In today’s digital world, anyone can become a victim of identity theft. Good news – Identity Guard has been a trusted name in protecting folks for over two decades.

This blog will dive deep into how choosing Identity Guard can shield you and your family from the nightmares of identity fraud. Keep reading to secure your peace of mind!

Key Takeaways

- Identity Guard has over 25 years of experience and a Trustpilot rating of 4.4 stars, offering comprehensive identity theft protection plans with a variety of features including social media monitoring, dark web surveillance, three-bureau credit monitoring, and up to $1 million in insurance for covered losses.

- Plans include options for individuals and families with prices ranging from $7.50 to $33.33 per month; the Ultra plan provides extensive coverage such as home title and 401k monitoring while all plans come with a 60-day money-back guarantee for annual subscriptions.

- The company uses advanced technology like IBM’s Watson AI to monitor threats constantly and offers customer support through U.S.-based agents available around the clock; additionally, their mobile app facilitates on-the-go access to security alerts and personal finance information.

- Identity Guard competes closely with services like LifeLock and Aura by offering unique features such as safe browsing tools, risk management reports, fast fraud alerts during tax season, plus tips on improving online presence using AI analysis.

- When considering an identity theft protection service it’s important to evaluate factors such as plan features that meet individual or family needs, the overall cost-to-value ratio of each plan offered by providers like Identity Guard compared against competitors in the market.

Overview of Identity Guard: Identity Theft Protection Service

Identity Guard has been a leading provider of identity theft protection for over 25 years, with a strong reputation and positive customer reviews. Its key features include credit monitoring, financial monitoring, user experience, and security measures to ensure comprehensive protection against identity theft and financial fraud.

History and Reputation

Identity Guard has earned its place as a veteran defender against identity theft, with over 25 years of experience in the industry. With dedication to safeguarding consumers’ private information and finances, the company has evolved alongside technological advances and cyber threats.

Trustpilot users have voiced their approval, awarding Identity Guard a robust 4.4-star rating thanks to its reliable ID protection services.

Recognition from esteemed publications further solidifies Identity Guard’s standing; U.S. News & World Report ranks it third among identity theft protection services for good reason.

Customers can confidently rely on this service to shield their personal data from dark web dangers and credit fraud incidents. Let’s delve into the Key Features and Benefits that establish Identity Guard as a trusted name in identity theft insurance.

Key Features and Benefits

With Identity Guard, rest easy knowing your personal information gets top-notch protection powered by IBM’s Watson artificial intelligence. This advanced tech keeps a vigilant watch for signs of identity theft, including monitoring the dark web where stolen data can be hidden.

If your identity is stolen, you don’t have to battle alone; get up to $1 million in reimbursements for covered losses and expenses. Plus, with the Ultra plan, enjoy comprehensive three-bureau credit monitoring and proactive credit lock options that put you in control.

