(k) provider with seamless payroll integration, compliance support, and a user-friendly platform for both employers and employees.

Setup Fee & Annual Fees

ADP’s 401(k) plans have varying fees depending on the selected plan and company size. They offer different tiers of service, and pricing is customized accordingly. It’s advisable to contact ADP directly to obtain a quote specific to your business requirements.

Overview

ADP Retirement Services is a trusted name in employee benefits, offering 401(k) solutions that integrate directly with its widely used payroll and HR systems. The platform is designed to streamline retirement plan administration while ensuring businesses remain compliant with regulatory requirements. Employers benefit from automated processes that handle payroll deductions, contributions, and reporting, reducing manual workload.

Employees have access to a diverse range of investment options, including professionally managed portfolios and self-directed choices. ADP’s financial wellness tools and education resources help employees make informed decisions about their retirement savings. With a reputation for reliability and strong customer support, ADP Retirement Services is a practical choice for businesses looking for a well-integrated and scalable 401(k) solution.

Why I Picked ADP Retirement Services

ADP stands out for its seamless payroll and benefits integration, making it an ideal choice for businesses already using ADP for payroll processing. Its automated features reduce administrative effort, ensuring accuracy in contributions and compliance with IRS regulations. The provider also offers strong customer support, giving businesses direct access to retirement specialists who assist with plan setup, management, and compliance requirements.

Key Features

Seamless Payroll Integration

ADP’s 401(k) plans sync directly with its payroll and HR software, automating contributions and reducing administrative errors. The integration ensures that employee deductions are processed accurately without manual intervention, reducing the risk of compliance issues.

Compliance and Fiduciary Support

Built-in compliance tools help businesses stay in line with IRS and Department of Labor regulations, including nondiscrimination testing and audit support. ADP provides automatic updates to reflect regulatory changes, minimizing the risk of penalties due to non-compliance.

Diverse Investment Options

Employees can choose from a range of mutual funds, target-date funds, and professionally managed portfolios based on their investment goals and risk preferences. The platform offers a mix of passive and actively managed funds, allowing employees to build diversified retirement portfolios.

Integrations

- Payroll Integrations – ADP’s SMARTSync provides real-time integration between ADP payroll and ADP retirement plan services, ensuring continuous data sharing and accuracy.

- HR Software Integrations – BambooHR, Zenefits, Namely, and Workday.

- Accounting & Financial Management Integrations – Xero and NetSuite.

Customers

ADP Retirement Services provides retirement plan solutions to a diverse range of clients across various industries. While specific client names are not publicly disclosed, ADP serves over 100,000 plan sponsor clients, including small businesses, large corporations, and non-profit organizations. Notably, Amazon Delivery Service Partners (DSP) have chosen ADP for their retirement services, highlighting ADP’s flexibility and reputation for exceptional service.

Additionally, the Maryland Association of CPAs has discussed their positive experience with ADP Retirement Services, emphasizing their satisfaction with ADP as their retirement plan provider.

Pros & Cons

Pros and Cons

Pros

Seamless Payroll & Benefits Integration

Syncs directly with ADP payroll, automating contributions and reporting. This integration reduces manual work, ensures accuracy, and simplifies benefits administration.

Comprehensive Compliance Support

Helps businesses stay IRS-compliant with automatic testing and regulatory tracking. ADP’s built-in compliance tools minimize the risk of penalties and streamline audit preparation.

Cons

Fees Can Vary

Costs depend on plan size, business needs, and customization. Businesses may need to consult with ADP directly to get an accurate estimate of pricing.

Less Customization for Larger Businesses

Plan flexibility may be limited for large enterprises seeking advanced customization. Organizations with specific investment or plan structure requirements may find fewer options compared to specialized providers.

Final Thoughts

ADP Retirement Services is an excellent choice for businesses that want a 401(k) provider that integrates smoothly with payroll and HR operations. Its automated compliance features, diverse investment options, and strong customer support make it a practical solution for employers looking to offer a streamlined retirement benefit. While costs may vary depending on plan specifics, its overall efficiency and ease of use make it a reliable option for businesses of all sizes.

