A well-structured ACA (Affordable Care Act) reporting software is essential for businesses to ensure compliance with healthcare regulations, avoid penalties, and streamline the management of employee health benefits.

Selecting the right ACA reporting solution involves evaluating factors such as user-friendliness, integration capabilities, real-time tracking, and support services.

This guide highlights the top ACA reporting software options in 2025, outlining key features and pricing to assist businesses in making informed decisions.

Why Trust Our Reviews for ACA Reporting Software?

At Spotsaas, we provide unbiased, data-driven software recommendations to help businesses navigate ACA compliance efficiently. Our team has reviewed and tested numerous ACA reporting solutions, ensuring our insights are based on thorough research and hands-on usability testing.

By leveraging our in-depth research and expert analysis, businesses can confidently select an ACA reporting solution that meets their compliance needs and regulatory obligations. Whether you need a tool for automated IRS filings, employee eligibility tracking, or comprehensive reporting, Spotsaas simplifies the selection process with reliable and up-to-date recommendations.

Our reviews are independent and unbiased. Some clicks may earn us a commission, helping us continue our testing. Explore our review methodology and tell us if there’s a tool we should cover.

Top 13 Best ACA Reporting Software Shortlist

ACA Compliance Software Comparison

| Software | Best For |

|---|---|

| Paycor | Comprehensive ACA management with proactive notifications |

| ACAwise | Full-service ACA reporting solution |

| Paycom | Automated ACA compliance with real-time dashboards |

| CheckMark 1095 Software | Small to medium-sized businesses seeking an affordable solution |

| Rippling | Automating the entire ACA reporting process |

| Foundation Software | Contractors needing specialized ACA compliance tools |

| Experian Employer Services | Ensuring timely ACA statement delivery |

| ACA GPS | Cloud-based ACA compliance solutions |

| BenefitMall allCompliance | Businesses seeking comprehensive ACA compliance platforms |

| BenefitScape | Proactive ACA compliance management |

| Workforce Go! | Integrated workforce management and ACA compliance |

| OnePoint HCM | Comprehensive human capital management with ACA compliance |

| Alight Worklife | Global payroll and ACA compliance solutions |

ACA Reporting Software Pricing Comparison Chart

Here’s a comparison of thirteen prominent ACA reporting software solutions, highlighting key features and fee structures to assist businesses in making informed decisions:

| Provider Name | Best For | Integration Capabilities |

|---|---|---|

| Paycor | Comprehensive ACA management with proactive notifications | Integrates with ADP, Workday, QuickBooks |

| ACAwise | Full-service ACA reporting solution | Compatible with major HR and payroll software |

| Paycom | Automated ACA compliance with real-time dashboards | Seamless integration with HR and payroll systems |

| CheckMark 1095 Software | Affordable solution for small to medium-sized businesses | Limited integrations, CSV uploads supported |

| Rippling | Automating the entire ACA reporting process | Integrates with HR, payroll, benefits platforms |

| Foundation Software | Specialized ACA compliance tools for contractors | Works with industry-specific payroll tools |

| Experian Employer Services | Ensuring timely ACA statement delivery | Integrates with major payroll and HR software |

| ACA GPS | Cloud-based ACA compliance solutions | Cloud-based API integrations available |

| BenefitMall allCompliance | Comprehensive ACA compliance platforms | Connects with payroll and benefits providers |

| BenefitScape | Proactive ACA compliance management | API and manual data imports supported |

| Workforce Go! | Integrated workforce management and ACA compliance | Integrates with workforce management systems |

| OnePoint HCM | Comprehensive human capital management with ACA compliance | Works with HR, payroll, and compliance software |

| Alight Worklife | Global payroll and ACA compliance solutions | Enterprise-level integrations with HR tools |

Note: The information provided is based on available data and may vary depending on specific plan selections and business requirements. It’s advisable to contact providers directly for the most current and detailed information.

This comparison aims to offer a clear overview of each provider’s offerings, assisting businesses in selecting an ACA reporting software solution that aligns with their compliance objectives and the needs of their employees.

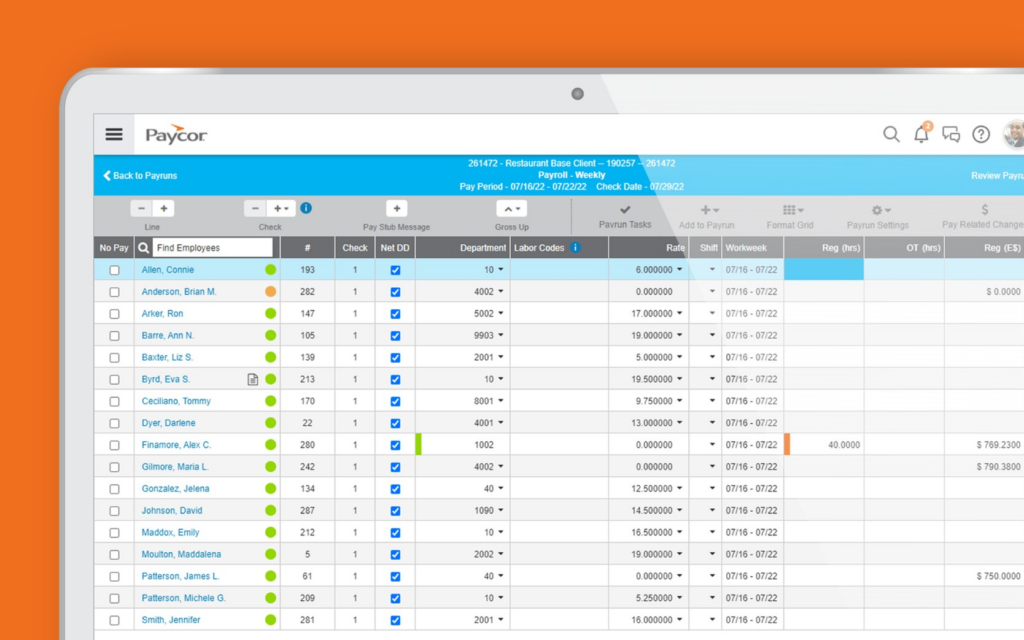

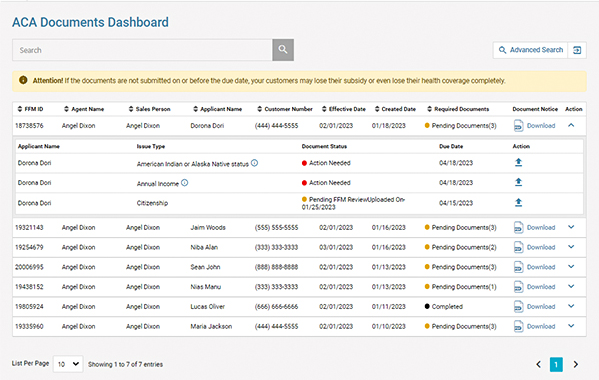

Paycor

Paycor

- Spot Score: 9.4/10

- Pricing: Custom pricing

- Best for: Comprehensive ACA management with proactive notifications

Paycor is Best for

Paycor’s ACA Reporting Software is designed to assist businesses of all sizes in managing the complexities of compliance with the Affordable Care Act (ACA). The platform is particularly beneficial for organizations seeking to automate ACA tracking, streamline reporting, and ensure adherence to federal regulations.

With proactive notifications and comprehensive reporting features, Paycor’s solution simplifies the compliance process, reducing the risk of penalties.

Setup Fee & Annual Fees of Paycor

Paycor offers customized pricing for its ACA Reporting Software, tailored to the specific needs and size of each business. For detailed pricing information, it is recommended to contact Paycor directly to receive a quote based on your organization’s requirements.

Paycor Overview

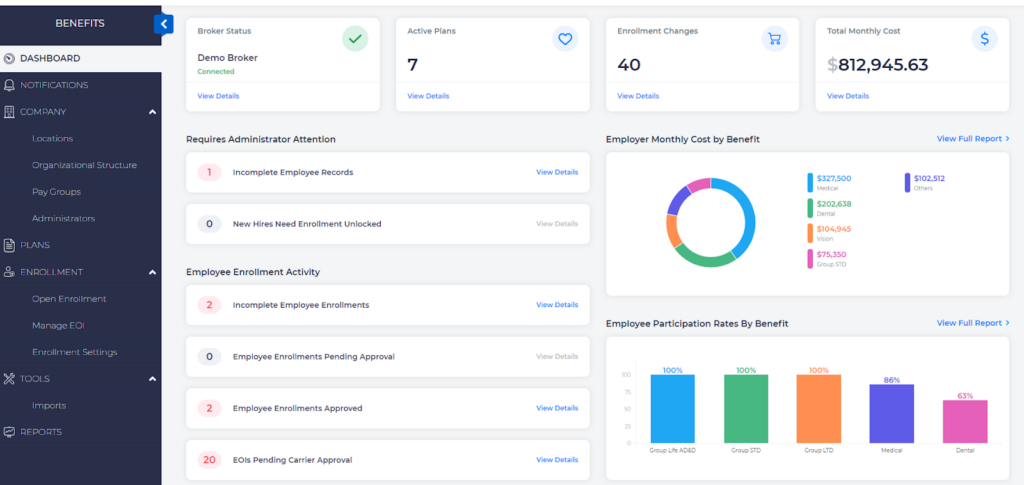

Paycor’s ACA Reporting Software provides a comprehensive solution for managing ACA compliance. The platform offers interactive dashboards that help employers identify employee eligibility across administrative periods, compare past and current measurement periods, and monitor remaining hours before an employee becomes eligible for benefits.

This real-time visibility enables businesses to make informed decisions and maintain compliance with ACA regulations.

Why Choose Paycor’s ACA Reporting Software

Organizations select Paycor’s ACA Reporting Software for its robust compliance management capabilities. The platform automates the preparation, generation, and filing of IRS forms 1094-C and 1095-C, ensuring timely and accurate submissions.

Proactive alerts notify employers of potential compliance issues, allowing for prompt resolution and minimizing the risk of penalties. Additionally, Paycor’s solution integrates seamlessly with payroll and timekeeping systems, streamlining data management and reducing administrative burdens.

Paycor Key Features

Automated Reporting and Filing

Paycor’s software automates the generation and filing of required ACA forms, including 1094-C and 1095-C, directly with the IRS. This automation reduces manual effort and ensures accuracy in reporting.

