Choosing between Betterment and Guideline is a crucial decision for small businesses looking to offer 401k retirement benefits to employees. A well-structured plan not only helps employees achieve long-term financial security but also strengthens a business’s ability to attract and retain talent.

Both providers are known for their highly automated, low-cost retirement solutions with user-friendly platforms and payroll integration. However, they differ in key areas, such as pricing, investment options, and employee support. Understanding these differences will help businesses select the right provider based on their financial goals and administrative needs.

The Betterment vs Guideline comparison will outline the major differences between them to help businesses determine which best meets their financial goals, administrative needs, and those of their employees in general.

Betterment vs Guideline: Quick Comparison Table

| Aspect | Betterment 401k | Guideline 401k |

|---|---|---|

| Pricing Model | Asset-based fee: 0.25% – 0.50% of assets | Flat-fee: $39/month + $4 per participant |

| Investment Strategy | Automated portfolios with tax-efficient ETFs | Low-cost Vanguard index funds |

| Payroll Integration | Compatible with major payroll providers | Seamless integration with Gusto, QuickBooks, ADP, Paychex |

| Compliance & Administration | Automated compliance, fiduciary support, and ERISA compliance | Built-in compliance management with IRS & ERISA support |

| Best For | Businesses seeking automated investment management and financial advice | Startups and small businesses looking for a cost-effective, hands-off 401k plan |

Betterment

Betterment

- Setup Fee: $500

- Security Compliance: SOC 2, ISO 27001

- Best For: Robo-advisor 401k provider

Overview of Betterment 401k

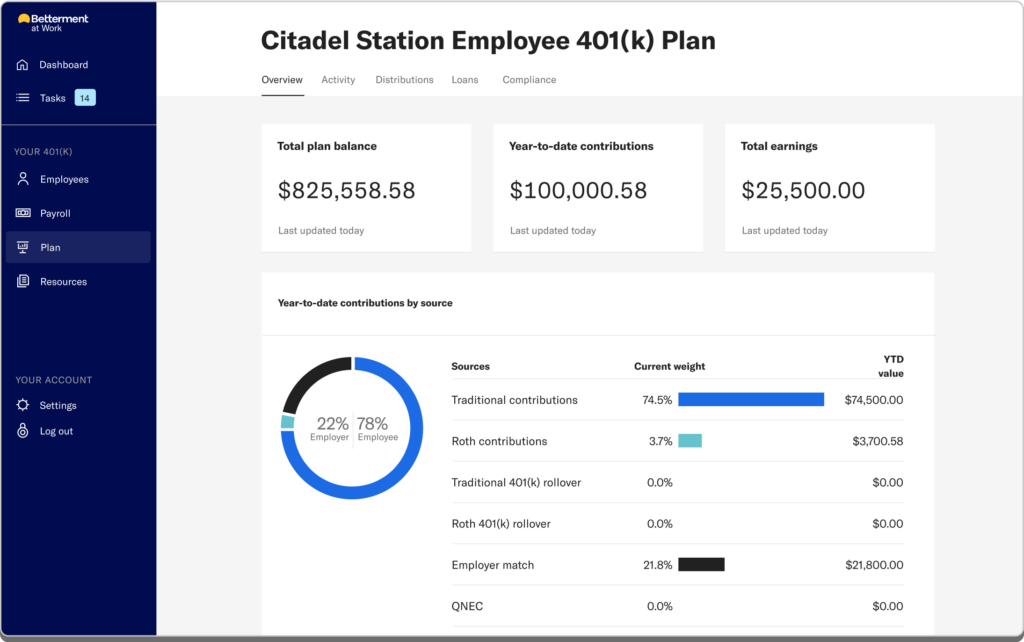

Betterment 401k is an intelligent retirement solution that provides investment management for businesses and employees with the objective of making it simple by employing technology. They provide a robo-advisor model for setting portfolio rebalancing, tax-efficient allocations, and fiduciary investment advising.

Unlike traditional 401k providers, Betterment focuses on personalized investment strategies, ensuring employees receive customized recommendations based on their risk tolerance and retirement goals.

How Betterment Works

Betterment uses automation to manage investments, rebalance portfolios, and optimize tax efficiency. The onboarding process for employees is simple and provides a hands-off investing experience.