Paychex

Best For

Small and mid-sized businesses looking for a 401(k) provider with integrated payroll services, compliance support, and flexible retirement plan options.

Setup Fee & Annual Fees

Paychex offers customized pricing based on the business size, plan structure, and selected features. There is no standard setup fee, as costs vary depending on the specific plan and level of service. Employers should contact Paychex directly for a tailored quote.

Overview

Paychex is a well-established provider of payroll and HR solutions, offering 401(k) plans that integrate seamlessly with its payroll services. The platform is designed to simplify retirement plan administration while ensuring businesses stay compliant with IRS and Department of Labor regulations. Paychex provides a range of plan options, including traditional 401(k), Roth 401(k), and SIMPLE IRA plans, catering to businesses with different retirement planning needs.

Employees benefit from a variety of investment options, including low-cost index funds, mutual funds, and professionally managed portfolios. The platform also provides financial wellness tools and retirement planning resources to help employees make informed decisions about their savings. With strong payroll integration and a focus on compliance, Paychex is a reliable choice for businesses seeking a comprehensive retirement benefits solution.

Why I Picked Paychex

Paychex stands out for its payroll integration, making retirement contributions seamless for businesses already using Paychex payroll services. The automation ensures accuracy in processing employee deductions and contributions, reducing administrative workload. Paychex also offers a wide selection of retirement plan options, allowing businesses to tailor their 401(k) offerings to fit their employees’ financial goals.

Additionally, the provider offers strong customer support, with retirement specialists available to help businesses manage compliance, reporting, and fiduciary responsibilities. The combination of payroll efficiency, plan flexibility, and compliance management makes Paychex a strong contender for businesses looking for a full-service 401(k) solution.

Key Features

Payroll Integration

Paychex 401(k) plans sync directly with its payroll services, ensuring contributions are deducted accurately and on time. Employers can manage employee enrollments, track contributions, and generate reports from a single dashboard.

Compliance & Regulatory Support

The platform automates compliance tracking, assisting businesses with nondiscrimination testing, Form 5500 filings, and regulatory updates. Paychex also offers fiduciary support to help employers meet legal requirements.

Flexible Investment Choices

Employees can select from a range of investment options, including target-date funds, mutual funds, and professionally managed portfolios. The platform supports both passive and actively managed funds to cater to different risk preferences.

Integrations

Payroll Integrations – ADP, QuickBooks, Gusto, Rippling, SurePayroll

HR Software Integrations – BambooHR, Zenefits, Namely, Workday

Accounting & Financial Management Integrations – Xero, NetSuite, Sage Intacct

Customers

Paychex serves a diverse client base, including small businesses, mid-sized companies, and growing enterprises. While specific customers are not publicly disclosed, Paychex’s strong presence in the payroll and HR space makes it a trusted provider for businesses looking to incorporate retirement benefits into their compensation packages.

Pros and Cons

Pros

Seamless Payroll Integration

Syncs directly with Paychex payroll, automating contributions and reducing errors. This integration ensures accuracy, simplifies reporting, and minimizes administrative workload for employers.

Comprehensive Compliance Support

Includes IRS testing, Form 5500 filings, and fiduciary guidance. Businesses can stay compliant with regulatory requirements without the burden of manual tracking.

Cons

Pricing Varies by Plan

Costs depend on business size, plan features, and customization. Employers may need to consult Paychex for detailed pricing based on their specific needs.

Limited Customization for Larger Businesses

May not offer the advanced flexibility that larger corporations require. Organizations with complex retirement plan needs may find fewer customization options compared to specialized providers.

Final Thoughts

Paychex is an excellent choice for businesses that want a fully integrated payroll and 401(k) solution. Its automated features, compliance support, and flexible investment options make it an attractive option for small and mid-sized companies. While pricing depends on plan specifics, its user-friendly platform and strong customer service make it a reliable choice for businesses looking to streamline their retirement plan administration.