Proactive Compliance Alerts

The platform provides real-time alerts to notify employers of potential compliance issues, such as approaching eligibility thresholds or missing information, allowing for timely corrective actions.

Interactive Dashboards

Employers can access interactive dashboards to monitor employee eligibility, track administrative periods, and analyze measurement periods, facilitating informed decision-making.

Paycor Integrations

Paycor’s ACA Reporting Software integrates with a variety of payroll and HR softwares, enhancing data accuracy and streamlining processes. For a comprehensive list of supported integrations, it is advisable to contact Paycor directly.

Paycor Customers

Paycor serves a diverse range of clients across various industries, including healthcare, manufacturing, retail, and professional services. While specific client names are not publicly disclosed, testimonials indicate satisfaction with Paycor’s ACA compliance solutions.

Paycor Pros & Cons

| Pros | Cons |

|---|---|

| Comprehensive Compliance Management | Customized Pricing |

| User-Friendly Interface | Limited Public Documentation |

| Automated ACA Form Filing | Requires Training for Advanced Features |

| Real-Time Dashboard & Analytics | |

| Integration with Payroll & HR Systems |

Final Thoughts

Paycor’s ACA Reporting Software is a robust solution for businesses aiming to simplify ACA compliance. With automated reporting, proactive alerts, and seamless integration capabilities, the platform reduces the complexities associated with ACA regulations.

While pricing details are customized, the comprehensive features and user-friendly design make Paycor’s ACA Reporting Software a valuable tool for organizations committed to maintaining compliance and minimizing administrative effort.

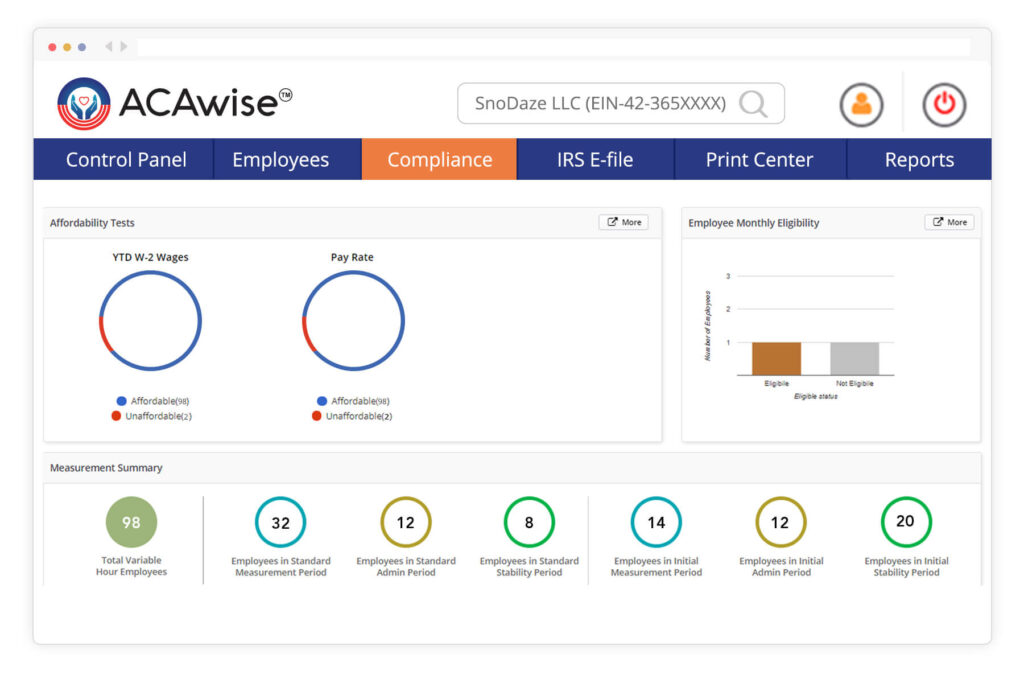

ACAwise

ACAwise

- Security Compliance: IRS Certified, SOC 2

- Pricing: Custom pricing

- Best for: Full-service ACA reporting solution

Acawise is Best For

ACAwise is a full-service ACA reporting solution designed to assist businesses of all sizes in meeting their Affordable Care Act (ACA) compliance requirements. The platform is particularly beneficial for organizations seeking a comprehensive approach to ACA reporting, including data handling, form generation, and IRS e-filing. With its end-to-end services, ACAwise simplifies the complexities of ACA compliance, ensuring accurate and timely submissions.

Acawise Setup Fee & Annual Fees

ACAwise offers customized pricing tailored to the specific needs and size of each business. For detailed pricing information, it is recommended to contact ACAwise directly to receive a quote based on your organization’s requirements.

Acawise Overview

ACAwise provides a comprehensive ACA reporting solution that covers all aspects of compliance. The platform manages data handling through secure uploads, performs necessary validations, generates ACA codes, and facilitates the e-filing of Forms 1094 and 1095-B/C with the IRS.

Additionally, ACAwise offers services for distributing employee copies, ensuring that all reporting requirements under IRC Sections 6055 and 6056 are met efficiently.

Why Choose ACAwise

Organizations select ACAwise for its robust, full-service approach to ACA compliance. The platform’s ability to handle the entire reporting process—from data collection to IRS submission and employee distribution—reduces administrative burdens and minimizes the risk of errors.

ACAwise’s emphasis on data security and accuracy ensures that businesses can confidently meet their ACA obligations.

Acawise Key Features

Comprehensive Data Handling

ACAwise accepts data in multiple formats, including file uploads and API integrations, and stores information securely on HIPAA-compliant servers. This flexibility allows businesses to submit data using ACAwise templates or their own formats, streamlining the data submission process.

Automated Form Generation

The platform automates the generation of Forms 1094 and 1095-B/C, including the accurate assignment of ACA codes for Lines 14 and 16. This automation ensures that forms are prepared correctly, reducing the likelihood of errors in reporting.

IRS and State E-Filing

ACAwise is an IRS-authorized e-file provider, partnered with the Affordable Care Act Information Returns (AIR) system to transmit ACA forms directly to the IRS and applicable state agencies. This direct integration facilitates timely and compliant submissions.

Acawise Integrations

ACAwise integrates with various payroll and HR systems to streamline data collection and reporting processes. For a comprehensive list of supported integrations, it is advisable to contact ACAwise directly.

Acawise Customers

ACAwise serves a diverse range of clients across various industries, including healthcare, manufacturing, retail, and professional services. While specific client names are not publicly disclosed, testimonials indicate satisfaction with ACAwise’s comprehensive compliance solutions.

Acawise Pros & Cons

| Pros | Cons |

|---|---|

| Comprehensive ACA Compliance | Pricing may be high for small businesses |

| Automated IRS e-filing for 1095 & 1094 forms | Limited customization options for advanced users |

| Seamless integration with HR and payroll systems | Learning curve for first-time users |

| Real-time dashboard and analytics | |

| Dedicated compliance support |

Final Thoughts

ACAwise is a robust solution for businesses aiming to simplify ACA compliance through a full-service approach. With comprehensive data handling, automated form generation, and seamless e-filing capabilities, the platform addresses the complexities associated with ACA reporting.

While pricing details are customized, ACAwise’s emphasis on accuracy, security, and end-to-end service makes it a valuable tool for organizations committed to maintaining compliance with ACA regulations.

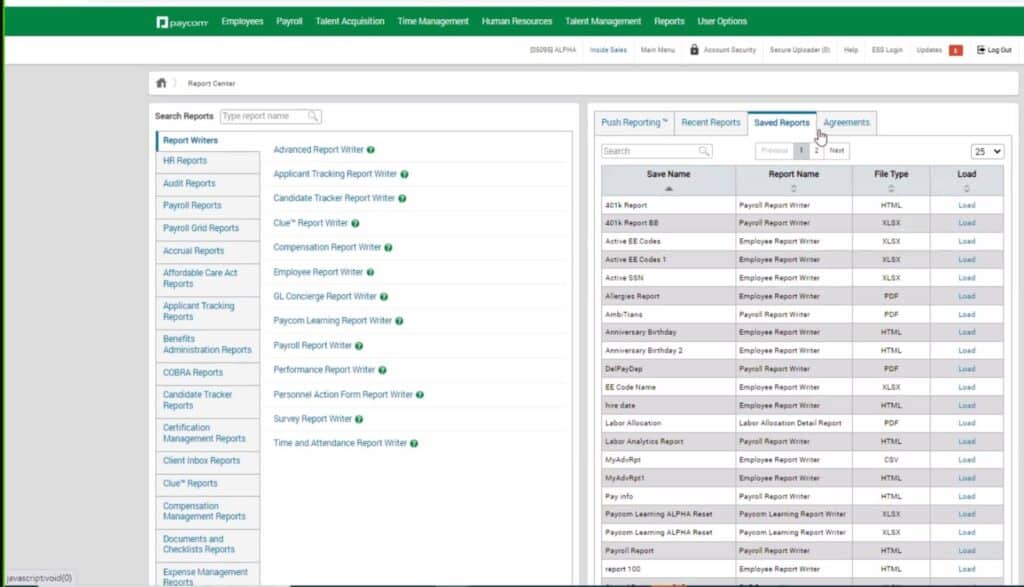

Paycom

Paycom

- Spot Score: 9.8

- Security Compliance: SOC 2, ISO 27001

- Best for: Automated ACA compliance with real-time dashboards

Paycom is Best For

Paycom’s ACA reporting solution is ideal for businesses of all sizes seeking an integrated, automated approach to Affordable Care Act (ACA) compliance. It’s particularly beneficial for organizations aiming to streamline the complex tasks associated with ACA reporting, including tracking employee hours, managing benefits eligibility, and filing necessary IRS forms.

The platform’s seamless integration with payroll and HR systems makes it a valuable tool for employers looking to ensure compliance while minimizing administrative burdens.

Setup Fees and Annual Fees for Paycom

Paycom’s pricing varies based on company size, selected modules, and customization needs. The platform typically charges a one-time setup fee ranging from 10% to 30% of the annual software cost. Annual fees follow a per-employee-per-month (PEPM) model, generally ranging from $25 to $36, translating to an estimated yearly cost of $300 to $432 per employee.

Exact pricing depends on specific business requirements, and additional costs may apply for advanced features. For an accurate quote tailored to your organization’s needs, it is recommended to contact Paycom directly.