Easy administration, payroll integration, and built-in fiduciary support reduce the complexities tied to plan management for employers.

Key Features

Automated Portfolio Management and Financial Advising

Betterment uses algorithms to ensure that asset allocation is kept on track with long-term financial goals. It is a financial planning platform assisting employees with personal advice and suggestions of investment modes in exchange for guaranteed savings options.

Low-Cost Index Funds and Tax-Efficient Investing

The platform offers a range of diversified, low-cost ETFs. It also includes automated tax-loss harvesting and rebalancing, which help employees reduce tax liabilities and optimize returns.

Seamless Payroll Integration with Major Providers

Betterment integrates with leading payroll systems, streamlining contributions and deductions. This automation ensures accuracy and minimizes administrative work for employers.

Pricing Structure

Betterment follows an asset-based pricing model. While exact fees vary, businesses typically pay:

- Base fee: Custom pricing depending on company size and needs

- Employee fee: Ranges from 0.25% to 0.50% of managed assets

- Additional charges: May include financial advisory fees for extra guidance

Best For

Betterment 401k is well-suited for:

- Businesses that prefer an automated, hands-off investment strategy

- Companies looking to offer personalized financial advising to employees

- Organizations that want a tax-efficient investment approach with automated portfolio adjustments

Betterment provides a modern, AI-driven retirement solution for businesses seeking an efficient and cost-effective way to help employees grow their savings.

Guideline 401k

Guideline

- Starting Fee: $39

- Security Compliance: IRS Certified, SOC 2

- Best For: Startups and small businesses

Overview of Guideline 401k

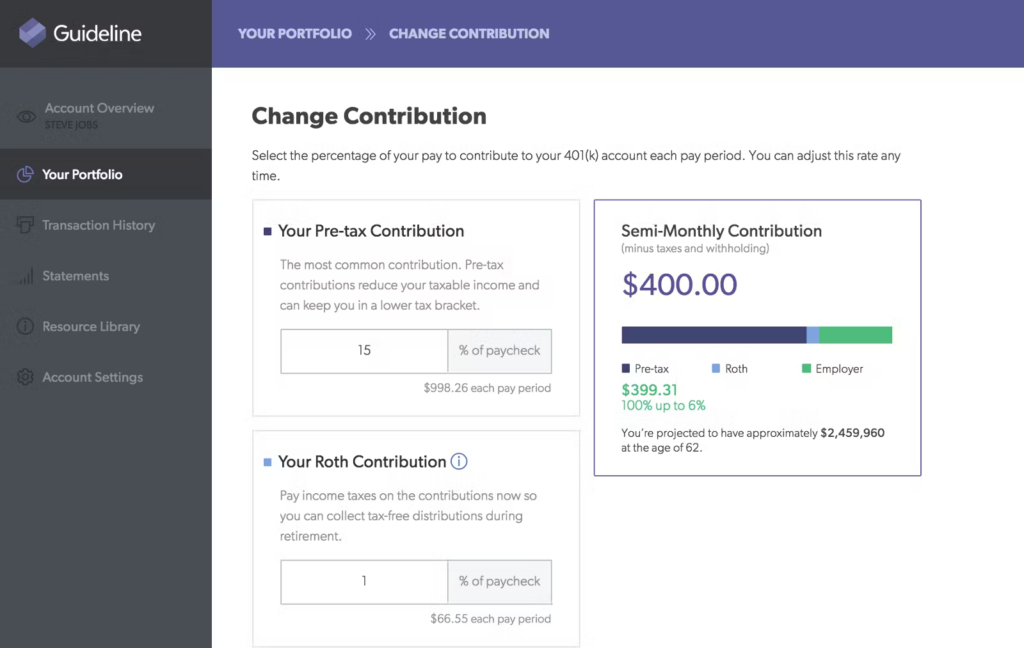

Guideline 401k is a fully automated retirement solution designed to simplify plan administration for small businesses. It eliminates the need for third-party intermediaries, offering a cost-effective, flat-fee pricing model with seamless payroll integration.

With an emphasis on automation and compliance, Guideline reduces the administrative burden for employers while providing employees with easy access to low-cost investment options.

How Guideline Works

Guideline automates all facets of 401k management, from payroll deductions to compliance reporting. The platform interfaces directly with payroll service providers to make sure the right amount and contributions are made at the right time.