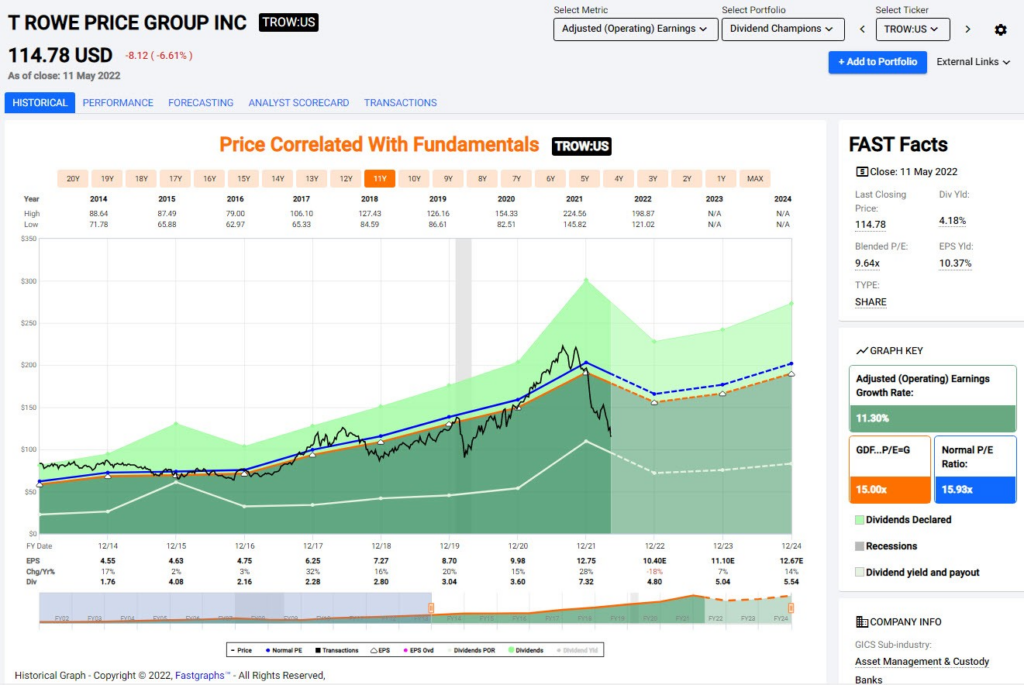

T. Rowe Price

Best For

Businesses of all sizes looking for a 401(k) provider with a strong reputation for investment management, personalized advisory services, and a wide selection of actively managed and index funds.

Setup Fee & Annual Fees

T. Rowe Price offers customized pricing based on the size of the business, plan complexity, and selected features. There is no standard setup fee, and costs vary depending on the level of service and investment options chosen. Businesses should contact T. Rowe Price directly for a personalized quote.

Overview

T. Rowe Price is a well-established investment management firm that provides a range of retirement plan solutions, including 401(k) plans for businesses of all sizes. The company is known for its research-driven investment strategies and high-quality fund offerings, making it a strong choice for businesses that prioritize long-term financial growth for their employees.

Employers benefit from a streamlined platform that includes plan administration tools, compliance support, and access to dedicated retirement specialists. Employees can choose from a diverse lineup of investment options, including mutual funds, index funds, and target-date funds designed to support different risk tolerances and retirement timelines.

Why I Picked T. Rowe Price

T. Rowe Price stands out for its investment expertise and diverse fund offerings. Unlike some 401(k) providers that focus primarily on low-cost index funds, T. Rowe Price provides both passive and actively managed funds, giving employees more control over their investment strategies.

Additionally, the company’s commitment to personalized service ensures that businesses receive tailored support for plan setup, administration, and compliance. Employees benefit from financial education resources, interactive planning tools, and access to professional investment advisors who help them optimize their retirement savings strategies.

Key Features

Diverse Investment Options

T. Rowe Price offers a mix of actively managed funds, index funds, and target-date funds, allowing employees to create customized portfolios based on their risk tolerance and financial goals.

Retirement Planning & Advisory Services

Employers and employees have access to professional investment advisors who provide tailored retirement planning strategies, helping participants make informed decisions about their savings.