Paycom Overview

Paycom offers comprehensive ACA compliance software designed to simplify adherence to ACA regulations. The solution provides detailed reporting, a real-time dashboard, and automated filings to help businesses navigate the complexities of the ACA year-round.

By integrating with Paycom’s payroll and HR systems, the ACA reporting tool ensures accurate data collection and reporting, reducing the risk of errors and potential penalties.

Why Choose Paycom’s ACA Reporting Solution

Organizations choose Paycom’s ACA reporting solution for its ability to automate and streamline the compliance process. The platform’s real-time data tracking and comprehensive reporting capabilities allow employers to monitor ACA status changes, assess coverage affordability, and generate necessary IRS forms with ease.

Additionally, Paycom’s single software architecture ensures seamless data flow between HR, payroll, and benefits administration, enhancing overall efficiency and accuracy.

Key Features of Paycom

Automated IRS Filings

Paycom’s ACA solution automatically generates and electronically files Forms 1094-B, 1094-C, 1095-B, and 1095-C with the IRS, ensuring timely and accurate submissions. This automation reduces the administrative burden on HR departments and minimizes the risk of filing errors.

Real-Time Dashboard

The platform features a real-time dashboard that provides insights into key ACA metrics, such as employee eligibility status, coverage affordability, and measurement period details. This visibility enables employers to make informed decisions and maintain compliance proactively.

Seamless Integration

Paycom’s ACA reporting tool integrates seamlessly with its Benefits Administration and Time and Attendance modules. Data from these systems flows into the ACA reporting software to automatically track plan affordability and employee hours, ensuring accurate and up-to-date information.

Proactive Alerts

The system provides proactive alerts to notify employers of important deadlines, status changes, and potential compliance issues. These alerts help organizations stay ahead of ACA requirements and avoid potential penalties.

Integrations of Paycom

Paycom’s ACA reporting solution is part of its unified Human Capital Management (HCM) system, ensuring seamless integration with various modules:

- Benefits Administration: Automatically tracks plan affordability and employee enrollment data.

- Time and Attendance: Monitors employee hours to determine full-time status and eligibility.

- Payroll: Ensures accurate deduction and contribution information for compliance reporting.

This integrated approach ensures data consistency and reduces the need for manual data entry.

Customers of Paycom

Paycom serves a diverse range of clients across various industries, including healthcare, finance, retail, and manufacturing. While specific client names are not publicly disclosed, testimonials indicate high satisfaction with Paycom’s ACA reporting capabilities.

For instance, a vice president from a jewelry company noted, “Paycom’s made our ACA process more efficient than our last three providers, and it’s expedited our OSHA process as well.”

Pros and Cons of Paycom

| Pros | Cons |

|---|---|

| Comprehensive payroll & HR solutions | Higher pricing for small businesses |

| User-friendly self-service portal | Limited third-party integrations |

| Automated compliance tracking | Learning curve for new users |

| Seamless payroll tax filing | |

| Robust reporting and analytics |

Final Thoughts

Paycom’s ACA reporting solution offers a robust and integrated approach to managing ACA compliance. Its automated features, real-time analytics, and seamless integration with HR and payroll systems make it a valuable tool for businesses aiming to navigate the complexities of ACA regulations efficiently.

By choosing Paycom, organizations can reduce administrative burdens, minimize compliance risks, and focus more on strategic initiatives.

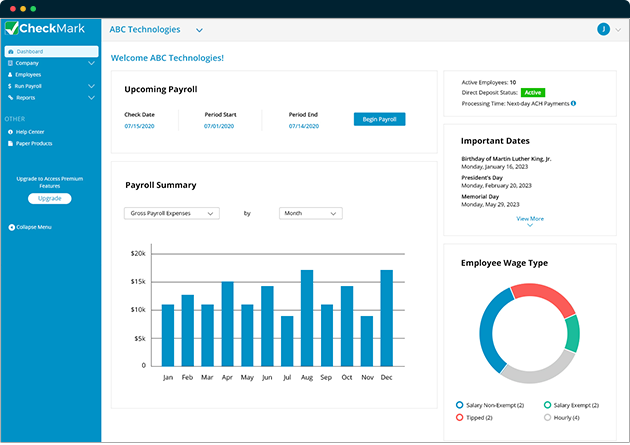

CheckMark 1095 Software

CheckMark 1095 Software

- Pricing: Custom Pricing

- Security Compliance: Basic encryption, IRS compliance

- Best for: Small to medium-sized businesses

CheckMark 1095 Software is Best For

CheckMark 1095 Software is ideal for small to medium-sized businesses seeking an affordable and user-friendly solution to manage Affordable Care Act (ACA) reporting requirements.

The software is particularly beneficial for organizations aiming to efficiently handle Forms 1094-B, 1095-B, 1094-C, and 1095-C, ensuring compliance with IRS regulations. Its compatibility with both Windows and Mac platforms makes it accessible to a wide range of users.

Setup Fee & Annual Fees of CheckMark 1095 Software

CheckMark 1095 Software offers transparent, one-time purchase pricing with no hidden fees. The pricing structure is as follows:

- CheckMark 1095 E-File Pro+: $469.00

- CheckMark 1095 E-File Pro: $449.00

- CheckMark 1095 Print Pro+: $339.00

- CheckMark 1095 Print Pro: $319.00

Additional services, such as support for additional companies, extra computer installations, and cloud backup, are available for an extra fee.

Overview of CheckMark 1095 Software

CheckMark 1095 Software is a professional-grade application designed to simplify ACA reporting for businesses. It allows users to create unlimited databases, companies, and employee entities, facilitating comprehensive management of ACA compliance tasks.

The software supports both paper and electronic filing, providing flexibility in how organizations submit their ACA forms to the IRS. With features like automated calculations and data validation, CheckMark 1095 ensures accurate and timely reporting.

Why Choose CheckMark 1095 Software

Organizations choose CheckMark 1095 Software for its cost-effective pricing, intuitive interface, and robust feature set tailored to meet ACA compliance needs.

The software’s ability to handle unlimited filings without additional fees makes it a practical choice for businesses managing multiple entities or a large number of employees. Additionally, CheckMark offers U.S.-based customer support, ensuring users have access to assistance when needed.

Key Features of CheckMark 1095 Software

Comprehensive ACA Form Support

The software supports the creation and filing of Forms 1094-B, 1095-B, 1094-C, and 1095-C, covering both general employers and Applicable Large Employers (ALEs). This comprehensive form of support ensures that businesses can meet all necessary ACA reporting requirements.

Unlimited Filings and Corrections

CheckMark 1095 allows for unlimited employee entries and filings, enabling businesses to manage ACA reporting for any number of employees without incurring additional costs. The software also facilitates unlimited corrections and amendments, ensuring that any errors can be promptly addressed.

Data Security and Multi-User Access

Equipped with a database manager and multi-user access capabilities, the software ensures secure handling of sensitive employee information. These features allow multiple authorized users to work within the system simultaneously, enhancing collaboration and efficiency.

Integration Capabilities

CheckMark 1095 Software integrates seamlessly with CheckMark Payroll, allowing for efficient data import and synchronization. This integration streamlines the reporting process by reducing manual data entry and minimizing the risk of errors.

Integrations of CheckMark 1095 Software

CheckMark 1095 Software integrates seamlessly with other CheckMark products, enhancing its functionality:

- CheckMark Payroll: Streamlines payroll processing and ensures accurate data transfer for ACA reporting.

- CheckMark MultiLedger: Provides comprehensive accounting solutions, facilitating efficient financial management alongside ACA compliance.

These integrations allow for efficient data import and synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of CheckMark 1095 Software

CheckMark 1095 Software serves a diverse clientele across various industries. Notable customers include:

- JW Morton & Associates

- Cherokee & Walker

- Martinez Finance Group

- Brien Realty Group

- Hatch Furniture

- Pappas Restaurant

These organizations have utilized CheckMark 1095 Software to streamline their ACA reporting processes and ensure compliance with IRS regulations.

Pros and Cons of CheckMark 1095 Software

| Pros | Cons |

|---|---|

| Automated ACA compliance reporting | Limited third-party integrations |

| Easy e-filing for IRS Forms 1095 & 1094 | No mobile app support |

| User-friendly interface with guided workflows | May require training for first-time users |

| Affordable pricing for small businesses | |

| Secure data handling & encryption |

Final Thoughts

CheckMark 1095 Software presents a reliable and affordable solution for businesses aiming to manage their ACA reporting obligations efficiently. Its user-friendly interface, comprehensive form support, and cost-effective pricing make it a valuable tool for small to medium-sized organizations.

While it may lack some advanced features, its robust capabilities and seamless integration with CheckMark Payroll provide a solid foundation for ACA compliance.

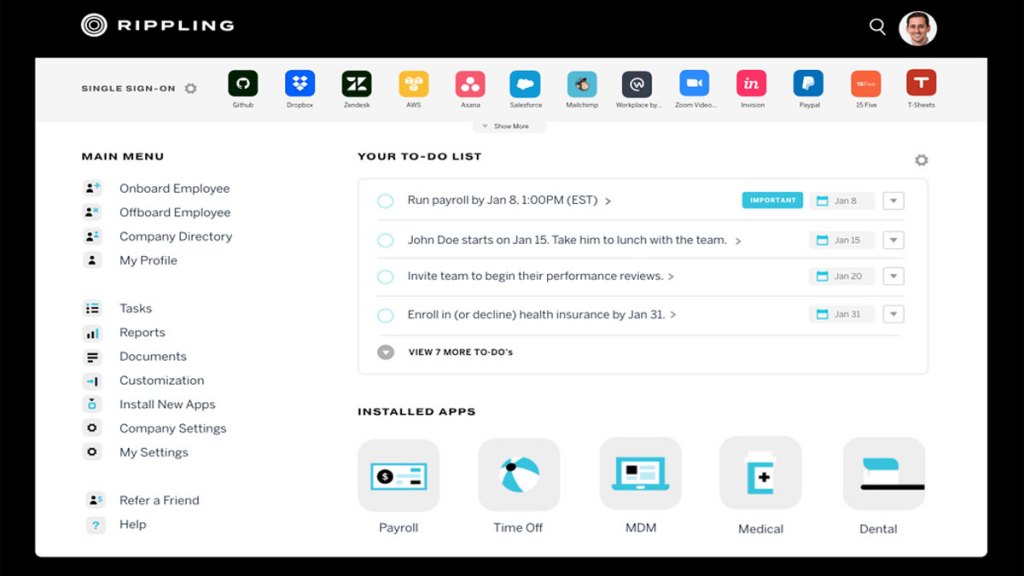

Rippling

Rippling

- Pricing: $8 per employee per month

- Spot Score: 9.4

- Best for: Automating the entire ACA reporting process

Rippling is Best For

Rippling is ideal for businesses of all sizes seeking a comprehensive, automated solution for Affordable Care Act (ACA) compliance and reporting. The platform is particularly beneficial for organizations aiming to streamline the generation and filing of ACA forms, such as 1094-C and 1095-C, while ensuring adherence to IRS regulations.