Differing from traditional 401k Providers, Guideline does not impose transaction fees and is economically viable for any small businesses. Focused mostly on low-cost Vanguard index funds, employees are given a diversified, passive choice.

Key Features

Integrated Payroll and Automatic Compliance Management

Guideline seamlessly connects with leading payroll platforms, automating deductions and tax filings. Employers do not need to manage contributions manually, reducing errors and administrative effort.

Low-Cost Vanguard Index Fund Options

The platform offers a range of low-fee Vanguard index funds, allowing employees to invest in diversified portfolios without high asset management costs.

Transparent, Flat-Fee Pricing with No Transaction Fees

Guideline follows a predictable pricing structure, eliminating per-transaction fees or hidden costs. This makes it an attractive option for businesses looking for affordability and transparency.

Pricing Structure

Guideline uses a straightforward pricing model:

- Monthly base fee: Starts at $39 per month

- Per-participant fee: $4 per active employee

- Employee asset-based fee: 0.15% to 0.35% annually, depending on plan tier

Unlike traditional providers, Guideline does not charge for plan transactions, rollovers, or distributions.

Best For

Guideline 401k is an ideal choice for:

- Small businesses seeking an affordable, automated retirement solution

- Companies that prioritize payroll integration to minimize administrative tasks

- Employers looking for a transparent, low-cost plan with no hidden fees

Guideline is a streamlined, budget-friendly 401k provider that simplifies retirement savings for both businesses and employees.

Betterment Vs Guideline 401K – Comparing Investment Options, Fees, and Features

Investment Options

Betterment Vs Guideline both provide investment opportunities through their respective 401k plans, but their approaches to portfolio management are quite different. Understanding these will facilitate businesses’ search for the right investment provider for their employees.

Betterment

Betterment is a robo-advisor that invests customers’ 401k funds into a personalized portfolio according to their risk tolerance and financial goals. It emphasizes low-cost exchange-traded funds (ETFs) diversified with asset allocation, employing automated rebalancing and tax-efficient strategies to leverage time.

Keeping a hands-off investor in mind by making all necessary portfolio adjustments automated and driven by data, without any burden on the investor.

Guideline

The platform allows for investment in Vanguard index funds to various extents. At the same time, it is rightfully passive in nature, keeping fees low and allowing employees to choose from a plethora of extremely diversified funds.

It is best for businesses that want quick, reasonably priced, easy-to-understand investment options who and need little personal touches or dynamic management of their funds.

Which Provider Offers More Diversification Opportunities?

Betterment suits employees who prefer an individual, data-driven investment strategy with adjustors that execute changes automatically in the portfolio, while Guideline suits low-cost, passive-balanced investment alternatives when using proven Vanguard index funds.

Fees and Expense Ratios

Another major factor influencing the overall growth of long-term portfolios is that of 401k provider costs. While they seem slight, differences in fees could have significant differences in retirement savings over time. Betterment provides economic investment options like Guideline; however, their respective fees can differ.

Betterment

Betterment uses an asset-based pricing model, where the asset-based pricing model charges the individual some percentage of their managed assets. By such a charging mechanism, Betterment may earn more than flat-fee coaches but, in exchange, it ups the beauty by providing free automated management of the financial assets of the client.

Employee fee may range from 0.25-0.50 percent of assets. Advisory fees may pertain to individual financial planning.

Guideline

Guideline operates under a flat-fee pricing model. Thus, it is one of the cheapest 401k providers in the market, catering to small companies. Monthly subscriptions and per-participant fees keep employers’ costs predictable.

The monthly subscription starts at $39, adding a per-participant fee of $4 for every employee. Employee asset-based fees are charged between 0.15 and 0.35 percent annually.

Which Provider is More Cost-Effective?

Guideline’s flat-fee pricing strategy makes it a great alternative for cost-sensitive businesses. The percentage-linked fee structure favours financial advisory and active management of portfolios over low-cost pricing in Betterment.

Employer-Sponsored 401k Plans

Betterment Vs Guideline both provide employer-sponsored 401k plans, but their offerings cater to different business sizes and administrative needs.

Betterment

Betterment is designed for businesses seeking a full-service investment solution with personalized employee retirement planning. It integrates automated rebalancing, goal-based investing, and financial advising to create a customized experience for employees.