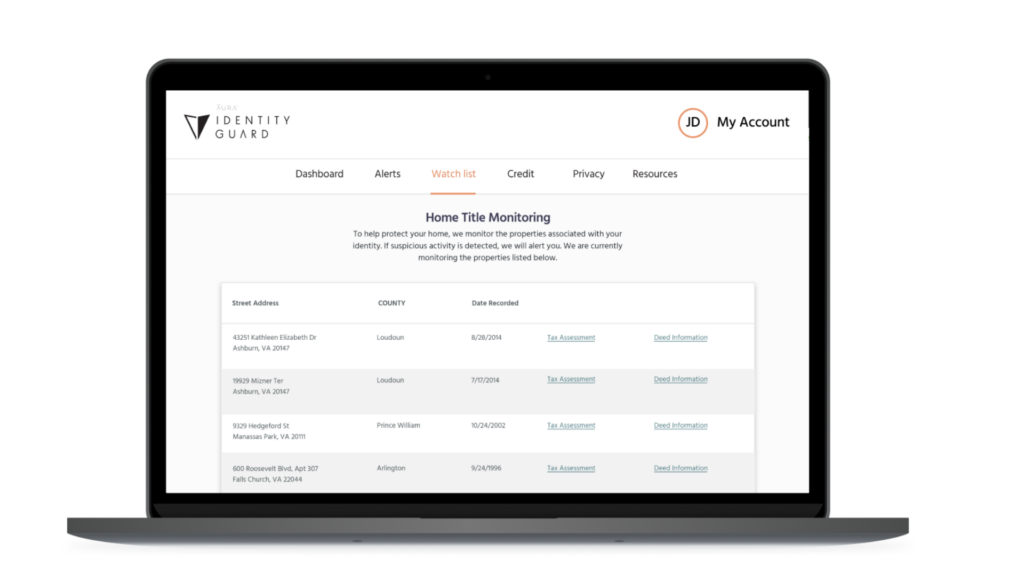

Embrace peace of mind with services designed for both individuals and families. Benefit from features like home title monitoring and 401k protection that safeguard more than just your Social Security number or bank account—your entire asset base is defended against fraudulent threats.

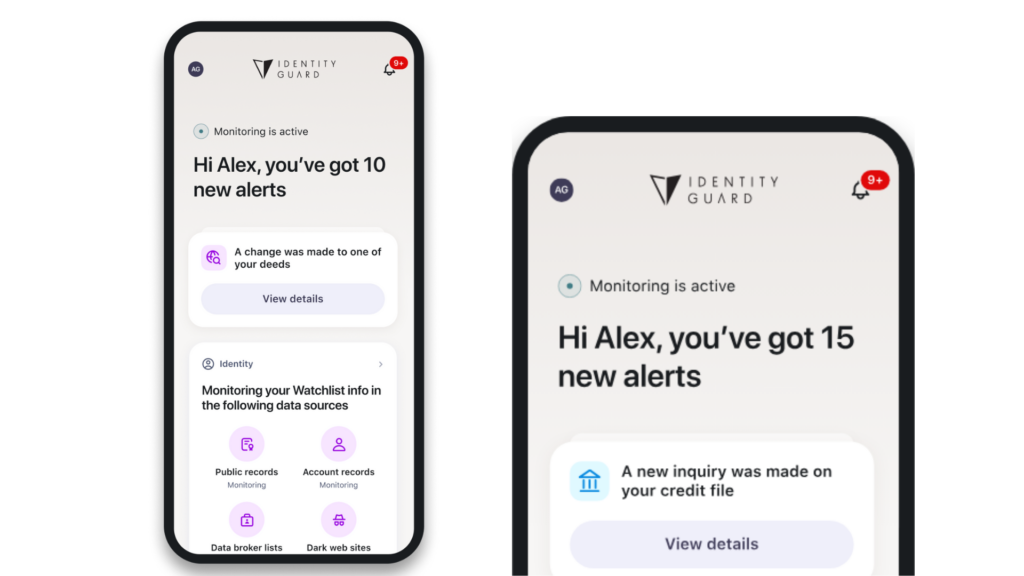

The Identity Guard mobile app puts the power of security right at your fingertips on iOS or Android devices, making it simpler to stay informed about your financial health whether you’re at home or on-the-go.

And if uncertainty strikes, count on U.S.-based fraud agents ready to guide you every step of the way towards resolution—all backed by a reassuring 60-day money-back guarantee for annual plan subscribers.

Identity Guard Review

Identity Guard offers a comprehensive review of its credit monitoring capabilities, financial monitoring services, user experience, and security measures. This in-depth analysis will provide you with valuable insights into the effectiveness of their identity protection strategies.