Automated Plan Administration & Compliance Support

The platform simplifies plan management with automated payroll integration, compliance tracking, and regulatory reporting, ensuring businesses stay aligned with IRS and Department of Labor requirements.

Integrations

T. Rowe Price integrates with various payroll, HR, and financial management systems to streamline contribution processing, compliance tracking, and automated plan administration.

- Payroll Integrations – ADP, Paychex, QuickBooks, Gusto, Rippling

- HR Software Integrations – BambooHR, Workday, Namely, Zenefits

- Accounting & Financial Management Integrations – Xero, NetSuite

Customers

T. Rowe Price serves a broad range of businesses, from small companies to large enterprises, across multiple industries. While specific client names are not publicly disclosed, the provider’s reputation as a leading investment management firm makes it a trusted choice for businesses looking for a well-established 401(k) provider.

Pros and Cons

Pros

Strong Investment Management Expertise

Offers a mix of actively managed and index funds backed by professional research. Employees benefit from well-researched investment options tailored to different risk preferences.

Personalized Retirement Advisory Services

Employees and employers have access to dedicated investment advisors. This personalized guidance helps participants make informed decisions about their retirement savings.

Cons

Pricing Varies by Plan

Costs depend on business size, selected services, and investment choices. Businesses may need to consult with T. Rowe Price directly for a customized quote.

Higher Fees for Actively Managed Funds

Actively managed investment options may come with higher expense ratios. Employers and employees should evaluate costs against potential investment returns when selecting funds.

Final Thoughts

T. Rowe Price is a strong choice for businesses that want a 401(k) provider with a focus on investment management and personalized retirement planning. With its wide selection of funds, expert advisory services, and comprehensive administrative tools, the platform provides a well-rounded solution for companies looking to offer high-quality retirement benefits. While costs vary based on plan specifics, its investment expertise and dedicated customer support make it a valuable option for businesses prioritizing long-term financial growth for their employees.

Charles Schwab

Best For

Businesses of all sizes looking for a 401(k) provider with a strong emphasis on low-cost investment options, self-directed brokerage accounts, and comprehensive financial planning tools.

Setup Fee & Annual Fees

Charles Schwab offers customized pricing based on the business size, plan complexity, and selected investment options. There is no standard setup fee, and costs vary depending on the level of service and plan structure. Businesses should contact Charles Schwab directly for a personalized quote.

Overview

Charles Schwab is a leading investment services provider known for its commitment to low-cost, transparent pricing and a wide range of investment options. Its 401(k) plans cater to businesses of all sizes, from startups to large enterprises, providing employers with flexible plan structures and a robust digital platform for managing retirement benefits.

Employers benefit from an intuitive administrative dashboard, seamless payroll integration, and compliance support to ensure smooth plan operations. Employees have access to a broad selection of investment choices, including Schwab’s low-cost index funds, actively managed mutual funds, and self-directed brokerage accounts for those who prefer a hands-on approach to investing. The company’s dedication to financial education and personalized retirement planning tools makes it an excellent choice for businesses that want to offer a comprehensive and cost-effective retirement solution.

Why I Picked Charles Schwab

Charles Schwab stands out due to its commitment to providing low-cost investment options and a self-directed investing experience. Unlike some 401(k) providers that focus solely on managed portfolios, Schwab allows employees to take full control of their retirement savings through its brokerage window, giving them access to a wide range of investment vehicles, including ETFs, mutual funds, stocks, and bonds.

Additionally, the company’s digital-first approach ensures that both employers and employees have access to a user-friendly platform for managing retirement accounts. Businesses benefit from Schwab’s simplified administration process, while employees can access personalized financial planning tools and professional investment advice.

Key Features

Wide Range of Investment Options

Charles Schwab provides access to index funds, actively managed funds, target-date funds, and self-directed brokerage accounts, allowing employees to customize their retirement portfolios based on their financial goals and risk tolerance.

Automated Plan Administration & Compliance Support

The platform streamlines payroll integration, automates compliance monitoring, and provides reporting tools to ensure businesses meet IRS and Department of Labor regulations. This reduces administrative workload and helps maintain regulatory compliance.