However, it may not be the best choice for businesses that prioritize low costs over financial guidance.

Guideline

Guideline is a budget-friendly, automated solution that integrates directly with payroll providers, making it ideal for small businesses that want a hands-off 401k plan. It lacks personalized financial advising but offers low-cost, streamlined plan administration.

Which Provider is Better for Employers?

Betterment is better suited for companies that want a comprehensive investment management solution for employees.

Guideline is ideal for small businesses looking for an easy-to-manage, cost-efficient 401k plan with automated compliance and payroll integration.

Mobile App and Online Experience

A user-friendly digital experience is essential for managing retirement savings. Betterment vs Guideline both offer intuitive online platforms, but they cater to different types of users.

Betterment

Betterment’s mobile app and web platform are designed for data-driven, hands-on investing. Employees can access goal-based financial planning, investment performance tracking, and automated portfolio rebalancing in real-time.

Its platform is ideal for employees who want interactive financial tools and hands-on control over their investment strategy.

Guideline

Guideline provides a simpler digital experience, focusing on automation and ease of use. The platform allows employees to set contributions, track savings, and adjust investment preferences without requiring extensive financial knowledge.

Its design is best suited for passive investors who want a set-it-and-forget-it approach to retirement savings.

Which Platform Offers a Better Digital Experience?

Betterment’s platform is more interactive and feature-rich, making it the better choice for employees who want personalized investment insights. Guideline’s platform is ideal for employees who prefer a simple, automated retirement savings experience.

Pros and Cons – Betterment vs Guideline

Betterment vs Guideline 401k providers help businesses determine which solution aligns best with their financial and administrative needs.

Pros and Cons – Betterment

| Pros | Cons |

|---|---|

| Personalized investment strategies | Higher asset-based fees than flat-fee models |

| Automated tax-efficient investing | Limited payroll provider compatibility |

| Built-in financial advisory support | No flat-fee pricing option |

| Diversified ETF portfolios with rebalancing | Plan customization is limited |

| Seamless payroll integration with select providers |

Pros and Cons – Guideline

| Pros | Cons |

|---|---|

| Flat, transparent pricing | Limited investment customization |

| Seamless payroll integration | No personalized financial advisory services |

| Automated compliance and tax filings | No Roth 401k option in basic plans |

| No transaction or rollover fees | Employee investment options are limited to Vanguard funds |

| User-friendly platform with simple setup |

Betterment vs Guideline – Which One is Right for Your Business?

Betterment vs Guideline to choose between both depends on your business’s budget, administrative preferences, and employee investment needs. Both providers offer automated 401k solutions but cater to different priorities.

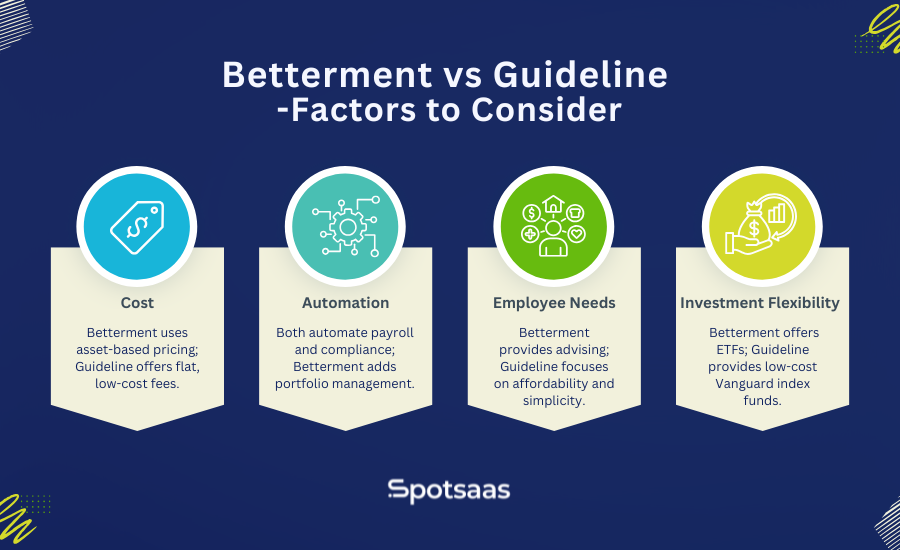

Factors to Consider

- Cost – Betterment follows an asset-based pricing model, which can become expensive as assets grow, while Guideline offers a flat-fee structure with lower costs for small businesses. Companies with fewer employees may find Guideline more budget-friendly, whereas larger businesses may need to weigh long-term costs.

