Managing insurance licenses and renewals can be a complex maze to navigate for many professionals in the industry. Sircon offers an integrated platform designed to streamline this often cumbersome process.

This article will reveal how Sircon simplifies license management, ensuring timely compliance and peace of mind for users. Dive into the benefits of automation and stay ahead in your career with ease!

Key Takeaways

- Sircon offers a centralized hub for insurance professionals to apply and renew licenses quickly, ensuring compliance with state requirements.

- The system guides users through checking continuing education credits and paying outstanding fines, making license renewal a hassle-free process.

- Educational resources are available on Sircon to aid new applicants in understanding insurance principles and preparing for exams.

- With real–time application tracking and direct scheduling of required exams via the platform, agents can efficiently manage their licensing status.

- The platform connects all compliance stakeholders, allowing seamless management of credentials while reducing compliance risks and saving money.

Understanding Sircon Platform

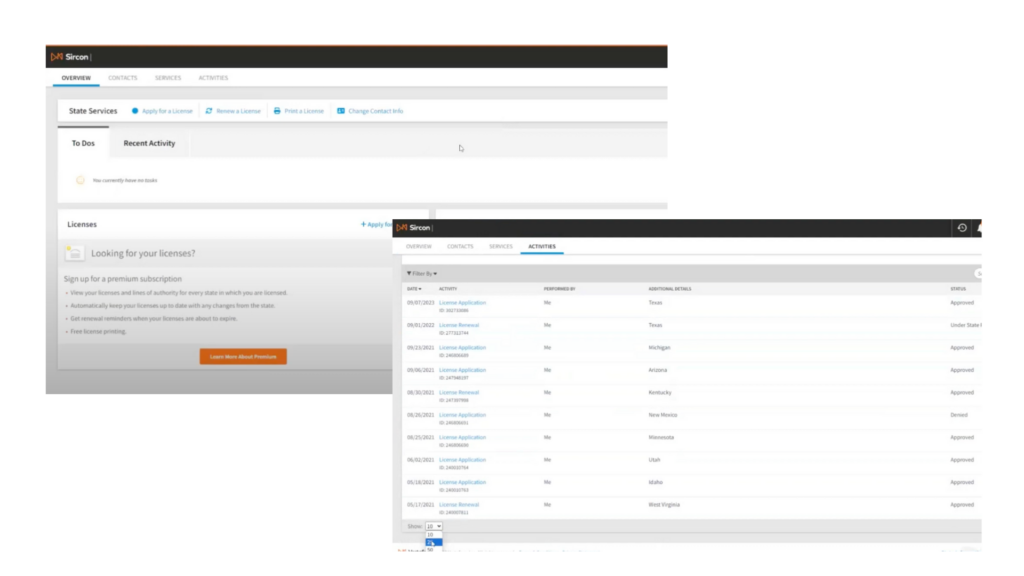

Sircon stands out as the go-to digital hub for professionals in the insurance sector, delivering robust tools for credentialing and compliance management. As a comprehensive resource, it streamlines regulatory transaction processing and simplifies license renewal procedures.

With its intuitive interface, users efficiently navigate their compliance dashboard to track and maintain up-to-date producer credentials.

Carriers benefit immensely from Sircon’s ability to automate onboarding processes, ensuring that agents adhere to stringent regulatory requirements. The platform empowers education providers by allowing them to swiftly submit critical information like course completions directly to state insurance carriers.

This integration of services not only facilitates quicker transactions but also significantly lowers the risk of non-compliance while expediting agent authorization—a crucial step toward revenue growth in this competitive industry.