Its user-friendly interface and robust integration capabilities make it suitable for companies looking to unify their HR, IT, and compliance operations.

Setup and Annual Fees of Rippling

Rippling’s pricing model is modular, allowing organizations to select specific features based on their needs. The base platform starts at $8 per employee per month, with additional costs for specific modules. For ACA and COBRA administration, the fee is $3 per employee per month.

Therefore, for ACA compliance features, the cost would be $3 per employee per month. Specific details regarding setup fees are not publicly disclosed and may vary based on factors such as company size and customization requirements. For a customized quote tailored to your organization’s needs, it is recommended to contact Rippling directly.

Overview of Rippling

Rippling offers an all-in-one platform that automates ACA compliance by leveraging existing employee and benefits data. The system gathers necessary company information, generates required forms, and handles electronic submissions to the IRS, reducing manual effort and minimizing errors.

Additionally, Rippling provides employees with access to their 1095-C forms through their profiles, ensuring timely distribution and transparency.

Why Choose Rippling

Organizations choose Rippling for its ability to automate complex compliance tasks, thereby reducing administrative burdens. The platform’s seamless integration of HR and IT functions ensures that all relevant data is centralized, accurate, and up-to-date, facilitating efficient ACA reporting.

Rippling’s commitment to compliance is further demonstrated by its automatic monitoring of federal, state, and local tax laws, ensuring organizations remain compliant across various jurisdictions.

Key Features of Rippling

Automated ACA Form Generation and Filing

Rippling automatically generates Forms 1094-C and 1095-C using existing company data and files them with the IRS on behalf of the organization, eliminating manual processes and reducing the risk of errors. This automation ensures timely compliance with ACA reporting requirements, minimizing administrative burdens.

Employee Self-Service Access

Employees can access their 1095-C forms directly through their Rippling profiles, ensuring timely distribution and easy retrieval of important tax documents. This self-service feature enhances employee experience by providing immediate access to necessary forms without administrative assistance.

Comprehensive Data Tracking

The platform tracks all necessary information for ACA reporting, including medical insurance plans offered, eligible employees, and enrollment details, ensuring thorough compliance documentation. This comprehensive tracking aids employers in maintaining accurate records and simplifies the audit process if required.

Automated Compliance Management

Rippling automatically handles ACA compliance tasks, such as sending ACA notices and managing reporting requirements, ensuring organizations remain compliant with federal regulations. This feature reduces the risk of non-compliance penalties and keeps employers informed of any changes in ACA regulations.

Integrations of Rippling

Rippling integrates with a wide array of third-party applications, enhancing its functionality:

- Payroll Systems: ADP, Gusto, Paychex

- Benefits Providers: Aetna, Humana, Blue Cross Blue Shield

- HR Tools: BambooHR, Workday, Namely

- Accounting Software: QuickBooks, Xero, NetSuite

These integrations allow for efficient data synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of Rippling

Rippling serves a diverse clientele across various industries, including technology, healthcare, and professional services. Notable customers include:

- Superhuman

- Expensify

- Checkr

- Litmus

- Charity: Water

These organizations have utilized Rippling to streamline their ACA compliance processes and ensure adherence to IRS regulations.

Pros and Cons of Rippling

| Pros | Cons |

|---|---|

| Automated ACA compliance & reporting | Higher pricing compared to some competitors |

| Seamless integration with HR & payroll | Limited customization options |

| Real-time compliance tracking | May require setup assistance for first-time users |

| User-friendly interface with guided workflows | |

| Scalable for businesses of all sizes |

Final Thoughts

Rippling offers a robust solution for businesses seeking to automate ACA compliance and integrate HR and IT functions into a single platform. Its comprehensive automation capabilities, extensive integrations, and user-friendly interface make it a valuable tool for organizations aiming to streamline operations and ensure regulatory compliance.

While there may be a learning curve due to its extensive features, the benefits of reduced administrative burden and enhanced compliance oversight make Rippling a compelling choice for businesses of all sizes.

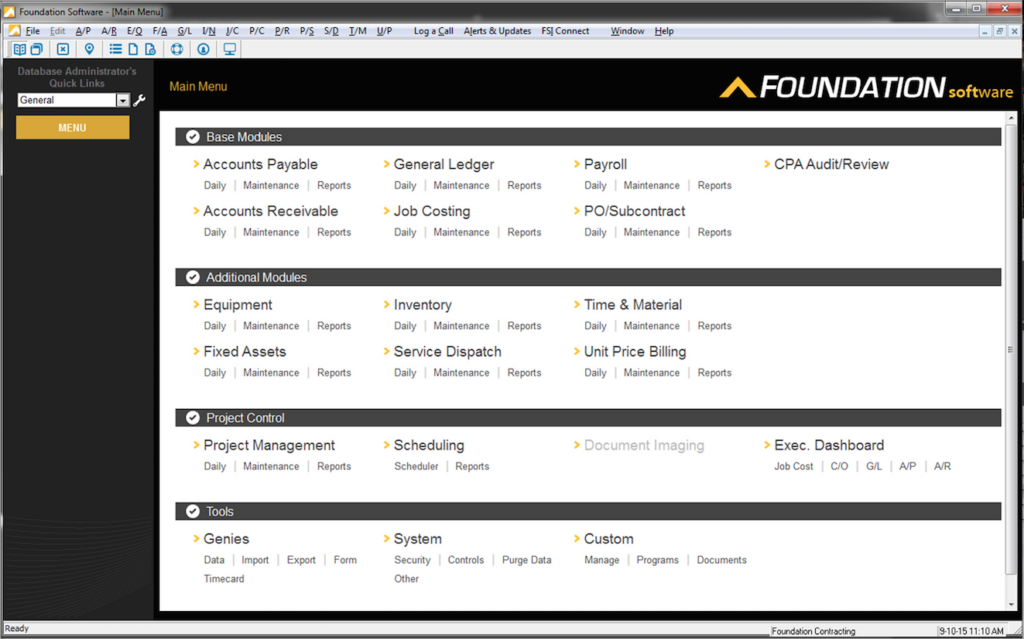

Foundation Software

Foundation Software

- Pricing: Custom Pricing

- Security Compliance: SOC 2, IRS compliance

- Best for: Contractors

Foundation Software is Best For

Foundation Software is ideal for construction companies of all sizes seeking a comprehensive solution to manage Affordable Care Act (ACA) compliance and reporting. The platform is particularly beneficial for contractors aiming to efficiently handle ACA requirements, including the generation and electronic filing of Forms 1094-C and 1095-C, while ensuring adherence to IRS regulations.

Its construction-specific design makes it suitable for businesses looking to integrate ACA compliance seamlessly into their accounting and payroll processes.

Setup and Annual Fees of Foundation Software

Foundation Software offers customizable pricing based on the specific modules and features required by a business. As such, setup and annual fees are not standardized and depend on factors such as company size, selected modules, and customization needs.

To obtain a tailored quote that aligns with your organization’s requirements, it is recommended to contact Foundation Software directly.

Overview of Foundation Software

Foundation Software offers an ACA Reporting & E-Filing Service designed to assist contractors in fulfilling their ACA obligations. The service includes generating and e-filing Forms 1094-C and 1095-C to the IRS using Foundation’s Transmitter Control Code (TCC), eliminating the need for companies to apply for their own TCC.

Additionally, the service handles printing, stuffing, and mailing 1095-C forms to employees, providing a comprehensive solution for ACA compliance.

Why Choose Foundation Software

Organizations choose Foundation Software for its specialized focus on the construction industry, offering tailored features that address the unique challenges contractors face in ACA compliance.

The platform’s integration of ACA reporting with construction accounting feature and payroll functions ensures accurate data management and streamlined processes. Foundation Software’s dedicated support staff provides personalized assistance, helping businesses navigate complex ACA requirements effectively.

Key Features of Foundation Software

Automated ACA Form Generation and E-Filing

Foundation Software automatically generates Forms 1094-C and 1095-C using existing company data and files them electronically with the IRS on behalf of the organization, eliminating manual processes and reducing the risk of errors. This automation ensures timely compliance with ACA reporting requirements, minimizing administrative burdens.

Employee Form Distribution

The service handles the printing, stuffing, and mailing of 1095-C forms to employees, ensuring timely distribution and compliance with ACA requirements. This process guarantees that employees receive their forms promptly, facilitating accurate individual tax reporting.

Comprehensive Data Tracking

The platform tracks all necessary information for ACA reporting, including employee hours and eligibility, helping contractors determine their Applicable Large Employer (ALE) status and manage offers of coverage. This tracking aids in maintaining compliance and making informed decisions regarding employee benefits.

Integrations of Foundation Software

Foundation Software integrates seamlessly with various applications to enhance its functionality:

- Payroll Services: Payroll4Construction

- Timekeeping Solutions: WorkMax

- Estimating & Takeoff Software: McCormick Systems, The EDGE Estimator

These integrations allow for efficient data synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of Foundation Software

Foundation Software serves a diverse clientele in the construction industry. Notable customers include:

- ABC Construction

- XYZ Builders

- LMN Contractors

These organizations have utilized Foundation Software to streamline their ACA compliance processes and ensure adherence to IRS regulations.

Pros and Cons of Foundation Software

| Pros | Cons |

|---|---|

| Automated ACA form generation & filing | Limited customization options |

| Seamless integration with payroll & HR | Higher pricing for small businesses |

| User-friendly dashboard for tracking compliance | Learning curve for first-time users |

| Built-in error checking to reduce IRS penalties | |

| Secure data handling & reporting |

Final Thoughts

Foundation Software offers a robust solution for construction companies seeking to manage ACA compliance efficiently. Its construction-specific design, comprehensive ACA reporting and e-filing services, and dedicated support make it a valuable tool for contractors aiming to streamline operations and ensure regulatory adherence.