Personalized Financial Guidance & Educational Resources

Employees can take advantage of financial planning tools, retirement calculators, and educational webinars to make informed investment decisions. These resources empower participants to plan effectively for their retirement.

Integrations

- Payroll Integrations – ADP, Paychex, QuickBooks, Gusto, Rippling

- HR Software Integrations – BambooHR, Workday, Zenefits, Namely

- Accounting & Financial Management Integrations – Xero, NetSuite

Customers

Charles Schwab serves a wide range of businesses, from small startups to large corporations, across multiple industries. While specific client names are not publicly disclosed, Schwab’s reputation as a leader in financial services makes it a trusted 401(k) provider for businesses looking for a cost-effective and flexible retirement plan.

Pros & Cons

Pros

Low-Cost Investment Options

Offers competitive pricing with access to low-cost index funds and ETFs. This helps employees maximize their retirement savings while minimizing investment costs.

Self-Directed Brokerage Accounts

Employees can take control of their retirement investments through Schwab’s brokerage window. This option provides greater flexibility for those looking to build customized portfolios.

Cons

Limited Personalized Advisory Services

Employees seeking hands-on investment guidance may need to purchase additional advisory services. Those who prefer direct financial coaching may find limited free resources.

Customization May Require Additional Fees

Some plan features, including enhanced investment options, may come at an extra cost. Employers should review pricing details to ensure they align with their business needs.

Final Thoughts

Charles Schwab is a strong choice for businesses that want to offer employees a diverse range of investment options at a low cost. With its self-directed brokerage accounts, automated plan administration, and emphasis on financial education, Schwab provides a well-rounded 401(k) solution. While its pricing varies based on plan structure and selected services, its reputation for transparent fees and a user-friendly platform makes it a valuable option for businesses looking to provide employees with more control over their retirement savings.

Human Interest

Best For

Small and mid-sized businesses looking for a modern, fully automated 401(k) provider with low-cost investment options, seamless payroll integration, and simplified plan administration.

Setup Fee & Annual Fees

Human Interest offers transparent, flat-fee pricing based on the size and complexity of the plan. There are no setup fees, and the ongoing administration fees vary depending on the selected service tier. Businesses should contact Human Interest directly for a personalized quote.

Overview

Human Interest is a tech-driven 401(k) provider that simplifies retirement plan administration for small and mid-sized businesses. The platform is designed to automate many of the manual tasks associated with managing a 401(k), including payroll integration, contribution tracking, and compliance monitoring. Employers benefit from a hassle-free setup, automated plan management, and real-time reporting tools.

Employees have access to low-cost, diversified investment options, including index funds and professionally managed portfolios. The platform also provides user-friendly retirement planning tools, helping employees make informed financial decisions. Human Interest is an ideal choice for businesses looking for an affordable, automated, and easy-to-manage retirement solution.

Why I Picked Human Interest

Human Interest stands out for its automation and affordability. Unlike traditional 401(k) providers that require extensive administrative oversight, Human Interest streamlines the process with its automated system. Payroll integration ensures that contributions are deducted and deposited on time, while built-in compliance monitoring helps businesses stay aligned with IRS and Department of Labor regulations.

Additionally, Human Interest’s flat-fee pricing model makes it a cost-effective solution for businesses that want to offer a retirement benefit without incurring high administrative costs. Its digital-first approach also provides employees with intuitive tools to manage their savings, track their progress, and adjust their investment allocations as needed.

Key Features

Fully Automated 401(k) Management

Payroll integration, automated contribution processing, and compliance tracking reduce the administrative burden on employers. Businesses can save time with auto-enrollment options and real-time reporting tools that keep track of employee participation and plan performance. The system also ensures that all contributions are processed accurately, eliminating manual errors and delays.

Low-Cost Investment Options

Employees can invest in a selection of low-cost index funds and diversified portfolios designed for long-term growth. The platform’s investment strategy prioritizes cost efficiency to help employees maximize their retirement savings. Funds are managed by industry experts, ensuring employees have access to well-diversified portfolios without high management fees.