Managing Insurance Licenses with Sircon Solutions

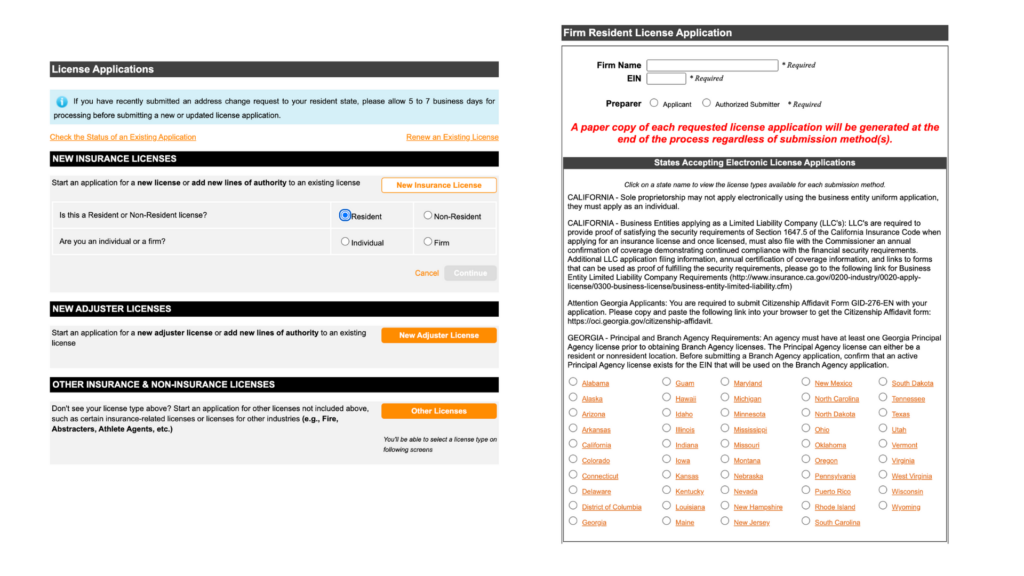

Applying for a License: Sircon simplifies the process of applying for an insurance license by providing a centralized platform for submitting applications and supporting documentation.

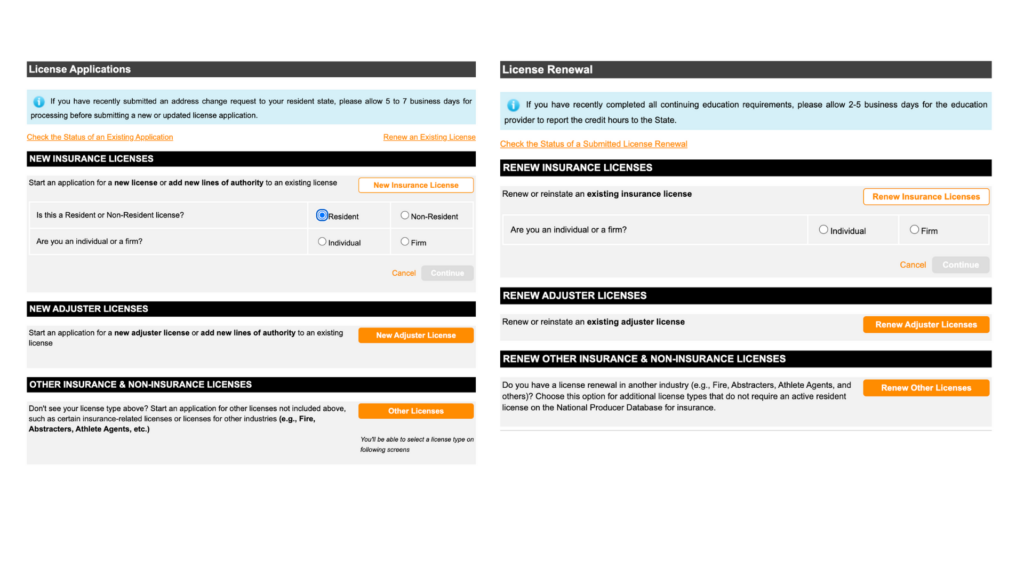

Renewing an Existing License: Through the platform, insurance professionals can easily manage their license renewals by accessing state-specific renewal requirements and completing the necessary steps to stay compliant.