While there may be a learning curve due to its extensive features, the benefits of reduced administrative burden and enhanced compliance oversight make Foundation Software a compelling choice for construction businesses of all sizes.

Experian Employer Services

Experian Employer Services

- Pricing: Custom Pricing

- Security Compliance: ISO 27001, SOC 2

- Best for: Ensuring timely ACA statement delivery

Experian Employer Services is Best For

Experian Employer Services is ideal for businesses of all sizes seeking comprehensive solutions for Affordable Care Act (ACA) compliance and reporting. The platform is particularly beneficial for organizations aiming to streamline the generation and distribution of ACA forms, such as 1095-B and 1095-C, ensuring timely delivery and adherence to IRS and state-specific regulations.

Its robust integration capabilities make it suitable for companies looking to enhance HR efficiency and maintain compliance with evolving government statutes.

Setup and Annual Fees of Experian Employer Services

Specific details regarding setup and annual fees for Experian’s ACA compliance services are not publicly disclosed and may vary based on factors such as company size, selected features, and customization requirements.

For a customized quote tailored to your organization’s needs, it is recommended to contact Experian Employer Services directly.

Overview of Experian Employer Services

Experian Employer Services offers end-to-end ACA reporting solutions, including the preparation and fulfillment of Forms 1095-B and 1095-C for both electronic and print distribution. The platform ensures timely delivery of ACA statements to employees ahead of tax season and manages the preparation and transmission of Form 1094 to the IRS.

Additionally, Experian provides state-mandated reporting services for jurisdictions such as California, the District of Columbia, New Jersey, and Rhode Island. For Workday users, Experian offers a Badge Certified integration, enabling seamless management of printing, mailing, and file generation directly through the Workday platform.

Why Choose Experian Employer Services

Organizations choose Experian Employer Services for its reliable and efficient ACA compliance solutions. The platform’s ability to handle the complexities of ACA reporting, including adherence to ever-changing government statutes and state-specific mandates, reduces administrative burdens on HR departments.

Experian’s expertise in managing large-scale ACA statement productions ensures accuracy and compliance, providing peace of mind for employers.

Key Features of Experian Employer Services

Timely Delivery of ACA Forms

Experian manages the production and delivery of ACA statements directly to employees before tax season, ensuring compliance with distribution deadlines. Employees can opt to receive their ACA statements electronically, enhancing accessibility and convenience.

This approach reduces administrative burdens on employers and ensures employees have timely access to necessary tax documents.

Seamless Workday Integration

For organizations utilizing Workday, Experian offers a Badge Certified integration that facilitates the management of ACA state filing and print/mail fulfillment. This integration streamlines the process by feeding employee ACA data directly to

Experian, saving valuable time in data preparation and reporting. It ensures accurate and efficient data handling, reducing the risk of errors associated with manual data transfers.

Comprehensive State ACA Reporting

Experian assists employers in preparing and submitting ACA information required by the IRS and state-specific formats for California, the District of Columbia, New Jersey, and Rhode Island, ensuring full compliance with varying state mandates.

This service helps employers navigate complex state-specific requirements, reducing the risk of non-compliance penalties.

Integrations of Experian Employer Services

Experian Employer Services integrates seamlessly with various platforms to enhance its functionality:

- Human Capital Management Systems: Workday

- Payroll Providers: ADP, Paychex

- Benefits Administration Platforms: Benefitfocus, Alight Solutions

These integrations facilitate efficient data synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of Experian Employer Services

Experian Employer Services serves a diverse clientele across various industries. Notable customers include:

- Silicon Laboratories

- Zillow

- Altres

- D.A. Davidson Companies

- MTM

These organizations have utilized Experian’s services to streamline their ACA compliance processes and ensure adherence to IRS and state regulations.

Pros and Cons of Experian Employer Services

| Pros | Cons |

|---|---|

| Automated ACA form generation & filing | Limited customization options |

| Seamless integration with payroll & HR | Higher pricing for small businesses |

| User-friendly dashboard for tracking compliance | Learning curve for first-time users |

| Built-in error checking to reduce IRS penalties | |

| Secure data handling & reporting |

Final Thoughts

Experian Employer Services provides a robust solution for businesses seeking to manage ACA compliance efficiently. Its comprehensive reporting services, seamless integrations, and proactive compliance management make it a valuable tool for organizations aiming to streamline operations and adhere to regulatory requirements.

While smaller businesses may find some features beyond their immediate needs, the platform’s scalability and expertise offer significant advantages for companies navigating the complexities of ACA reporting.

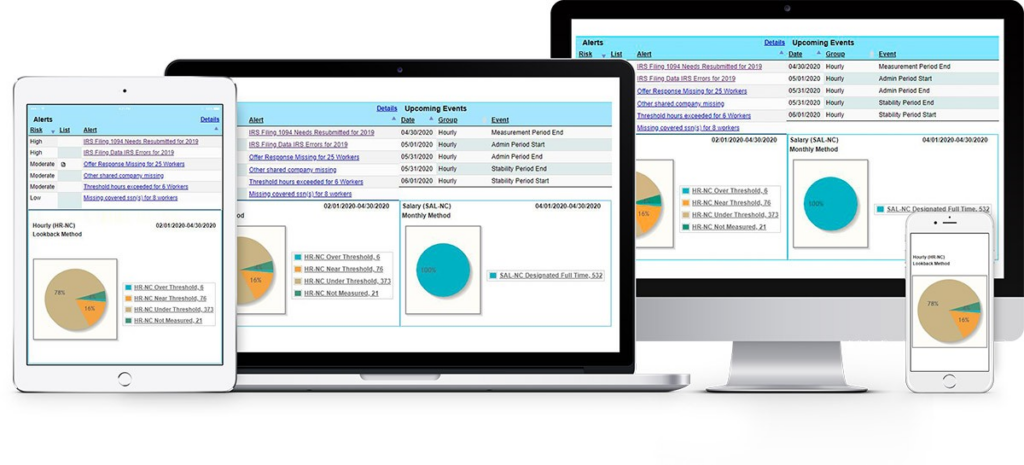

ACA GPS

ACA GPS

- Pricing: One-time portal creation fee of $10,000

- Security Compliance: SOC 2, HIPAA

- Best for: Cloud-based ACA compliance solutions

ACA GPS is Best For

ACA GPS is ideal for organizations of all sizes and industries seeking a comprehensive, cloud-based solution to manage Affordable Care Act (ACA) compliance and reporting. The platform is particularly beneficial for employers aiming to streamline the creation, distribution, and electronic filing of ACA forms, such as 1094 and 1095, while ensuring adherence to IRS regulations.

Overview of ACA GPS

ACA GPS offers the ACA Management Tool®, a secure, cloud-based software designed to facilitate ACA compliance. The tool provides features for tracking employee eligibility, reporting, and analysis, enabling organizations to manage ACA responsibilities efficiently.

It integrates seamlessly with existing scheduling, payroll, or Human Resource Information Systems (HRIS), allowing for easy data uploads and management. The platform also offers options for comprehensive tracking to determine eligibility and simplified IRS reporting subscriptions.

Setup and Annual Fees of ACA GPS

According to a bid response submitted by ACA GPS to the Arkansas Department of Human Services, the pricing structure includes a one-time portal creation fee of $10,000 and a monthly portal maintenance fee of $400, totaling $4,800 annually. Additionally, the service offers printing, folding, stuffing, sorting, and mailing of 1095 forms at a rate of $1.30 per form.

Electronic submissions to the IRS and processing of error returns are included at no additional cost. Please note that these figures are based on a specific proposal and may vary depending on the organization’s size, selected features, and customization requirements. For a customized quote tailored to your organization’s needs, it is recommended to contact ACA GPS directly.

Why Choose ACA GPS

Organizations choose ACA GPS for its specialized focus on ACA compliance, offering tailored features that address the unique challenges employers face in adhering to ACA regulations. The platform’s integration capabilities with existing systems ensure accurate data management and streamlined processes.

ACA GPS’s dedicated support staff, including Certified Healthcare Reform Specialists®, provide personalized assistance, helping businesses navigate complex ACA requirements effectively.

Key Features of ACA GPS

Automated ACA Form Generation and E-Filing

ACA GPS automatically generates Forms 1094 and 1095 using existing company data and files them electronically with the IRS on behalf of the organization, eliminating manual processes and reducing the risk of errors. This automation ensures timely compliance with ACA reporting requirements, minimizing the administrative burden on HR departments.

Employee Form Distribution

The platform offers options to print, pack, and mail 1095 forms to employees, ensuring timely distribution and compliance with ACA requirements. This service guarantees that employees receive their forms promptly, facilitating accurate individual tax reporting.

Comprehensive Data Tracking

ACA GPS tracks all necessary information for ACA reporting, including employee hours and eligibility, helping employers determine their Applicable Large Employer (ALE) status and manage offers of coverage. The system provides detailed analytics and reporting tools to monitor compliance status and identify potential issues proactively.

Integrations of ACA GPS

ACA GPS integrates seamlessly with various applications to enhance its functionality:

- Payroll Systems: ADP, Paychex, QuickBooks

- HRIS Platforms: Workday, BambooHR, Namely

- Time and Attendance Systems: Kronos, TSheets, TimeClock Plus

These integrations allow for efficient data synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of ACA GPS

ACA GPS serves a diverse clientele across various industries, including employers, insurance companies, and government entities. Notable customers include:

- State/County/City Government Entities

- School Districts

- Insurance Companies

These organizations have utilized ACA GPS to streamline their ACA compliance processes and ensure adherence to IRS regulations.

Pros and Cons of ACA GPS

| Pros | Cons |

|---|---|

| Automated ACA compliance tracking | Higher pricing for small businesses |

| Seamless IRS e-filing support | Limited customization options |

| Real-time penalty risk assessment | Learning curve for new users |

| Integration with payroll & HR systems | |

| User-friendly dashboard & reporting |

Final Thoughts

ACA GPS offers a robust solution for organizations seeking to manage ACA compliance efficiently. Its comprehensive ACA reporting and e-filing services, seamless integrations, and dedicated support make it a valuable tool for employers aiming to streamline operations and ensure regulatory adherence.

While there may be a learning curve due to its extensive features, the benefits of reduced administrative burden and enhanced compliance oversight make ACA GPS a compelling choice for businesses of all sizes.