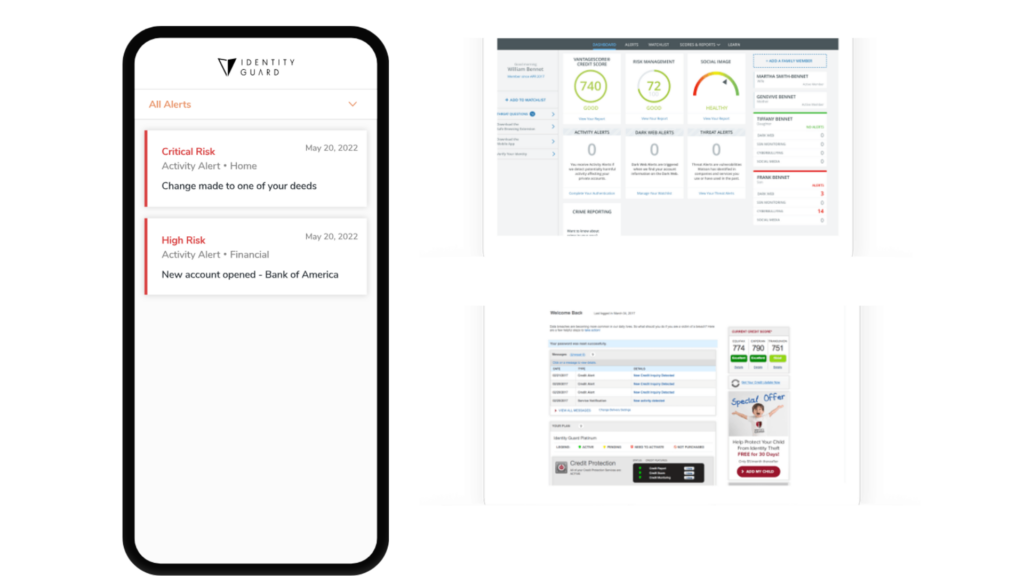

Credit Monitoring Capabilities

Credit monitoring capabilities form a critical shield in protecting your financial health against identity thieves. With Identity Guard, you get continuous surveillance of credit reports from major credit bureaus such as Equifax and Experian.

These services alert you to new inquiries, potential frauds, and changes that could signal unauthorized activity on your accounts. Stay ahead of the game with real-time notifications so you can act swiftly if something seems off.

Strengthening your defense even more is the risk management report feature included in Identity Guard’s suite of tools. This helps track and manage your credit score effectively by providing detailed insights into factors affecting it.

And should the worst happen, rest easy knowing that up to $1 million in reimbursements for identity theft is there to back you up. Safeguarding personal finance just got more reliable with constant monitoring and robust response strategies ready at hand.

Financial Monitoring Services

After delving into the comprehensive credit monitoring capabilities of Identity Guard, it’s essential to explore its robust financial monitoring services. When it comes to safeguarding your financial information, Identity Guard offers high-quality protection with features such as bank account monitoring and high-risk transaction alerts.

By actively tracking your financial data, this service can alert you to potential threats like unauthorized transactions or unusual spending patterns before they escalate into larger issues.

Furthermore, Identity Guard provides additional layers of security by offering dark web monitoring and social media monitoring as part of its financial info protection suite. This proactive approach helps users stay ahead of potential identity theft scenarios involving leaked financial details on the dark web or through phishing attacks disguised within social media platforms.

User Experience and Security Measures

To ensure a seamless user experience, Identity Guard employs state-of-the-art security measures. Users can navigate the platform effortlessly, thanks to an intuitive interface and robust protective features.

With user-friendly dashboards and real-time alerts, individuals can stay proactive in safeguarding their identities and financial information. The service’s military-grade encryption ensures that all data collected from users remains secure and protected at all times.

Moreover, Identity Guard leverages advanced technology such as IBM Watson to monitor billions of data points continuously for early detection of identity theft. By utilizing SMS, app alerts, and email communication, the company provides timely advice on data protection while keeping users informed about any potential risks or breaches.

Identity Protection Strategies

After ensuring top-notch user experience and robust security measures, focusing on effective identity protection strategies is crucial. Identity Guard offers a range of proactive approaches to safeguard personal information from potential threats.

These strategies include continuous credit monitoring to detect any suspicious activity, financial monitoring services to track high-risk transactions or unfamiliar accounts, and personal information monitoring to ensure that sensitive data remains secure.

Identity Guard’s identity protection strategies also encompass fraud alerts and notifications in the event of potential breaches or unusual activities. Additionally, the service provides legal assistance and reimbursement for stolen identities, offering peace of mind and financial security in an increasingly digitized world.

Check more Rapid Identity Automation: Streamlining Identity and Access Management

Comparing Identity Guard ID Theft Protection Plans

Compare Identity Guard’s individual and family plans to find the best option that suits your needs. To learn more about the pricing and value of each plan, read on for a detailed comparison.

Individual and Family Plans

Identity Guard provides flexible identity theft protection plans to cater to the needs of both individuals and families. With monthly prices ranging from $7.50 to $33.33, there are three tiers of coverage: Value, Total, and Ultra for both individual and family plans.

Taking advantage of Identity Guard’s holiday promotion can lead to significant savings, with prices as low as $6.67 per month for individual plans and up to 50% off on the Ultra package.