- Automation – Both providers automate payroll integration and compliance, reducing administrative workload for employers, but Betterment includes automated portfolio management for employees. This feature helps employees maintain optimized investment allocations without manual adjustments, making it beneficial for hands-off investors.

- Employee Needs – Businesses that want personalized financial advising for employees may prefer Betterment, as it provides human advisors along with automated tools. In contrast, Guideline is better for companies that prioritize cost efficiency and simplicity, offering a no-frills approach that keeps expenses low while ensuring compliance.

- Investment Flexibility – Betterment offers diversified ETF portfolios with tax-efficient investing, making it ideal for businesses that want hands-off portfolio optimization. Guideline provides low-cost Vanguard index funds with limited customization, making it a strong choice for cost-conscious employers who want straightforward investment options.

Ideal Choice Based on Business Priorities

- Betterment is best for businesses seeking an automated investment strategy with financial guidance for employees. It suits companies willing to pay higher fees for personalized investment advice.

- Guideline is best for small businesses looking for a low-cost, fully automated 401k plan with transparent pricing and easy payroll integration. It is ideal for companies that want a simple, hands-off retirement solution.

Understanding your company’s retirement plan goals, employee expectations, and administrative capacity will help determine the best provider for your needs.

Betterment vs Guideline – Final Thought

Selecting the right 401k provider depends on your business’s financial priorities, administrative capacity, and employee investment needs. Betterment is well-suited for companies that value personalized financial advice and automated portfolio management, while Guideline offers a cost-effective, fully automated solution with seamless payroll integration.

Both providers simplify 401k administration, but the best choice depends on whether you prioritize investment flexibility and advisory support or affordability and automation. Evaluating pricing, features, and long-term benefits will help you make an informed decision that supports both your business and employees’ financial well-being.

Conclusion

In conclusion, both Betterment and Guideline offer robust 401k solutions tailored to small and medium-sized businesses, each with distinct advantages. Guideline stands out for its cost-effectiveness, featuring lower monthly base fees starting at $39 plus $4 per participant and minimal employee fees around 0.08% of assets.

This makes it particularly appealing for companies seeking an affordable, straightforward retirement plan with seamless payroll integrations and comprehensive fiduciary support. On the other hand, Betterment provides a more personalized experience with dedicated onboarding specialists and flexible plan designs, albeit at a higher starting cost of $100 per month plus $5 per participant, along with a 0.25% annual advisory fee.

This option may be preferable for businesses desiring enhanced employee engagement tools and a broader range of investment options. Ultimately, the optimal choice depends on your company’s specific needs, budget constraints, and the level of service desired.

Carefully evaluating these factors will guide you toward a 401k provider that aligns with your business objectives and supports your employees’ retirement goals.

Frequently Asked Questions

What is the main difference between Betterment and Guideline 401k?

Betterment offers a robo-advisor approach with automated portfolio management and personalized investment strategies, while Guideline focuses on low-cost Vanguard index funds with a flat-fee pricing model.

Which provider is more cost-effective for small businesses?

Guideline is generally more affordable due to its flat-fee pricing model, starting at $39 per month plus $4 per participant. Betterment charges an asset-based fee ranging from 0.25 to 0.50 percent, making it a better choice for businesses that prioritize financial advising over lower costs.

Does Betterment or Guideline offer more investment options?

Betterment provides diversified ETF portfolios with automated rebalancing, while Guideline offers a selection of low-cost Vanguard index funds.

Which provider is better for payroll integration?

Guideline integrates seamlessly with major payroll providers like Gusto, QuickBooks, ADP, and Paychex, making it easier for businesses to automate 401k contributions. Betterment also supports payroll integration, but its compatibility may be more limited depending on the provider.

How do I decide which 401k provider is right for my business?

Choosing between Betterment and Guideline depends on factors like budget, investment strategy, and administrative needs. Betterment is ideal for businesses seeking a hands-off, goal-based investment approach with financial advising, while Guideline is better suited for those looking for a simple, cost-efficient 401k solution with automated compliance and payroll integration.