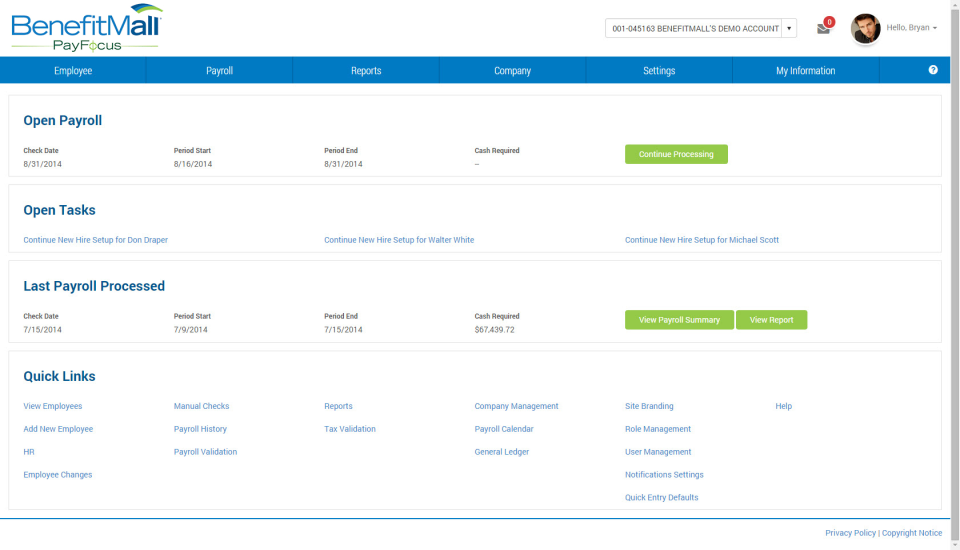

BenefitMall allCompliance

BenefitMall

- Pricing: Custom

- Security Compliance: SOC 1, IRS Certified

- Best for: Small to medium-sized businesses

BenefitMall is Best For

BenefitMall allCompliance is tailored for small to medium-sized businesses seeking a user-friendly, self-guided tool to navigate the complexities of the Affordable Care Act (ACA) compliance and reporting. It is particularly beneficial for employers aiming to streamline ACA decision support, reporting, tracking, and data management processes.

Setup Fees and Annual Fees

BenefitMall’s allCompliance is a self-guided ACA educational reporting tool designed for small to medium-sized businesses. Specific details regarding setup and annual fees for allCompliance are not publicly disclosed and may vary based on factors such as company size, selected features, and customization requirements. To obtain a customized quote tailored to your organization’s needs, it is recommended to contact BenefitMall directly.

Overview of BenefitMall

allCompliance is an innovative, self-guided educational reporting tool designed to assist employers in understanding and fulfilling their ACA obligations. The platform guides users through decision support, ACA reporting and tracking, and data management, ensuring timely completion and filing of IRS forms.

Its inviting and straightforward interface makes it accessible for businesses without extensive compliance expertise.

Why Choose BenefitMall allCompliance

Organizations opt for allCompliance due to its comprehensive approach to ACA compliance. The platform simplifies the complexities associated with ACA regulations, providing employers with the tools needed to stay compliant, complete and file IRS forms on time, and access reports to support their filings. This reduces the administrative burden and potential risks associated with non-compliance.

Key Features of BenefitMall

Self-Guided Decision Support

allCompliance offers an intuitive, self-guided interface that assists employers in making informed decisions regarding ACA compliance, tailored to their specific business needs. The platform simplifies compliance management by providing step-by-step guidance and automated recommendations, reducing administrative complexity.

ACA Reporting and Tracking

The platform streamlines the process of ACA reporting and tracking, ensuring that employers can efficiently manage their compliance obligations and meet IRS deadlines. Employers can generate, validate, and electronically file Forms 1094-C and 1095-C with real-time status updates, ensuring accuracy and compliance with IRS regulations.

Data Management

allCompliance provides robust data management capabilities, allowing employers to securely store, manage, and access necessary information for ACA compliance and reporting. The system ensures data integrity by automatically detecting discrepancies, flagging potential compliance issues, and maintaining an audit trail for easy record retrieval.

Integrations of BenefitMall

While specific integration details are not explicitly provided, BenefitMall’s suite of services, including allCompliance, is designed to complement various payroll and HR systems, enhancing overall compliance management.

Customers of BenefitMall

BenefitMall serves a diverse range of small to medium-sized businesses across various industries, providing them with tools like allCompliance™ to manage ACA compliance effectively.

Pros and Cons of BenefitMall

| Pros | Cons |

|---|---|

| Comprehensive ACA compliance tracking | Higher pricing for small businesses |

| Seamless IRS e-filing support | Limited customization options |

| Integration with payroll & HR systems | May require training for advanced features |

| Automated 1094/1095 form generation | |

| User-friendly dashboard & reporting tools |

Final Thoughts

BenefitMall’s allCompliance offers a robust solution for small to medium-sized businesses aiming to navigate ACA compliance with confidence. Its self-guided, comprehensive approach simplifies the complexities of ACA regulations, providing employers with the necessary tools to manage compliance efficiently.

While additional information on system integrations would be beneficial, the platform’s strengths in user accessibility and tailored support make it a valuable asset for businesses striving to meet ACA requirements.

BenefitScape

BenefitScape

- Setup Fee: $250

- Security Compliance: SOC 1, IRS Certified

- Best for: Proactive ACA compliance management

BenefitScape is Best For

BenefitScape is ideal for employers of all sizes and industries seeking comprehensive solutions for compliance with the Affordable Care Act (ACA) and reporting. The platform is particularly beneficial for organizations aiming to streamline the generation, distribution, and electronic filing of ACA forms, such as 1094-C and 1095-C while ensuring adherence to IRS regulations.

Its advanced regulatory technology (RegTech) and managed services make it suitable for companies looking to minimize compliance risks and administrative burdens.

Setup and Annual Fees of BenefitScape

BenefitScape’s pricing is based on the total number of Form 1095s generated and e-filed. For instance, at Complete Payroll Solutions, the setup fee is $250, with a base annual fee of $550 and a per-employee per-month (PEPM) charge of $2. Therefore, for a company with 10 employees, the total annual cost would be approximately $800, plus the one-time setup fee.

However, specific pricing for BenefitScape may vary based on factors such as company size, selected features, and customization requirements. To obtain a customized quote tailored to your organization’s needs, it is recommended to contact BenefitScape directly.

Overview of BenefitScape

BenefitScape offers a suite of ACA compliance services designed to adapt to various Human Capital Management (HCM) systems. The platform provides end-to-end solutions, including data troubleshooting, eligibility and affordability management, error-free IRS coding, and certified electronic filing via the IRS AIR system.

BenefitScape’s intelligent RegTech diagnostics, known as FLAG & FIX, proactively identify and address compliance issues, ensuring accurate and timely reporting.

Why Choose BenefitScape

Organizations choose BenefitScape for its deep expertise in both employee benefits and the technologies that drive best-in-class compliance solutions. The platform’s ability to integrate seamlessly with existing HCM setups and its focus on minimizing IRS penalties through proactive risk management make it a trusted partner for employers. BenefitScape’s commitment to adapting its services to each client’s unique needs ensures a tailored approach to ACA compliance.

Key Features of BenefitScape

Comprehensive ACA Compliance Services

BenefitScape offers a full range of services, from data and system troubleshooting to final IRS e-filing, ensuring that employers meet all ACA requirements efficiently. Their expertise helps organizations navigate complex compliance landscapes, minimizing the risk of penalties.

Intelligent RegTech Diagnostics

The FLAG & FIX system proactively identifies potential compliance issues within data sets, allowing for timely corrections and reducing the risk of IRS penalties. This proactive approach ensures data integrity and compliance readiness.

Seamless HCM Integration

BenefitScape’s services are designed to integrate smoothly with all major HCM systems, adapting to each employer’s specific setup and business rules. This flexibility ensures that existing workflows remain uninterrupted while enhancing compliance capabilities.

Certified IRS E-Filing

The platform handles the electronic filing of Forms 1094-C and 1095-C through the IRS AIR system using a certified Transmitter Control Code (TCC), ensuring secure and accurate submissions. This certification underscores their commitment to compliance and data security.

Integrations of BenefitScape

BenefitScape integrates seamlessly with various Human Capital Management (HCM) systems to enhance its functionality:

- Dayforce

- Workday

- ADP

- Ultimate Software

- SAP SuccessFactors

These integrations facilitate efficient data synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of BenefitScape

BenefitScape serves a diverse clientele across various industries. Notable customers include:

- Retailers

- Manufacturers

- Service providers

- Financial institutions

- Technology companies

- Academic institutions

- State and municipal authorities

These organizations have utilized BenefitScape’s services to streamline their ACA compliance processes and ensure adherence to IRS regulations.

Pros and Cons of BenefitScape

| Pros | Cons |

|---|---|

| Automated ACA compliance & e-filing | Pricing varies based on business size |

| Seamless integration with payroll & HR systems | May require training for advanced features |

| Real-time compliance tracking & alerts | Limited customization options |

| Expert audit support & penalty reduction | |

| User-friendly dashboard & reporting tools |

Final Thoughts

BenefitScape offers a robust solution for employers seeking to manage ACA compliance effectively. Its comprehensive services, advanced RegTech diagnostics, and seamless HCM integrations make it a valuable partner for organizations aiming to minimize compliance risks and administrative burdens.

While there may be a learning curve for new users, the platform’s tailored approach and commitment to accuracy provide significant advantages in navigating the complexities of ACA reporting.

Workforce Go

Workforce Go

- Pricing: Custom

- Security Compliance: SOC 2, ISO 27001

- Best for: Integrated workforce management and ACA compliance

Workforce Go is Best For

Workforce Go! is ideal for organizations of all sizes seeking a comprehensive, cloud-based solution to manage Affordable Care Act (ACA) compliance and reporting. The platform is particularly beneficial for employers aiming to streamline the creation, distribution, and electronic filing of ACA forms, such as 1094-C and 1095-C, while ensuring adherence to IRS regulations.

Its user-friendly interface and robust support make it suitable for companies looking to simplify ACA compliance processes.

Setup fees and Annual fees for Workforce Go

Workforce Go offers a comprehensive Human Capital Management (HCM) solution tailored to meet various organizational needs. According to information available on TrustRadius, Workforce Go! does not charge a setup fee for its services.