The annual plans not only offer convenience but also result in considerable savings – up to $59.88 for individuals and a substantial $79.92 for families. Whether you’re seeking basic protection or comprehensive coverage, Identity Guard’s individual and family plans offer tailored solutions at competitive rates in the realm of identity theft protection services.

Pricing and Value

Identity Guard offers a range of protection plans, with prices varying from $7.50 to $33.33 per month. The Ultra plan provides the most comprehensive coverage, including home title monitoring and 401k protection, making it ideal for individuals seeking extensive security measures at a competitive price point.

Additionally, Identity Guard’s reimbursement for identity theft can reach up to $1 million, ensuring heightened peace of mind for consumers concerned about potential financial losses due to stolen identities or fraudulent activities.

The cheapest plan may not meet user expectations as it does not include credit monitoring; however, it still serves as an entry-level option for those seeking basic protection against identity theft and related risks.

When considering the value offered by these plans alongside their respective costs, Identity Guard demonstrates a commitment to providing flexible solutions that cater to diverse needs while prioritizing consumer security in an ever-evolving digital landscape.

Customer Support and Service

Identity Guard provides 24/7 US-based fraud agents to offer comprehensive customer support. With a Trustpilot rating of 4.4 stars, the company is dedicated to ensuring top-quality service and assistance for its customers.

Having protected consumers from identity theft and financial fraud for over two decades, Identity Guard’s reliable team offers fraud monitoring and alerts as part of its commitment to safeguarding customers against potential threats.

Identity Guard’s customers can feel secure knowing that they have access to round-the-clock assistance with any concerns or issues regarding their protection plan.

The company’s individual and family plans cater to different customer needs, providing flexibility and choice in selecting the most suitable identity theft protection package. Additionally, the Ultra plan offers extensive coverage, including home title monitoring and 401k protection, enhancing the overall security offered by Identity Guard’s services.

Moving on from this detailed overview of customer support and service provided by Identity Guard, let’s explore another critical aspect—the Identity Guard Mobile App.

Identity Guard Mobile App

The Identity Guard Mobile App offers credit score monitoring, risk management reports, identity theft insurance, and safe browsing tools. Users gain social insight reports and recommendations for improving their online image using IBM Watson’s artificial intelligence.

Furthermore, the app effectively communicates with users through SMS, app alerts, and email to offer valuable advice on protecting personal data. It is used for receiving user alerts, accessing credit information, and checking for incidents of identity theft—all in an efficient manner.

Comparison with Competitors

When comparing Identity Guard with competitors like LifeLock and Aura, it’s important to consider the unique features, pricing, and customer satisfaction ratings of each service. By analyzing these factors, you can make an informed decision about which identity theft protection service best suits your needs.