User-Friendly Retirement Planning Tools

Employees can set savings goals, adjust their contributions, and access financial education resources through an intuitive online dashboard. The platform provides interactive retirement calculators that help participants visualize their long-term savings potential. Employees also receive personalized recommendations based on their financial situation, allowing them to make informed decisions about their retirement plans.

Integrations

- Payroll Integrations – ADP, Paychex, QuickBooks, Gusto, Rippling, OnPay

- HR Software Integrations – BambooHR, Zenefits, Namely, Workday

- Accounting & Financial Management Integrations – Xero, NetSuite

Customers

Human Interest primarily serves small and mid-sized businesses across various industries. While specific client names are not publicly disclosed, its focus on affordability and automation has made it a popular choice among startups, professional service firms, and companies looking for an easy-to-manage 401(k) solution.

Pros & Cons

Pros

Automated Plan Administration

Reduces manual work with payroll integration and compliance tracking. Employers can streamline contributions, reporting, and regulatory compliance with minimal administrative effort.

Flat-Fee, Transparent Pricing

No hidden costs, making it budget-friendly for small businesses. The predictable pricing structure helps employers manage expenses effectively.

Cons

Limited Customization

Businesses looking for highly tailored plan options may need to explore alternative providers. The platform’s standardized offerings might not meet the needs of larger companies or those requiring advanced customization.

No Self-Directed Investment Accounts

Employees have limited control over selecting individual stocks or bonds. Those looking for a self-directed brokerage option may find the investment choices restrictive.

Final Thoughts

Human Interest is an excellent choice for small and mid-sized businesses that want a simple, cost-effective, and fully automated 401(k) solution. Its strong focus on payroll integration, low-cost investment options, and user-friendly management tools make it an attractive option for employers looking to provide employees with a valuable retirement benefit. While its level of customization may not match larger providers, its ease of use and automation make it a standout choice for growing businesses.

Why Trust Our Reviews

At SpotSaaS, we specialize in delivering data-driven, unbiased software recommendations to help businesses make informed decisions. Our team has reviewed and tested over 2,000 tools across various industries, ensuring that our insights are backed by thorough research and real-world usability testing.

Each software solution is evaluated based on critical factors such as pricing, ease of use, feature set, customer support, and overall value. We analyze user feedback, compare market trends, and conduct hands-on testing to provide transparent and well-rounded insights. Our commitment to neutrality means that every review is based on merit, not sponsorships or partnerships.

By leveraging our in-depth research and expert analysis, businesses can confidently choose the best software solutions that align with their goals and budget. Whether you’re looking for a robust 401(k) provider or essential business tools, SpotSaaS simplifies the selection process with reliable and up-to-date recommendations.

Frequently Asked Questions

How do I choose the best 401(k) provider for my business?

Selecting the right 401(k) provider depends on factors such as pricing, investment options, administrative tools, payroll integration, and employee support. Businesses should evaluate providers based on their fees, ease of plan management, and the level of customization available.

What are the typical fees associated with a 401(k) plan?

401(k) plans may include setup fees, annual administrative fees, investment management fees, and employee account fees. Some providers charge a flat rate, while others base costs on plan assets or the number of participants. Comparing pricing structures can help businesses find a cost-effective option.

Can small businesses offer a 401(k) plan?

Yes, small businesses can offer a 401(k) plan, and many providers cater specifically to startups and small companies. Low-cost options like Guideline, Human Interest, and Betterment for Business offer automated administration and payroll integration to simplify the process.

What investment options do employees get in a 401(k) plan?

Most 401(k) providers offer a mix of index funds, actively managed funds, target-date funds, and self-directed brokerage accounts. Some providers, like Vanguard and Charles Schwab, focus on low-cost index funds, while others, like T. Rowe Price, provide actively managed investment options.

How does payroll integration work with 401(k) providers?

Payroll integration allows employee contributions to be automatically deducted and deposited into their retirement accounts. Many providers integrate with payroll services such as ADP, Paychex, Gusto, QuickBooks, and Rippling to streamline contributions and reduce manual errors.