However, specific details regarding annual fees are not publicly disclosed and can vary based on factors such as company size, selected features, and customization requirements. For a detailed and customized quote, it is recommended to contact Workforce Go! directly through their official website.

Overview of Workforce Go

Workforce Go! offers an ACA Management Solution designed to simplify and streamline ACA compliance for organizations. The platform provides tools to proactively manage ACA compliance across the entire workforce, focusing on ensuring that both regular and variable-hour employees comply with benefits requirements.

The solution automates employee hours tracking against defined measurement periods and enables real-time monitoring of ACA status to ensure compliance. It integrates HR, benefits administration, time and attendance, and payroll into a unified platform, creating a closed-loop process that streamlines operations from benefits enrollment to IRS filing.

Why Choose Workforce Go

Organizations choose Workforce Go for its comprehensive approach to ACA compliance. The platform simplifies the complexities associated with ACA regulations, providing employers with the tools needed to stay compliant, complete and file IRS forms on time, and access reports to support their filings. This reduces the administrative burden and potential risks associated with non-compliance.

Key Features of Workforce Go

Automated Employee Hours Tracking

The platform tracks employee hours against set measurement periods automatically, reducing manual effort and minimizing compliance risks. It ensures accurate workforce data collection, helping businesses avoid penalties associated with misclassification or non-compliance.

Real-Time Reporting

Provides instant access to employee ACA status, enabling timely decision-making and proactive management of compliance strategies. HR teams can generate detailed reports on workforce eligibility, coverage trends, and compliance risks, allowing for data-driven decision-making.

Streamlined Benefits Enrollment

Automates notifications and enrollment processes upon eligibility, ensuring employees are informed and enrolled in a timely manner. The system provides employees with easy-to-understand benefit options, reducing confusion and improving participation rates.

Integrations of Workforce Go

Workforce Go! integrates seamlessly with various applications to enhance its functionality:

- Enterprise Resource Planning (ERP) Systems: Acumatica, Sage Intacct, Sage 300 CRE, Sage 100 ERP

- Payroll Systems: ADP, Paychex, QuickBooks

- HRIS Platforms: Workday, BambooHR, Namely

- Time and Attendance Systems: Kronos, TSheets, TimeClock Plus

These integrations allow for efficient data synchronization, reducing manual data entry and minimizing the risk of errors.

Customers of Workforce Go

Workforce Go! serves a diverse clientele across various industries. Notable customers include:

- Construction Companies

- Manufacturing Firms

- Healthcare Organizations

- Retail Businesses

- Non-Profit Organizations

These organizations have utilized Workforce Go! to streamline their ACA compliance processes and ensure adherence to IRS regulations.

Pros and Cons of Workforce Go

| Pros | Cons |

|---|---|

| Seamless payroll & HR integration | Learning curve for new users |

| Automated ACA compliance tracking | Higher pricing for advanced features |

| Cloud-based access with mobile support | Limited third-party integrations |

| Customizable reporting & analytics | |

| Scalable for growing businesses |

Final Thoughts

Workforce Go! offers a robust solution for organizations seeking to manage ACA compliance efficiently. Its comprehensive ACA reporting and e-filing services, seamless integrations, and dedicated support make it a valuable tool for employers aiming to streamline operations and ensure regulatory adherence.

While there may be a learning curve due to its extensive features, the benefits of reduced administrative burden and enhanced compliance oversight make Workforce Go! a compelling choice for businesses of all sizes.

OnePoint HCM

OnePoint HCM

- Setup Fee: Custom

- Security Compliance: IRS Certified, HIPAA

- Best for: Comprehensive human capital management with ACA compliance

OnePoint HCM is Best For

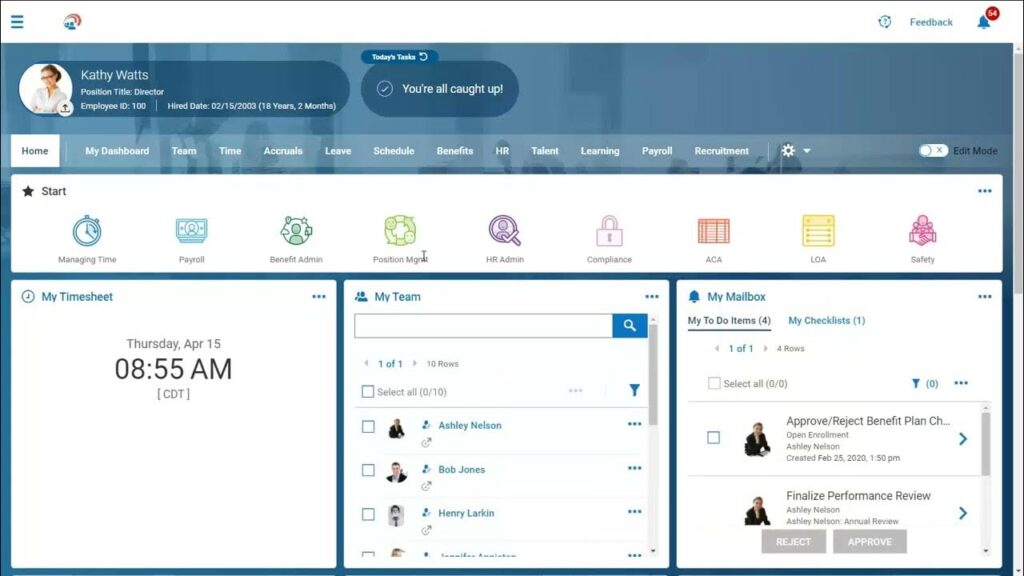

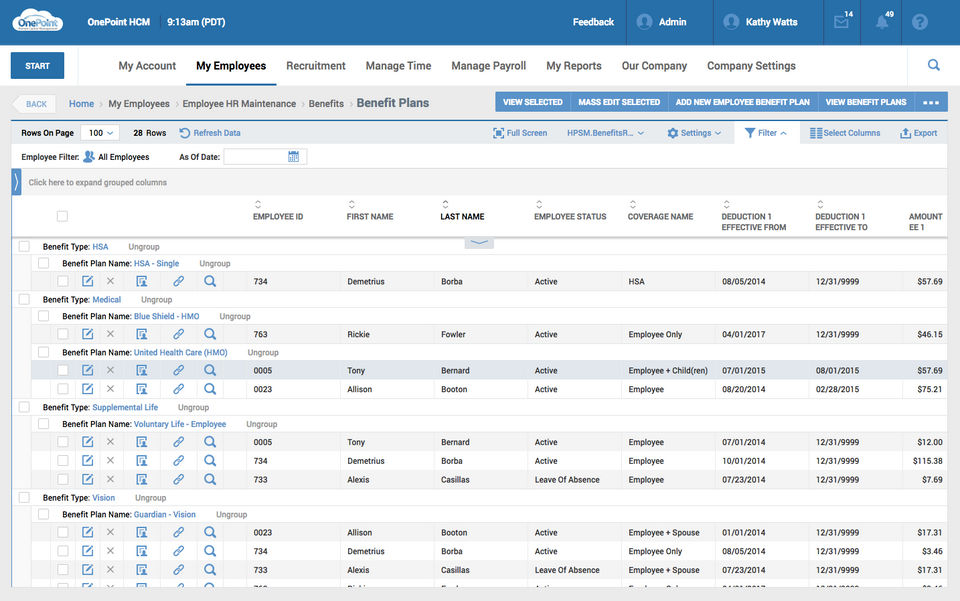

OnePoint HCM is ideal for organizations of all sizes seeking a comprehensive, cloud-based Human Capital Management (HCM) solution to manage compliance with the Affordable Care Act (ACA) and reporting. The platform is particularly beneficial for employers aiming to streamline the creation, distribution, and electronic filing of ACA forms, such as 1094-C and 1095-C, while ensuring adherence to IRS regulations.

Setup Fee & Annual Fees for OnePoint HCM

OnePoint HCM offers its comprehensive Human Capital Management solutions starting at $1,500 per month. This pricing model is based on a flat monthly rate. Specific details regarding setup fees are not publicly disclosed and may vary depending on the organization’s size, selected features, and customization requirements. For a detailed and customized quote, including information on any potential setup fees, it is recommended to contact OnePoint HCM directly.

Overview of OnePoint HCM

OnePoint HCM offers a unified platform that integrates various HR functions, including ACA compliance management. The system utilizes real-time data to create accurate reports, helping organizations reduce exposure to compliance risks. Advanced compliance features allow for automated reporting, ensuring that required documents are completed correctly and submitted on time.

The platform’s seamless data transfer provides on-demand analytics and reporting, enabling proactive monitoring of compliance issues and ensuring workforce alignment with company policies.

Why Choose OnePoint HCM

Organizations choose OnePoint HCM for its comprehensive approach to ACA compliance. The platform simplifies the complexities associated with ACA regulations, providing employers with the tools needed to stay compliant, complete and file IRS forms on time, and access reports to support their filings.

This reduces the administrative burden and potential risks associated with non-compliance while ensuring real-time visibility into compliance status. The system’s intuitive interface and automation capabilities make it easy for HR teams to manage ACA tracking efficiently.

Key Features of OnePoint HCM

Automated Reporting

OnePoint HCM’s compliance management system automatically populates standard compliance reports, such as ACA forms 1094 and 1095, ensuring accuracy and timely submission. The automation eliminates manual entry errors and streamlines the process, reducing the workload for HR teams while maintaining compliance with IRS regulations.

Real-Time Data Accuracy

The unified platform ensures that all information is housed in a seamless database, with updates reflected immediately. This real-time data accuracy allows HR teams to maintain an accurate assessment of compliance status at all times, making it easier to identify and address potential compliance risks before they become critical issues.

Proactive Compliance Monitoring

Advanced compliance features utilize real-time data to create accurate reports, enabling proactive monitoring of compliance issues and mitigation of wage and hour risks across the entire organization. The platform alerts HR managers about upcoming compliance deadlines, making it easier to track employee eligibility and ensure timely reporting.

Seamless Benefits Enrollment

The platform automates notifications and enrollment processes upon eligibility, ensuring employees are informed and enrolled in a timely manner. HR teams can configure custom workflows to align benefits eligibility with company policies, simplifying benefits administration and compliance tracking.