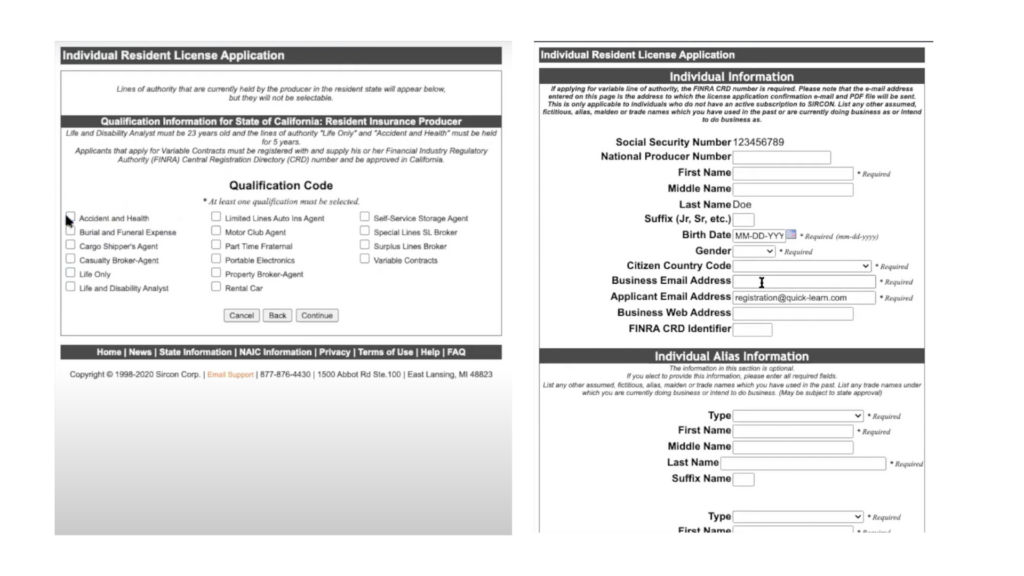

Applying for a License

Getting licensed as an insurance agent has been streamlined through this platform. It simplifies the process, from certification application, completely online.

- Begin by creating or logging into your existing Sircon account; this is your gateway to accessing all services.

- Select ‘Apply for a License’ within the platform to start your resident or non-resident licensing journey.

- Gather necessary personal information and documents before initiating the process to ensure a smooth application flow.

- Navigate through the user–friendly interface to fill out your online application form accurately and efficiently.

- Schedule any required exams directly through the platform, finding dates and locations that work best for you.

- Submit your completed application along with any evidence of qualifications and applicable fees via Sircon’s secure portal.

- Track your application for a certificate of license status online in real–time, enabling you to anticipate the next steps promptly.

- Make use of educational resources provided by Sircon if you need guidance on insurance principles or exam preparation.

Renewing an Existing License

Renewing an existing license through the Sircon platform streamlines the process for insurance professionals. The system ensures that all compliance requirements are met efficiently.

| Step | Description |

|---|---|

| Log in or sign-up | Access Sircon’s online services by setting up a new account or logging into your existing one. This is the first step towards managing credentials. |

| Check continuing education credits | Verify that you have completed the required continuing education for insurance before initiating the renewal process to avoid fines for incomplete CE hours. |

| Pay any outstanding fines | If you haven’t completed your CE hours, ensure to settle any fines you may be subject to before renewing your license. |

| Submit renewal application | Use the platform to fill out and submit your renewal application, making sure you provide accurate and up-to-date information. |

| Calculate and cover renewal fees | The system will help you determine the correct license renewal fees, which you can pay online as part of the application process. |

| Monitor approval status | Keep track of your application status through Sircon; they’ll update you on approval so you can continue offering insurance services without interruption. |

| Reinstating expired licenses | If necessary, Sircon also aids with reinstatement applications in case you need to reactivate a lapsed insurance license. |

Benefits of Using Sircon for License Management

Sircon’s license management solution offers benefits such as reducing compliance risk and accelerating revenue for agents and advisors. The platform facilitates seamless agent and advisor authorization, ensuring efficient credential verification while connecting all compliance stakeholders.

This connectivity leads to better compliance for users while also saving money through streamlined processes.

Moreover, Sircon’s compliance network enables insurance business entities to stay compliant by quickly accessing and managing licenses, ultimately leading to more sales authorizations.

With the platform, insurance professionals can experience improved efficiency in managing licenses, contributing to a smoother regulatory compliance process overall.

Conclusion

Managing insurance licenses and renewals with Sircon offers a streamlined approach to personal compliance and license management. Users gain access to regulatory requirements, track credentials, and benefit from automatic licensing updates.

The platform helps save money, reduce compliance risk, and accelerate time-to-revenue by ensuring everyone knows who is authorized to sell. With Sircon, managing insurance licenses becomes an efficient process that connects all compliance stakeholders for seamless credentialing and compliance solutions.

Frequently Asked Questions

How do I renew my insurance license using Sircon platform?

You can renew your insurance license on the platform by logging in, selecting the option for license renewal, and following the prompts to complete the process.

Can I manage multiple licenses on Sircon platform?

Yes, you can manage multiple licenses on Sircon from various states or lines of authority through a single account.

What documents do I need to submit for an insurance license renewal through the ?

The specific required documents may vary by state and license type. However, common requirements include proof of continuing education credits and any relevant background information.

How long does it take to process an insurance license renewal application via Sircon?

The processing time for a renewed insurance license application through the platform varies depending on the state regulatory agency’s review timeline.

Is there a fee for using Sircon for managing insurance licenses and renewals?

Yes, accessing certain services on the web site may involve fees based on the type of transaction or service requested.