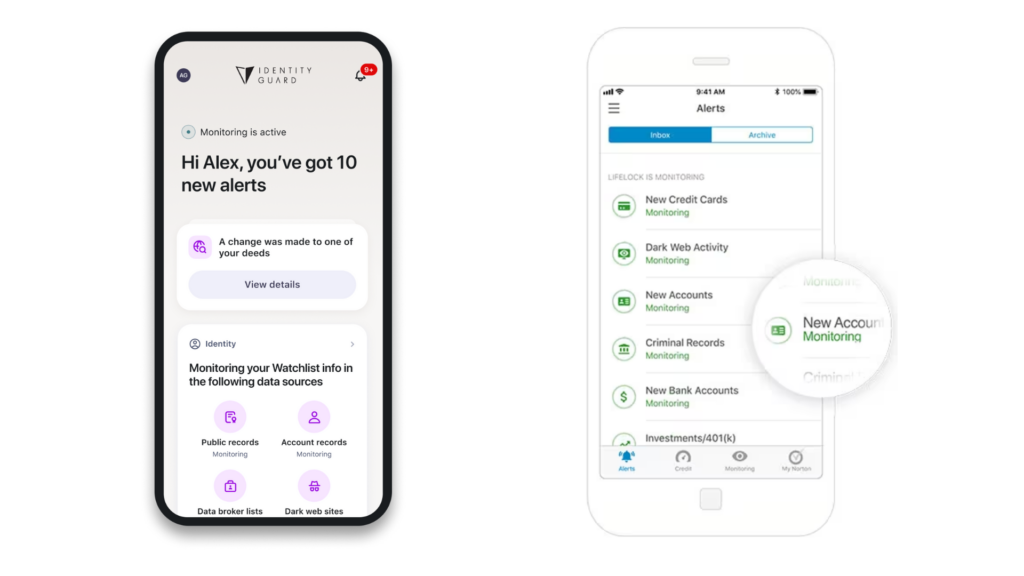

Identity Guard vs. LifeLock

Identity Guard and LifeLock are two major players in the identity theft protection industry, each offering comprehensive plans for individual and family protection. While Identity Guard uses IBM’s Watson artificial intelligence for identity monitoring, it has over 38 million customers and reimburses up to $1 million for identity theft.

On the other hand, LifeLock may have its own technology for identity protection with a similar or larger customer base.

Moreover, Identity Guard’s Ultra plan includes home title monitoring and 401k protection along with fast alerts for identity, credit, and tax refund compromise. Similarly, LifeLock offers premium plans with comparable features including insurance coverage of up to $1 million for identity theft.

Identity Guard vs. Aura

When comparing Identity Guard and Aura, it’s essential to consider a few key differences between the two services. Identity Guard offers a comprehensive approach to identity protection, including three major credit bureaus monitoring, credit lock, $1 million in insurance, and White Glove restoration in its Ultra plan.

On the other hand, Aura’s online security features include a VPN and Smart Vault for enhanced digital protection but lacks social media monitoring which is offered by Identity Guard.

Additionally, while Identity Guard offers a 60-day money-back guarantee for annual plan subscriptions, Aura’s individual plan costs significantly less at $12 per month.

Considering these distinctions can help consumers make an informed decision based on their specific needs and budget when selecting an identity theft protection service.

Conclusion

Choosing the best identity theft protection service is crucial for safeguarding your personal information. Identity Guard stands out with its extensive experience, comprehensive plans, and advanced technology.

Its positive Trustpilot rating and 30-day money-back guarantee offer peace of mind. With a variety of affordable plans to meet individual and family needs, along with fast alerts during tax season, choosing Identity Guard could be the proactive step you need to secure your financial future.

Identity Guard offers various plans suitable for different budgets and is powered by IBM’s Watson. The top-tier plan, however, is considered expensive but provides comprehensive protection.

The Ultra Individual plan costs $29.99 per month or $23.99 per month billed annually, whereas the Ultra Family plan costs $39.99 per month or $33.33 per month billed annually.

Additionally, Identity Guard offers social insight reports analyzing the user’s online image with AI from IBM Watson to suggest improvements. Communication with users is constant through SMS, app alerts, and email to provide advice and reminders on protecting personal data.

Frequently Asked Questions

What features should I look for in an identity theft protection service?

Look for comprehensive credit protection services that include high-risk transaction monitoring, data breach notifications, and U.S-based fraud agents to assist you.

How important is a VPN for identity theft protection?

A VPN (Virtual Private Network) is crucial as it secures your internet connection against trackers and helps protect personal information from data breaches while online.

Can identity theft services help if my credit card or debit card details are stolen?

Yes, these services monitor your financial accounts for suspicious activities and provide support like fraud resolution and legal fee coverage if your identity was stolen.

What does a good identity theft protection privacy policy offer?

A strong privacy policy ensures your sensitive information is protected; services like Norton 360 prioritize data security and customer service to keep your data private.

Why should I consider the ratings of an identity theft service on Google Play or Trustpilot?

Ratings on platforms such as Google Play Store or Trustpilot reflect customer experiences with Android apps’ effectiveness in protecting against viruses, malware, and anti-phishing measures.

Are there any additional benefits to signing up for annual plans with ID Watchdog or similar companies?

Annual plan costs often come at discounted rates providing long-term savings while delivering continuous credit-reporting updates and dedicated assistance from experienced fraud agents.

Author

-

Rajat, a CFA and seasoned SpotSaaS writer, thrives at the intersection of technology and finance. Drawing from his expertise in marketing and product management, he helps users navigate the complex software landscape to find solutions that align with their business goals. By blending his deep understanding of financial decision-making with a passion for emerging technologies, Rajat crafts insightful content that empowers businesses to choose software that drives growth, efficiency, and innovation. His work bridges the gap between technical possibilities and practical business needs, making software selection a strategic advantage for his audience.

View all posts