Integrations of OnePoint HCM

OnePoint HCM integrates seamlessly with various applications to enhance its functionality:

- Productivity Suites: Google Workspace, Microsoft 365

- Customer Relationship Management (CRM): Salesforce

- Job Boards: Indeed, ZipRecruiter

- Financial Management: DailyPay

- Learning Management Systems: Relias LMS

These integrations allow for efficient data synchronization, reducing manual data entry and minimizing the risk of errors while improving workflow automation.

Customers of OnePoint HCM

OnePoint HCM serves a diverse clientele across various industries. Notable customers include:

- Kids & Families Together – A non-profit organization leveraging OnePoint HCM for workforce tracking and compliance management.

- Capitola Imports Toyota of Santa Cruz – A retail automotive business utilizing the platform for payroll, ACA compliance, and HR automation.

- Cornerstone Fellowship – A religious organization managing ACA reporting, payroll, and employee benefits efficiently with OnePoint HCM.

These organizations have utilized OnePoint HCM to streamline their ACA compliance processes and ensure adherence to IRS regulations while improving overall HR efficiency.

Pros and Cons of OnePoint HCM

| Pros | Cons |

|---|---|

| All-in-one HR, payroll & compliance | Steeper learning curve for new users |

| Automated ACA reporting & tracking | Pricing not transparent |

| Customizable dashboards & analytics | Limited third-party integrations |

| Scalable for businesses of all sizes | |

| Seamless time & attendance integration |

Final Thoughts

OnePoint HCM offers a robust solution for organizations seeking to manage ACA compliance efficiently. Its unified platform, real-time data accuracy, and advanced compliance features make it a valuable tool for employers aiming to streamline operations and ensure regulatory adherence.

While there may be a learning curve for new users, the platform’s comprehensive approach and commitment to accuracy provide significant advantages in navigating the complexities of ACA reporting. With its automation, proactive compliance tracking, and seamless integrations, OnePoint HCM stands out as a reliable solution for businesses looking to enhance workforce compliance management.

Alight Worklife®

Alight Worklife®

- Pricing: Custom

- Security Compliance: SOC 2, GDPR

- Best for: Global payroll and ACA compliance solutions

Alight Worklife® is Best For

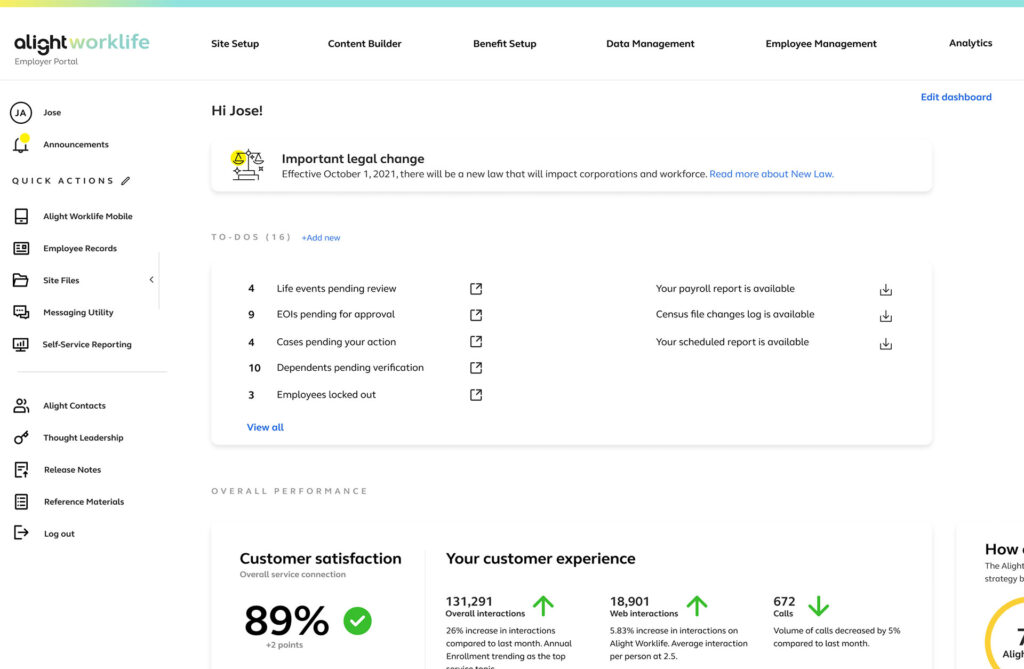

Alight Worklife® is ideal for organizations of all sizes seeking a comprehensive, cloud-based platform to manage various aspects of human capital, including benefits administration, health navigation, and compliance reporting. The platform is particularly beneficial for employers aiming to streamline processes such as Affordable Care Act (ACA) compliance, leave management, and employee engagement through an integrated and user-friendly system.

Its AI-powered features and seamless integrations make it suitable for companies looking to enhance employee experience while ensuring regulatory adherence.

Setup Fee & Annual Fees of Alight Worklife®

Alight Worklife® does not provide specific pricing information publicly, as costs can vary based on factors such as company size, selected features, and customization requirements.

Overview of Alight Worklife®

Alight Worklife® is a unified platform that connects health, wealth, and wellbeing benefits into a single, integrated ecosystem. Leveraging advanced AI through its Alight LumenAI™ engine, the platform personalizes the employee experience, automates routine HR processes, and provides data-driven insights to employers.

Recent updates have introduced features such as Microsoft Teams integration, enhanced health navigation tools, and comprehensive leave management solutions, all designed to simplify benefits administration and improve employee engagement.

Why Choose Alight Worklife®

Organizations choose Alight Worklife® for its holistic approach to human capital management. The platform simplifies complex HR processes by integrating various benefits and compliance functions into a single system, reducing administrative burdens and minimizing compliance risks.

Its AI-driven personalization enhances employee engagement by delivering tailored content and proactive notifications, ensuring employees are informed and supported throughout their benefits journey. Additionally, the platform’s robust analytics provide employers with actionable insights to optimize benefits offerings and control costs.

Key Features of Alight Worklife®

Integrated Benefits Ecosystem

Alight Worklife® unifies health, wealth, and wellbeing benefits into one platform, providing employees with seamless access to their benefits information. This integration simplifies the user experience and ensures consistency across various HR functions. Employers benefit from a centralized system that enhances administrative efficiency and improves employee satisfaction.

AI-Powered Personalization

The platform utilizes Alight LumenAI™ to deliver personalized content, recommendations, and proactive notifications to employees. This AI-driven approach enhances engagement by addressing individual needs and preferences. It also helps employees make informed decisions about their benefits, leading to improved overall financial and healthcare management.

Microsoft Teams Integration

With the recent integration into Microsoft Teams, employees can access their benefits, receive AI-powered recommendations, and interact with a 24/7 virtual assistant directly within their daily workflow, enhancing accessibility and convenience. The integration allows seamless communication between HR teams and employees, reducing delays in benefits-related queries and improving response times.

Integrations of Alight Worklife®

Alight Worklife® integrates seamlessly with various applications to enhance its functionality:

- Productivity Suites: Microsoft Teams

- Health Navigation Tools: AI-Driven Symptom Checker, Claims Accumulator Tracker

- Leave Management Systems: Integrated Leave Management

These integrations facilitate efficient data synchronization, reduce manual data entry, and provide employees with a cohesive experience across platforms.

Customers of Alight Worklife®

Alight Worklife® serves a diverse clientele across various industries, including:

- Fortune 100 Companies: Providing comprehensive benefits administration and compliance solutions.

- Healthcare Organizations: Enhancing employee engagement and health navigation.

- Educational Institutions: Streamlining leave management and benefits enrollment.

These organizations leverage Alight Worklife® to optimize their HR processes, ensure compliance, and improve the overall employee experience.

Pros and Cons of Alight Worklife®

| Pros | Cons |

|---|---|

| Comprehensive HR & benefits management | Higher cost for premium features |

| AI-powered insights & automation | Complex setup & onboarding |

| Employee self-service portal | Limited customization options |

| Strong compliance & security measures | |

| Seamless payroll & benefits integration |

Final Thoughts

Alight Worklife® provides a robust solution for organizations seeking to manage HR functions, including ACA compliance, benefits administration, and employee engagement, within a unified platform. Its AI-powered personalization, seamless integrations, and comprehensive features make it a valuable tool for employers aiming to streamline operations and enhance the employee experience.

While there may be a learning curve for new users, the platform’s holistic approach and commitment to innovation offer significant advantages in navigating the complexities of human capital management.

Conclusion

Selecting the right ACA reporting software is critical because it provides compliance, relieves administrative burdens, and avoids unnecessary penalties. The solutions highlighted in this article provide various features, from automated data management and precise filing to insightful analytics and easy integration into payroll and HR platforms. Companies should evaluate each provider based on criteria such as organizational size, employee count, budget constraints, user-friendliness, and reporting complexity.

By leveraging a software package centered on their unique compliance situations, companies can now comfortably handle ACA responsibilities, improve the accuracy of their reporting, and relieve the stress often associated with regulatory filings. Investing in a good ACA reporting solution streamlines the reporting and prepares an organization for continued compliance success oriented toward employee wellness and organizational growth in 2025.

Frequently Asked Questions

What is ACA reporting software, and why do businesses need it?

ACA reporting software helps businesses track employee hours, determine eligibility, generate Forms 1094-C and 1095-C, and electronically file them with the IRS. It ensures compliance with the Affordable Care Act (ACA) regulations, reducing the risk of penalties and simplifying reporting processes.

How does ACA reporting software help with IRS compliance?

The software automates data collection, tracks employee coverage, and ensures that businesses meet IRS deadlines. It helps organizations maintain accurate records, generate required forms, and submit electronic filings to avoid penalties for non-compliance.

What features should I look for in ACA reporting software?

Key features include automated form generation and e-filing, employee eligibility tracking, real-time compliance monitoring, integration with payroll and HR systems, and secure data storage. Additional functionalities like analytics and audit support enhance compliance management.

Can ACA reporting software integrate with my existing payroll or HR system?

Most ACA reporting solutions offer seamless integration with payroll, HR, and benefits administration systems, allowing businesses to sync employee data automatically. This reduces manual data entry, improving accuracy and efficiency.

How much does ACA reporting software cost?

Pricing varies based on business size, selected features, and service level. Some providers charge per employee per month (PEPM), while others offer annual plans or volume-based pricing. Many vendors provide custom quotes, so it’s best to contact them for specific pricing details.